Latest News

The Final Bar7h ago

Semiconductors are at CRITICAL Level!

In this edition of StockCharts TV's The Final Bar, Dave welcomes guest Danielle Shay of Simpler Trading. Danielle speaks to the downside rotation for the QQQ, SMH, and leading growth stocks, including why the $210 level is so crucial for the SMH Read More

"Fill the Gap" with the CMT12h ago

Important Inflection Point in FXI: Is It Time To Accumulate?

The iShares China Large-Cap exchange-traded fund (FXI) holds the 50 largest large-cap Chinese stocks that trade on the Hong Kong exchange. FXI could soon make a secondary test of its 2022 low. A successful test will show strength, but a failed test will show weakness Read More

Don't Ignore This Chart!13h ago

Will NFLX Pierce Through Resistance With Breakthrough Earnings? Here's What You Need to Know

It's showtime! On Thursday, after the stock market closes, Netflix, Inc. (NFLX) will announce Q1 earnings. The stock is close to a major resistance level. Will it break through when it reports earnings? Or will it fall? The answer depends on whether it beats or misses Read More

Members Only

Larry Williams Focus On Stocks16h ago

Larry's LIVE "Family Gathering" Webinar Airs TOMORROW - Thursday, April 18 at 2:00pm EDT!

The Final Bar1d ago

Bitcoin Halving Could Bring Massive Upside!

In this edition of StockCharts TV's The Final Bar, Dave shares a brief history of Bitcoin halving and relates it to the short-term and long-term technical outlook on this significant development for cryptocurrencies Read More

Don't Ignore This Chart!1d ago

AMD Plunges to a Critical Support Level: Is Now the Time to Go Long?

Leading chip designer Advanced Micro Devices, Inc. (AMD) is at a critical juncture, one which could go either way depending on the dynamics of the market and its specific industry. The stock's technical and fundamental indications are not only mixed, but on opposite extremes Read More

The Final Bar2d ago

Is Market Breadth Signaling THE TOP?!

In this edition of StockCharts TV's The Final Bar, Dave shows how bearish short-term breadth combined with the deterioration in long-term breadth lines up well with previous market tops. He then breaks down key levels for the S&P 500 index as well as MSFT, TSLA, and more Read More

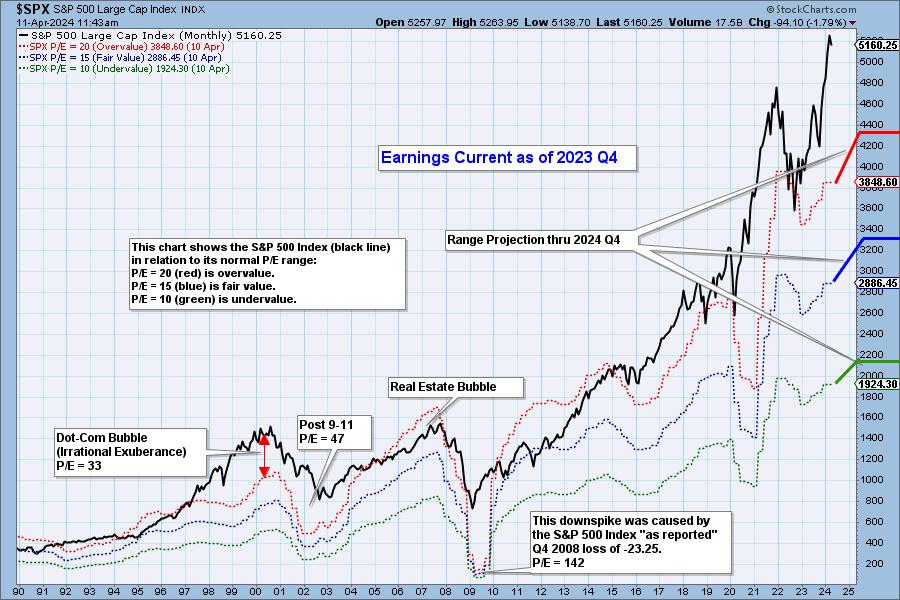

DecisionPoint2d ago

DP Trading Room: Final Earnings are In for 2023 Q4!

Carl opens the show with a view of the final earnings results for 2023 Q4! His chart reveals whether stocks are fair valued, overvalued or undervalued. Get his take on the current readings Read More

Members Only

Martin Pring's Market Roundup3d ago

Precious Metals Reach Exhaustion

In the last couple of weeks, I have been reading stories about shoppers picking up gold bars in, of all places, Costco. According to Gemini, the AI branch of Google, "Reports indicate they may be selling up to $200 million worth of gold bars every month Read More

Trading Places with Tom Bowley3d ago

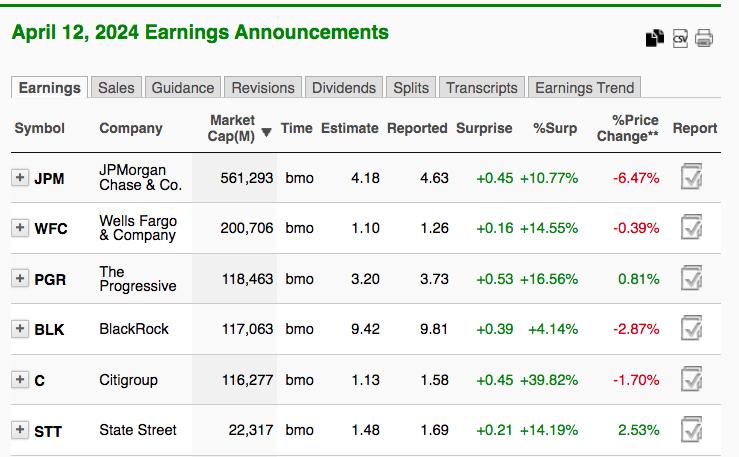

Are The Financials Sending Us A Major Warning Signal?

I've said for awhile that we could use some short-term selling to unwind overbought conditions and even negative divergences in some cases Read More

Analyzing India4d ago

Week Ahead: NIFTY May Stay Subdued Over the Truncated Week; Defensive Play May Seem Evident

Going into the previous week, the markets had been expected to inch higher; however, at the same time, while it was believed that incremental highs may be formed, it was also expected that a runaway move would not happen Read More

The Mindful Investor5d ago

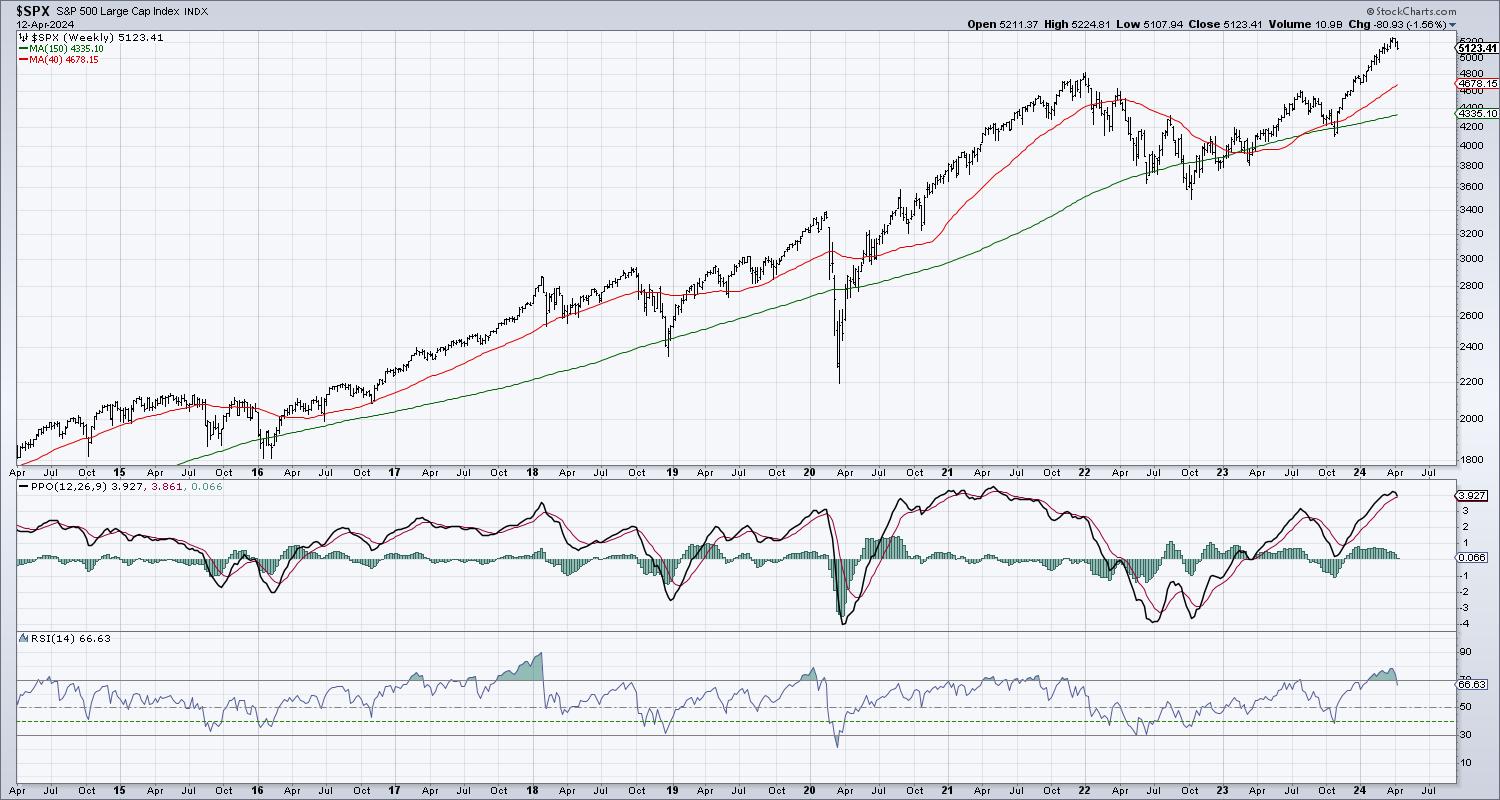

S&P 500 Flashes Major Topping Signals

Toward the bottom of my Mindful Investor LIVE ChartList, there is a series of charts that rarely generate signals Read More

The MEM Edge5d ago

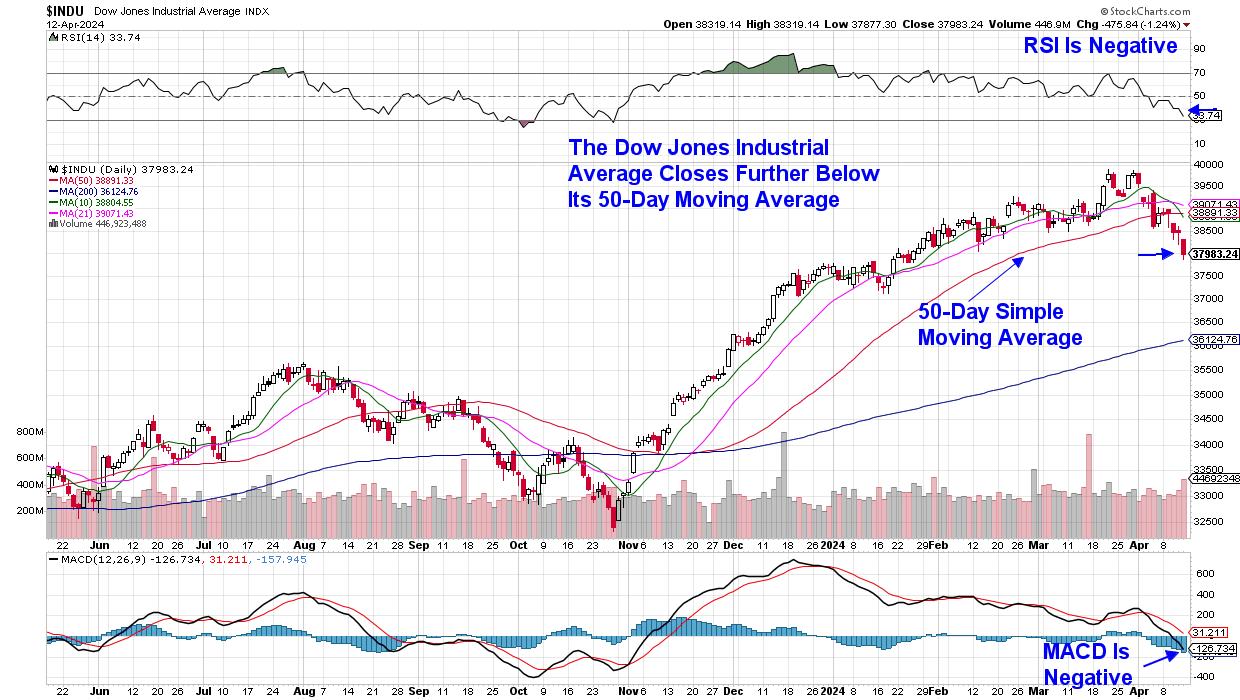

Keeping Up With The Jones - How Weakness in This Index May Foretell a Broader Market Correction

The Dow Jones Industrial Average fell 2.4% last week in a move that pushes this index further below its key 50-day simple moving average Read More

StockCharts In Focus5d ago

Stay Ahead of the Markets with AUTOMATED Portfolio Reports

Staying on top of your portfolio in a fast-moving market can be a challenge. On this week's edition of StockCharts TV's StockCharts in Focus, Grayson shows you how to make things easier on yourself with automated ChartList Reports for your portfolio Read More

The MEM Edge5d ago

MEM TV: Time To SELL EVERYTHING?!

In this episode of StockCharts TV's The MEM Edge, Mary Ellen shares key signals that it's time to sell a stock, using INTC as an example. She also reviews a key area of support for the markets, and new sectors that have entered a downtrend Read More

ChartWatchers5d ago

Stock Market Indexes Plunge After Hitting Resistance -- Support Levels You Need to Watch

Now that earnings season has begun, what can you expect the stock market to do, especially after its stellar Q1 run? Well, after a few months singing the monotone "up, up, up" tune, the stock market has mixed things up a little. Now you hear "up, down, up, down Read More

Members Only

Martin Pring's Market Roundup5d ago

The Day the Yields Broke Out

Wednesday brought an unexpected firming up of the inflation figures, causing analysts and commentators to trim the number of times they expect interest rates to be cut this year Read More

Art's Charts5d ago

Using Outsized Moves to Identify Trend Reversals - Checking in on Housing and Semis

Trends often start with outsized moves. But how do we measure and identify such moves? Chartists can measure moves in Average True Range (ATR) terms using the ATR Trailing Stop SAR indicator (ATR-SAR). ATR is a volatility indicator developed by Welles Wilder Read More

ChartWatchers5d ago

From Relic To Reckoning: Can Gold Surge To $3,000?

The strange thing about gold is that it's always a relic until it isn't. And when it isn't, everyone swears it's always been an alternative currency (why would anyone have thought it was a relic in the first place?) Read More

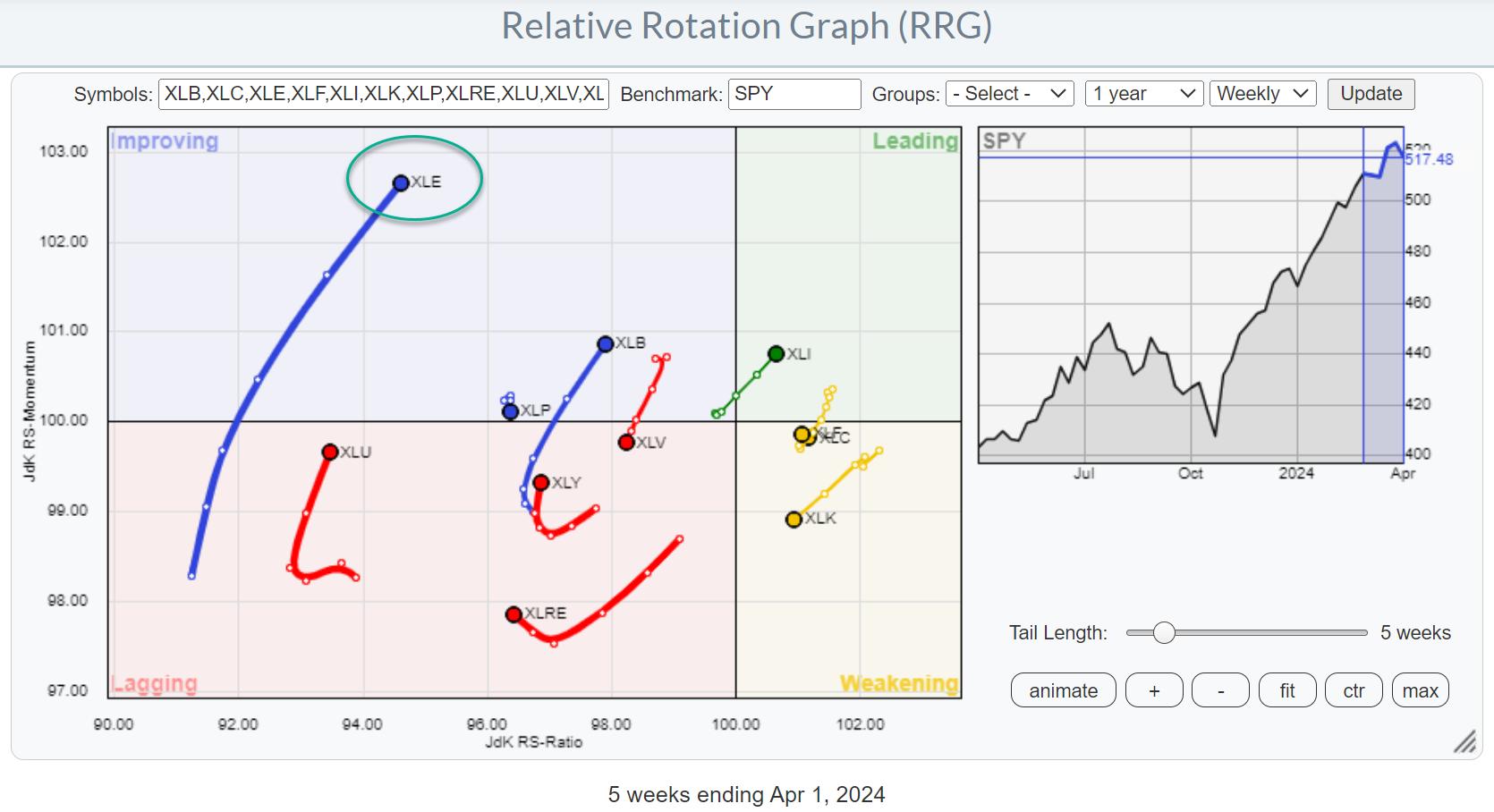

RRG Charts6d ago

RRG Indicates That Non-Mega Cap Technology Stocks are Improving

A Sector Rotation Summary A quick assessment of current sector rotation on the weekly Relative Rotation Graph: XLB: Still on a strong trajectory inside the improving quadrant and heading for leading Read More

Don't Ignore This Chart!6d ago

NVDA is Holding Strong: It's Time to Think About Accumulating this Stock

Sometimes, it helps to look at a stock like NVDA to get a pulse of the market. NVDA's stock price is up over 85% in 2024. It's a leader in the AI ecosystem and the most talked-about stock Read More

Stock Talk with Joe Rabil6d ago

Master Market Entry with This RSI Strategy!

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use the RSI along with the MACD and ADX indicators. RSI is used as a timing tool when things are lined up Read More

Dancing with the Trend6d ago

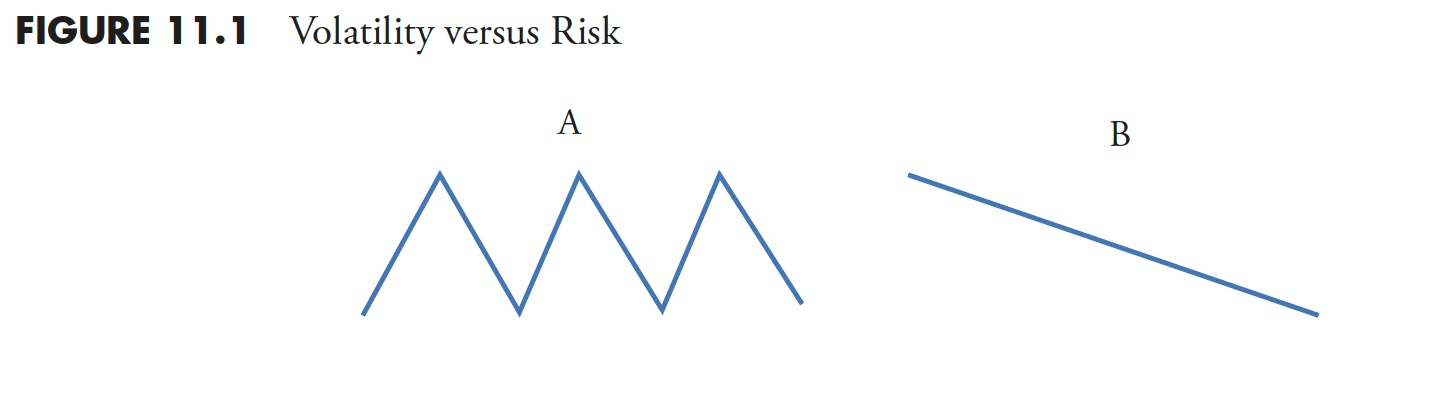

Market Research and Analysis - Part 5: Drawdown Analysis

Note to the reader: This is the sixteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful Read More

DecisionPoint6d ago

2023 Q4 Earnings Analysis and Projections Through 2024 Q4

S&P 500 earnings are in for 2023 Q4, and here is our valuation analysis Read More

ChartWatchers1w ago

Is the Banking System on the Verge of Systemic Implosion? What to Look Out For

2024 will be marked by a massive string of bank failures!!! Well, according to a few economists on the far end of the mainstream economic spectrum, that is Read More

Members Only

Martin Pring's Market Roundup1w ago

This Sector is Breaking Up and Down Simultaneously

This may seem like a contradiction, but it is possible for two different things to be true at the same time Read More

The Final Bar1w ago

Despite Stable Markets, Breadth Says Danger

In this edition of StockCharts TV's The Final Bar, Dave drops a market update, with a focus on Bitcoin's rebound above 70K, deteriorating short-term breadth conditions, and stocks still making new highs despite the market consolidation phase Read More

Trading Places with Tom Bowley1w ago

2 Consolidating Stocks Ready To Resume Their Uptrends

My preference is to trade strong stocks that are simply consolidating and ridding themselves of weak hands, hopefully just in time to ride the next wave higher Read More

Analyzing India1w ago

Week Ahead: NIFTY May Continue Finding Resistance at Higher Levels; These Sectors May Relatively Outperform

In the previous technical note, it was categorically mentioned that, while the markets may attempt to inch higher, they may not form anything beyond minor incremental highs and could largely continue to stay under consolidation Read More

The MEM Edge1w ago

MEM TV: Is It Safe To Reenter The Markets?

In this episode of StockCharts TV's The MEM Edge, Mary Ellen shares what to be on the lookout for to tell if it's safe to put new money to work. She also shares the weakness in select sectors and which areas she suggests to underweight Read More

The Final Bar1w ago

Double Top Forming in Growth vs. Value?

In this edition of StockCharts TV's The Final Bar, Dave answers questions from The Final Bar Mailbag. Today he talks about how to use the ADX indicator, how growth vs Read More

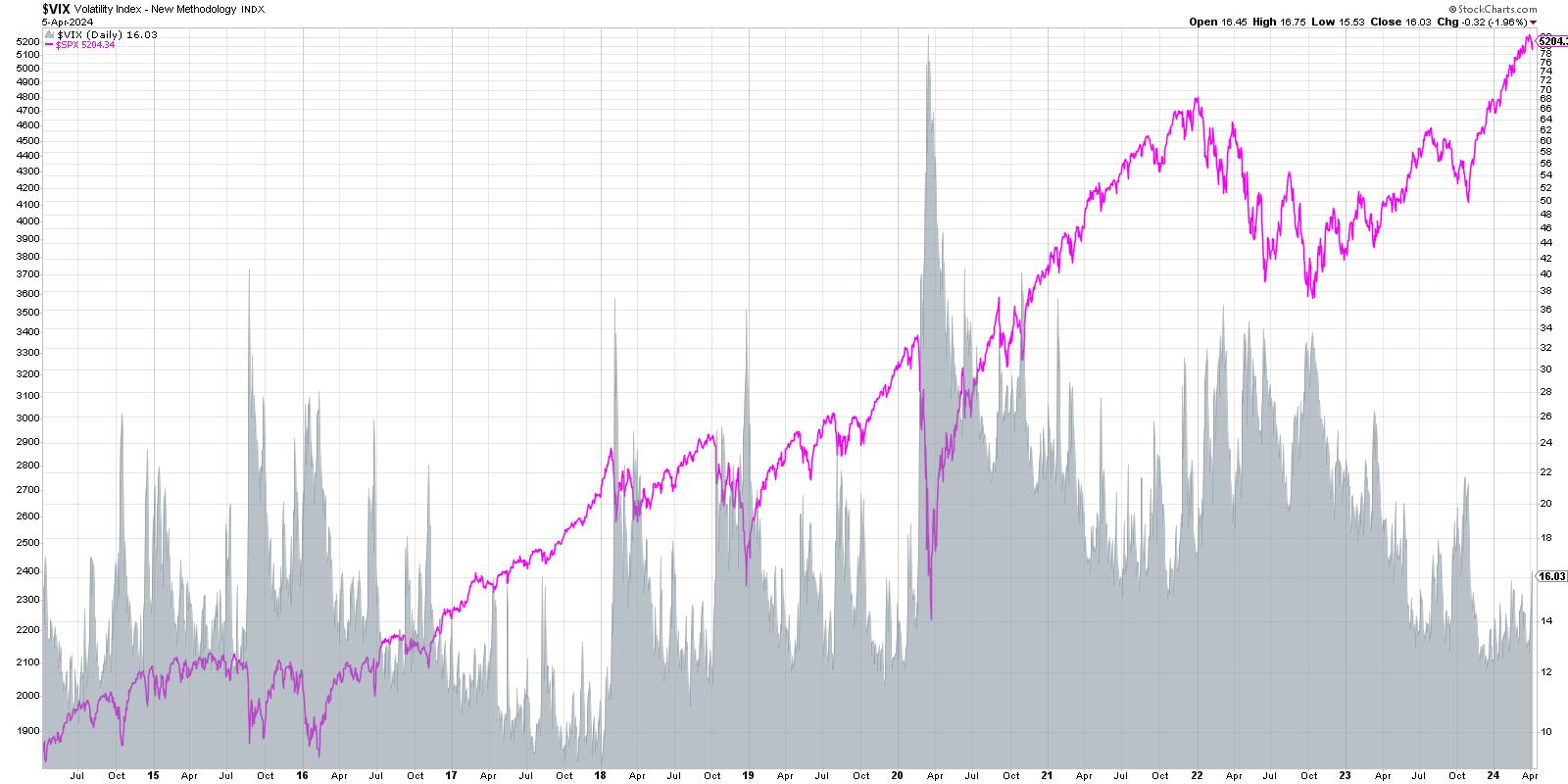

The Mindful Investor1w ago

VIX Spikes Above 16 - Is This the End?

The VIX ended the week just above 16, bringing it to its highest level in 2024 Read More

ChartWatchers1w ago

Jobs In the Spotlight: Stock Market Reverses Course After Massive Selloff

One day doesn't make a trend—that's one lesson we learned from this week's stock market action. The March non-farm payrolls data revealed that the US economy added 303,000 jobs, which is higher than the estimated 200,000. Additionally, the unemployment rate dropped to 3 Read More

RRG Charts1w ago

Energy is on Fire

Strong Rotation on the Weekly RRG For a few weeks now, the improvement in the energy sector (XLE) is becoming increasingly visible in the lengthening of the XLE tail on the Relative Rotation Graph Read More

Wyckoff Power Charting1w ago

Trifecta of Trouble

The Markup Phase of a Bull Market is glorious to behold and participate in. But they do ebb and flow. The bullish run in the major stock indexes has been persistent in 2024 Read More

ChartWatchers1w ago

Silver's Surge: Can It Reach $50 an Ounce This Year?

The likelihood of silver reaching $50 an ounce this year is a ‘real possibility,' according to analysts. More conservative yet bullish forecasts plot silver's target range between $35 and $50 Read More

The Final Bar1w ago

Two Options Plays Amid Market Selloff

In this edition of StockCharts TV's The Final Bar, Dave welcomes Sean McLaughlin of All Star Charts. Sean shares his outlook for the Ark Innovation Fund (ARKK) and energy stocks (XLE) and how to employ options strategies to bet on particular outcomes Read More

Stock Talk with Joe Rabil1w ago

Spot Big Reversals Using the ADX Indicator

On this week's edition of Stock Talk with Joe Rabil, Joe demonstrates how to use the "Big Green Bar" candlestick pattern. This candlestick provides great confirmation on certain types of entry points, and can also be helpful for exits Read More

Dancing with the Trend1w ago

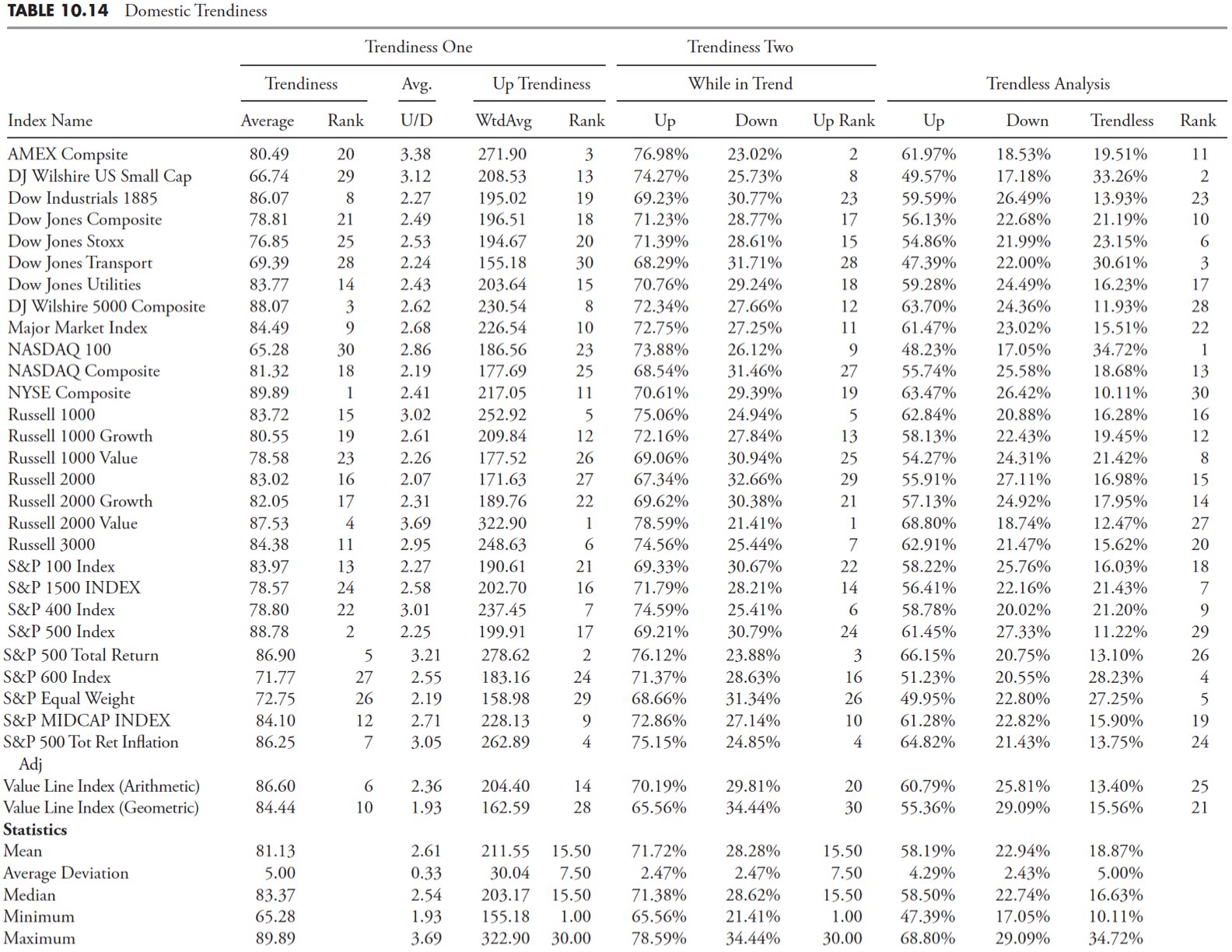

Market Research and Analysis - Part 4: Trend Analysis Continued

Note to the reader: This is the fifteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful Read More

ChartWatchers1w ago

The Stock Market's Tremendous Resilience: What This Means For Q2

Even though the broader stock market showed signs of pulling back, so far, signs don't show that it's time to panic. The S&P 500 ($SPX) was up 10.6%, the Dow Jones Industrial Average ($INDU) was up 5.6%, and the tech-heavy Nasdaq was up over 9% in Q1 2024 Read More