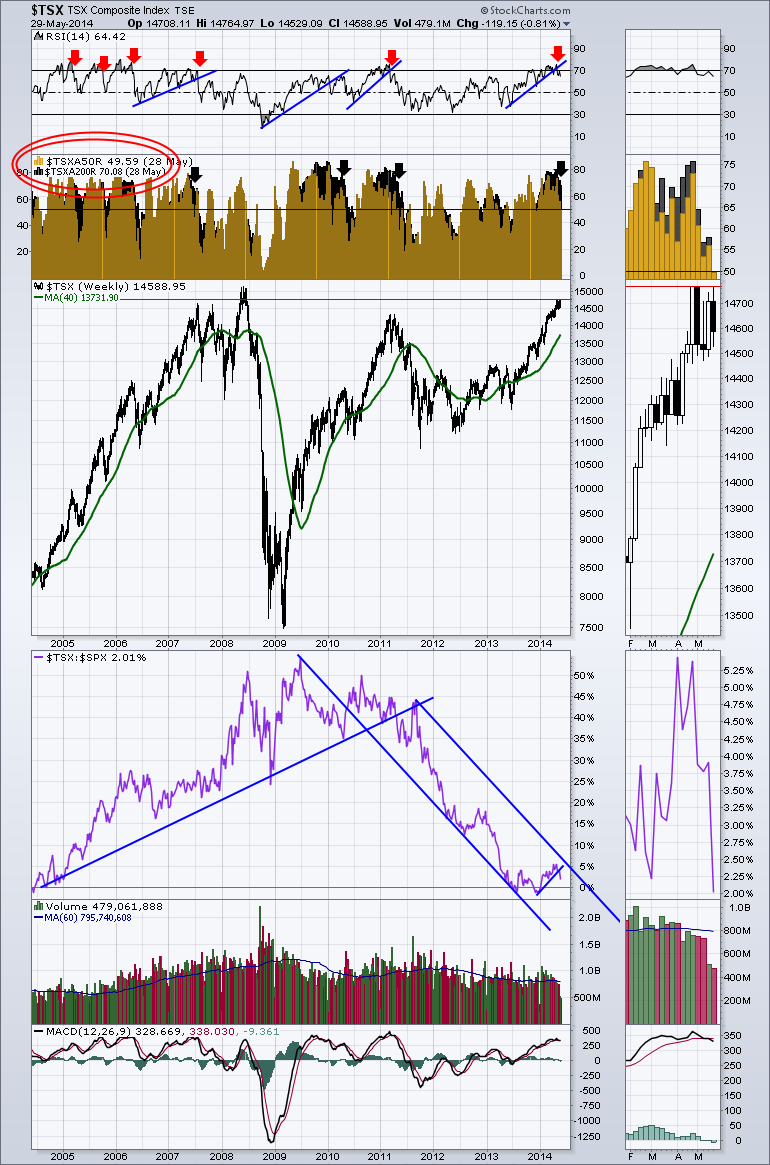

The Canadian Technician May 29, 2014 at 05:12 PM

Somedays the $TSX charts smile, and some days they don't. Rolling through my main market summary charts, the chart below is the 2nd chart on the chartlist. (The first one is the Fed meeting dates overlaid on the $SPX... Read More

The Canadian Technician May 29, 2014 at 11:36 AM

One of the largest royalty IPO's to come out this year started trading today. Prairie Sky Royalty Ltd. (PSK.TO) started trading and jumped up over 25% on the original IPO price of $28. The first trades this morning went through at $34... Read More

The Canadian Technician May 28, 2014 at 04:28 PM

Tekmira (TKM.TO) has been on the top of the Canadian SCTR rankings for most of the last 2 years. I spotted it today on the Biggest Movers. It found support at the 200 DMA or 40 WMA. This looks like an interesting buy point that allows us to place the stop very close... Read More

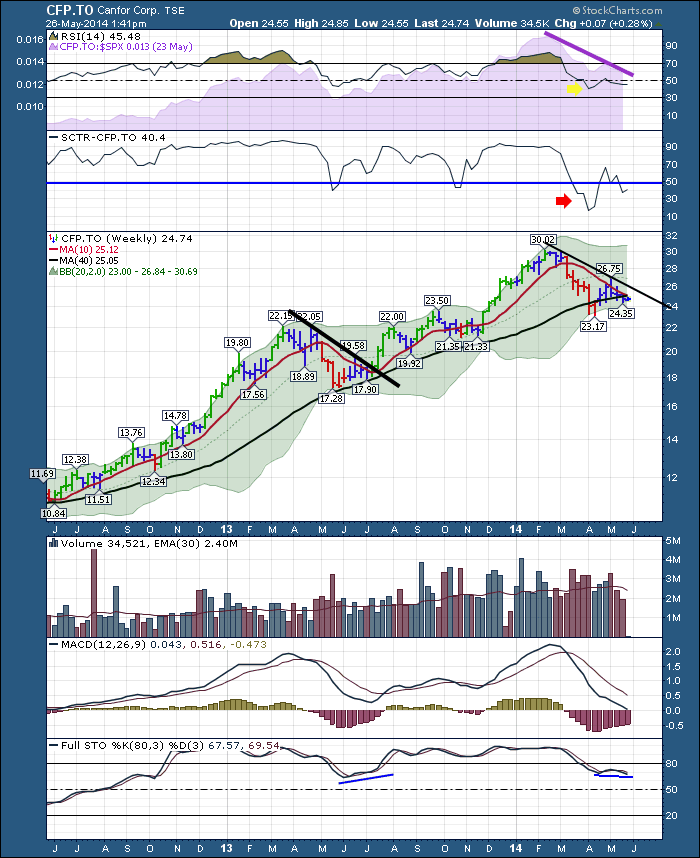

The Canadian Technician May 26, 2014 at 01:58 PM

Canfor (CFP.TO) has been in a long up trend. It has been a beautiful ride. Today Canfor looks like it is at a major support line. There is some indication that the investor support is waning. The RSI has put in the lowest low in 2 years on the chart marked by the yellow arrow... Read More

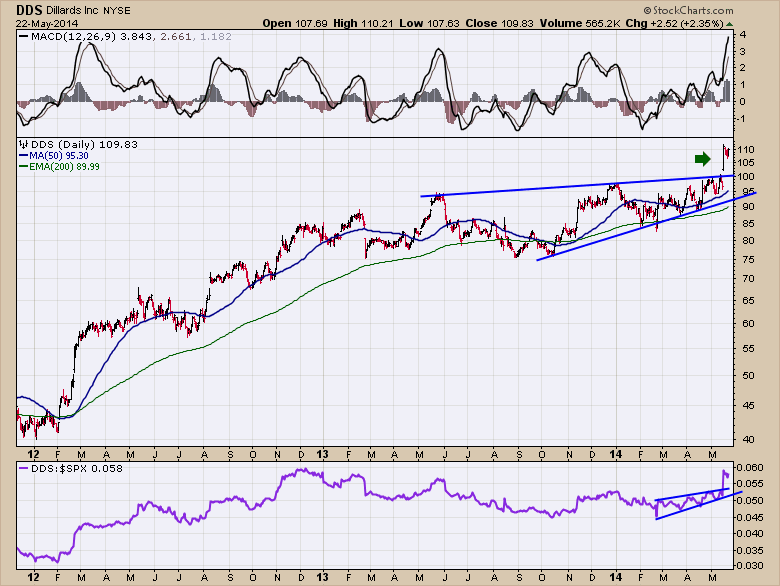

The Canadian Technician May 23, 2014 at 02:49 AM

There has been a huge volume of news out of the mainstream retailers the last two weeks. It seemed like all of them found their way onto the news channels. It prompted me to dive in and review the sector... Read More

The Canadian Technician May 20, 2014 at 05:04 PM

Manulife (MFC.TO) looks to me to be breaking down. It has one final support level left in the completion of a topping pattern. Lets work through an in depth analysis on the weekly and the daily. The RSI has been below 60 for 4 months... Read More

The Canadian Technician May 17, 2014 at 11:32 AM

One of the benefits of writing a blog is setting up charts at some previous date, and flipping through them much later. Way back in 2012, I created this chart. At the time commodities were really suffering after a brutal 2011... Read More

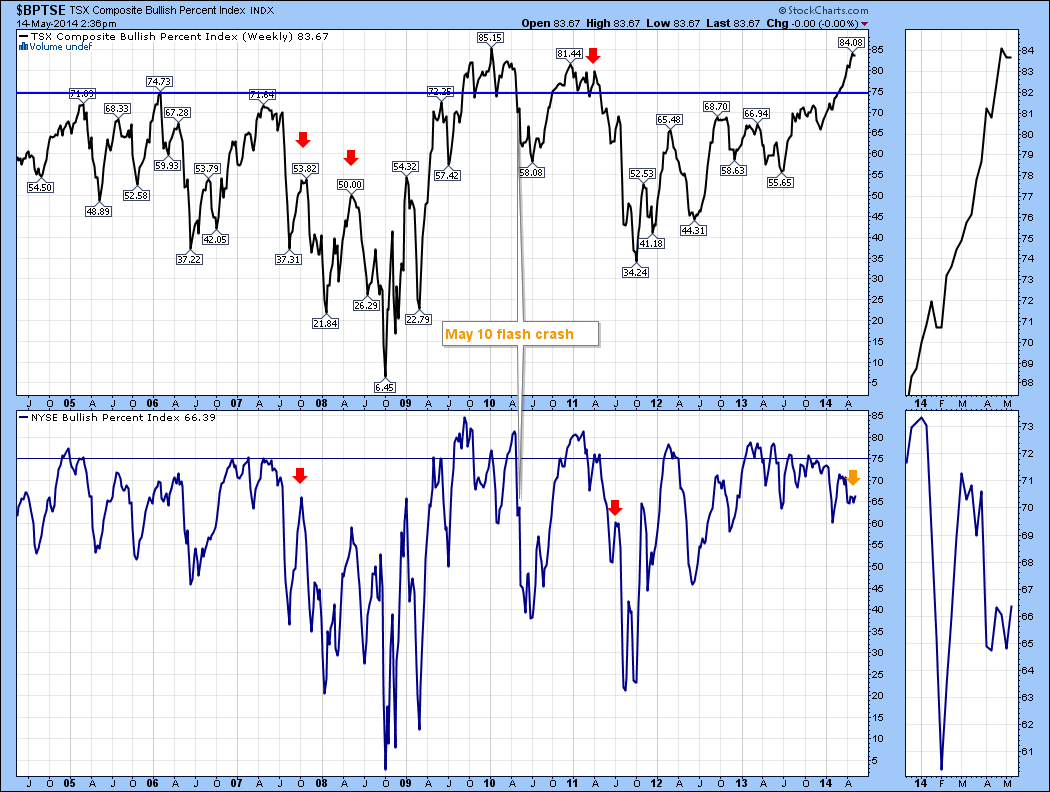

The Canadian Technician May 14, 2014 at 02:40 PM

The Bullish Percent Index is a great way to see extremes in the market. However, the concern with looking at this indicator now is where we closed last Friday at an extreme level. When I study the chart, the market does not seem to top out near these extremes... Read More

The Canadian Technician May 10, 2014 at 10:10 AM

Smart Technologies pulled back hard from it's initial IPO. After making a large base the stock has started to change behaviour recently. For those that are not aware, Smart makes interactive white boards that are used in classroom settings... Read More

The Canadian Technician May 09, 2014 at 11:51 AM

The energy stocks ETF for the Canadian Energy sector has pulled back in the last two days. This is a seasonal move that traditionally relaxes till July... Read More

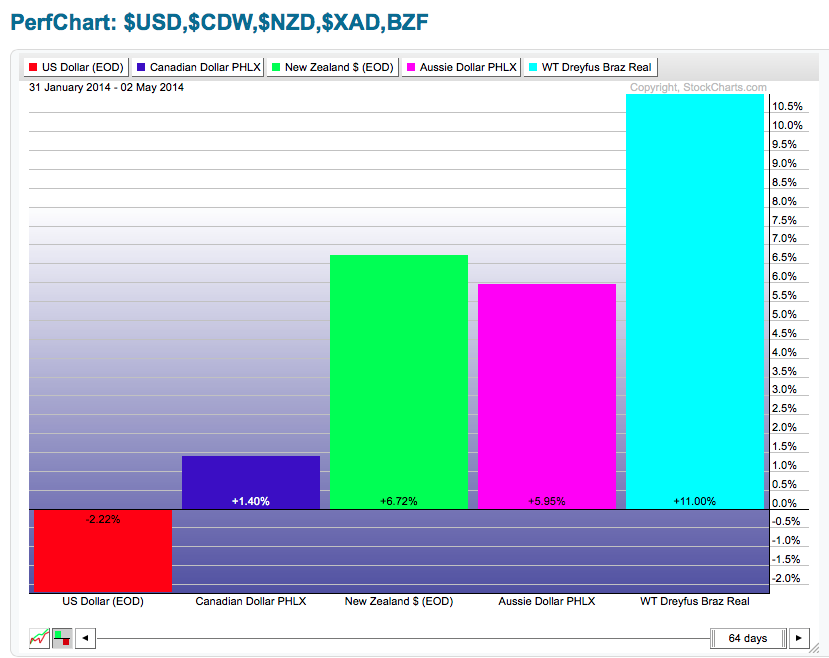

The Canadian Technician May 05, 2014 at 10:39 AM

The commodity currencies have been doing well lately. Interestingly, the industrial commodities are relatively weak. The soft commodities like Agriculture are doing well. Here are the metal commodities. Nickel has soared because of Indonesia holding back supply... Read More

The Canadian Technician May 02, 2014 at 11:42 AM

The Australian market is an important market to follow for global commodities. As a commodity cornerstone to Asia, this market can be very indicative. Recently the Aussie chart broke to new highs. Check it out... Read More