ChartWatchers June 23, 2007 at 10:06 PM

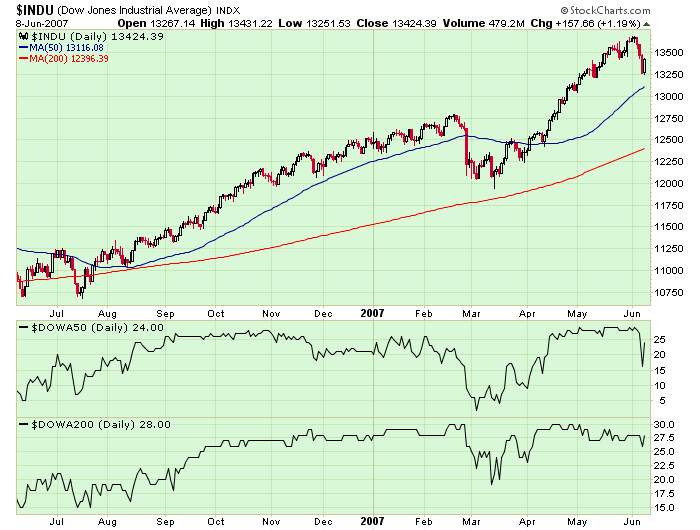

I discussed many months ago how the rotation from the tech-heavy NASDAQ to the safety of the Dow Jones evolves over time. As earnings disappoint and growth slows, money moves away from the high octane growth stocks to the more conservative components of the Dow... Read More

ChartWatchers June 23, 2007 at 10:05 PM

The S&P Midcap ETF (MDY) remains in an uptrend for now, but a lower high and waning upside momentum are cause for concern. The ETF established support around 160-161 with reaction lows in May and June. In addition, the rising 50-day moving average marks support in this area... Read More

ChartWatchers June 23, 2007 at 10:04 PM

On our first chart, a daily bar chart, we can see that bonds have been weakening for several months, with the most dramatic decline occurring in the last month or so... Read More

ChartWatchers June 23, 2007 at 10:03 PM

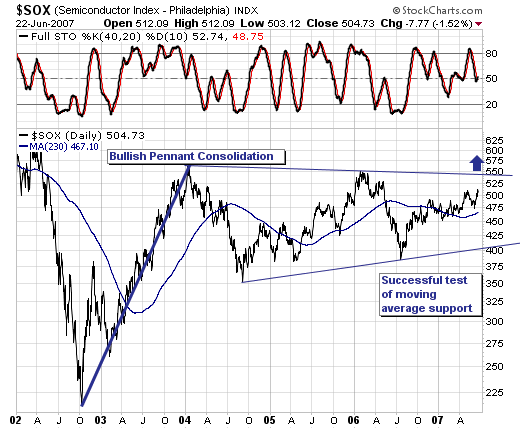

Last week's stock market correction was rather "brutal" to be sure; however, we believe that the balance of evidence suggests at this time it is nothing more than a correction and more likely a consolidation to higher highs... Read More

ChartWatchers June 23, 2007 at 10:02 PM

It took w-a-y longer than it was supposed to but all of our servers are now fully moved into our new, cooler, more powerful datacenter. The new datacenter will allow us to continue adding newer, more powerful computers that will allow our site to run even faster... Read More

ChartWatchers June 23, 2007 at 10:01 PM

Growing concerns about the fallout in the subprime mortgage market caused heavy selling in banks and brokers today. Today's selling more than wiped out yesterday's rebound in the financial group... Read More

ChartWatchers June 23, 2007 at 10:00 PM

This week, I thought we'd revisit an article I wrote way back in November of 2001 about the "Six Steps" you can take at StockCharts.com to quickly guage the overall health of the market and find great stock opportunities... Read More

ChartWatchers June 09, 2007 at 10:06 PM

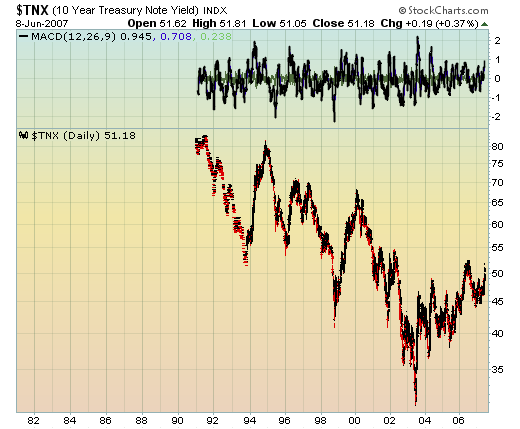

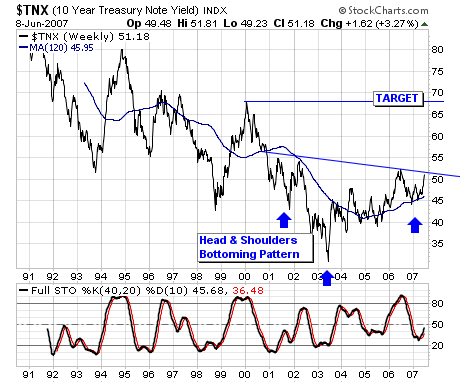

The market periodically finds reasons to selloff, even in bull markets. This past week it was all about interest rates. You could see it coming. Interest rates had been rising for the last month. The yield on the 10 year treasury bond increased from 4... Read More

ChartWatchers June 09, 2007 at 10:05 PM

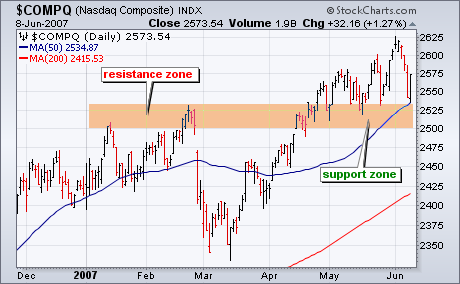

The Nasdaq held support and led the market higher on Friday. Even though Thursday's decline was quite drastic, the Nasdaq never broke support from its May lows and the medium-term uptrend remains. Nasdaq support is just above 2500 and extends back to the January highs... Read More

ChartWatchers June 09, 2007 at 10:04 PM

We have been watching prices trend higher for several weeks, even as internal strength trended lower and warned that price weakness could be ahead. Finally, this week prices broke down in a big way, signaling the start of a correction that could last at least a few weeks... Read More

ChartWatchers June 09, 2007 at 10:03 PM

Last week saw stocks sell off rather sharply for several days, of which the catalyst was the sharp rise in bond yields as inflation and too strong growth concerns too center stage... Read More

ChartWatchers June 09, 2007 at 10:02 PM

We've moved about 70% of our servers into our new server room where our new chiller plant keeps the temperature a "toasty" 60F degrees at all times... Read More

ChartWatchers June 09, 2007 at 10:00 PM

Things got a little bumpy last week as the Dow had a big "down" day on Thursday... Read More