ChartWatchers October 20, 2007 at 10:06 PM

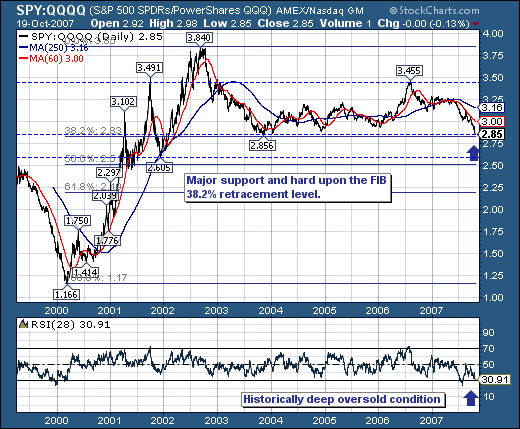

The panic selloff and subsequent recovery in August was nearly a mirror image of what we've seen in October. First, let's start with August. If you recall, we discussed how long-term market bottoms are marked by extreme bearish sentiment... Read More

ChartWatchers October 20, 2007 at 10:05 PM

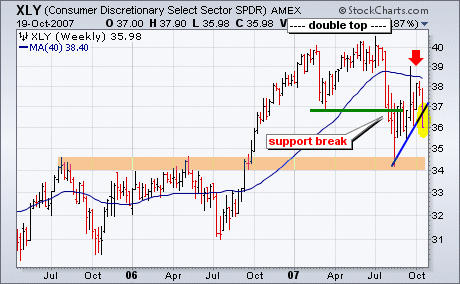

The Consumer Discretionary SPDR (XLY) and Finance SPDR (XLF) broke down this week to signal a continuation of downtrends that began in July. In other words, the Aug-Oct rally was just a countertrend advance within a larger downtrend... Read More

ChartWatchers October 20, 2007 at 10:04 PM

Two weeks ago I wrote an article that stated that it was a good time for a pullback. As it turns out the pullback started four trading days later, and it appears now that a full blown correction is in progress... Read More

ChartWatchers October 20, 2007 at 10:03 PM

Over the past 18-months, the technology sector has outperformed the S&P 500 by a rather handy amount; however, we believe this trend towards technology out-performance is very close to ending... Read More

ChartWatchers October 20, 2007 at 10:01 PM

The Dow Industrials were hit especially hard on Friday. A lot of that was due to big tumbles in two of its cyclical stocks – Caterpillar and 3M. Chart 3 shows Caterpillar falling 6% (on higher volume) to undercut its 50-day average... Read More

ChartWatchers October 20, 2007 at 10:00 PM

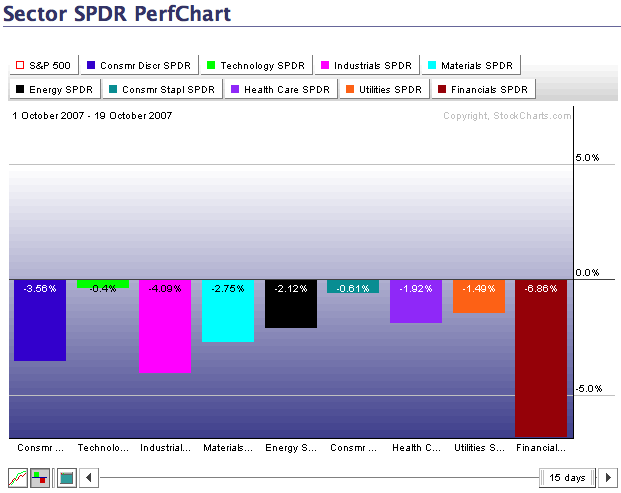

One thousand words: All the sectors are moving lower this month led by the Financials... Read More

ChartWatchers October 06, 2007 at 10:05 PM

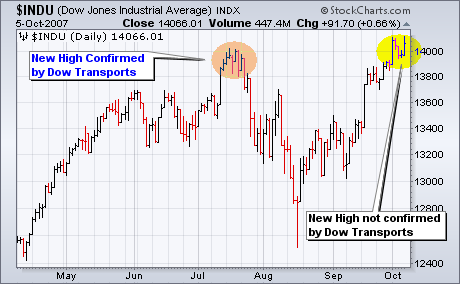

Before looking at the chart for the Dow Transports, let's look at the Dow Theory situation. The Dow Industrials and Dow Transports both hit new highs in July and this marked a Dow Theory confirmation (bullish)... Read More

ChartWatchers October 06, 2007 at 10:04 PM

The market has had a good run since the August lows, but it is challenging all-time highs, and the technical support has been somewhat anemic... Read More

ChartWatchers October 06, 2007 at 10:03 PM

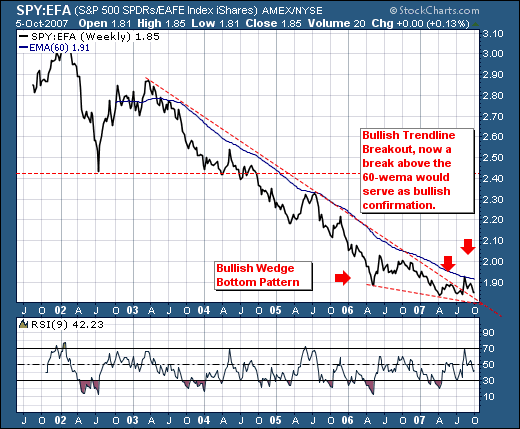

Last week, both the Dow Industrials and the S&P 500 broke out to new highs last week in show of modest strength; but what we find more interesting that this circumstance... is that the foreign markets aren't outperforming the US large caps... Read More

ChartWatchers October 06, 2007 at 10:02 PM

Last week we launched our new Ticker Cloud feature. Have you seen it? It's a dynamic list of the most requested stocks we've seen over the past 15 minutes... Read More

ChartWatchers October 06, 2007 at 10:01 PM

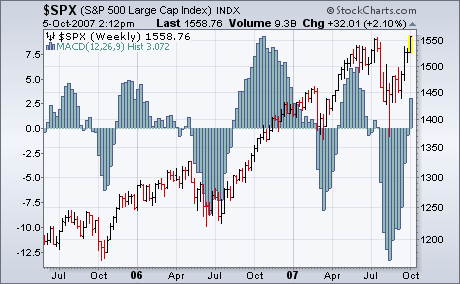

Last Friday, I wrote that the weekly MACD lines hadn't turned positive yet for the S&P 500, but were close to doing so. They turned positive this week... Read More

ChartWatchers October 06, 2007 at 10:00 PM

I realize that the long-term ChartWatchers out there already know how important our specials are, but I wanted to take a moment to mention it to our newer members. One thing that has never changed at StockCharts.com is our pricing... Read More