ChartWatchers March 19, 2011 at 06:00 PM

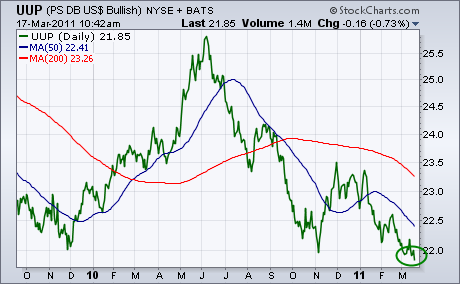

Traders continue to sell the U.S. Dollar. In yesterday's trading, the dollar fell to a 20-year low against the Japanese yen. Today, it's falling against everything else. More importantly, the greenback is breaking important support levels... Read More

ChartWatchers March 19, 2011 at 05:56 PM

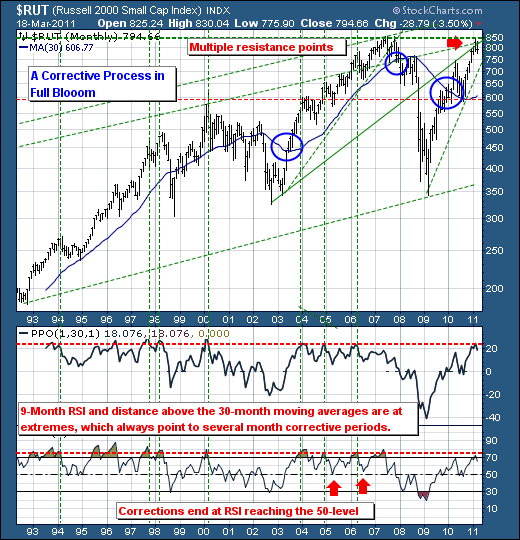

Over the past several weeks, we've seen the market leader Russell 2000 Small Cap Index ($RUT) falter modestly given Middle East/North Africa and Japanese concerns... Read More

ChartWatchers March 19, 2011 at 05:50 PM

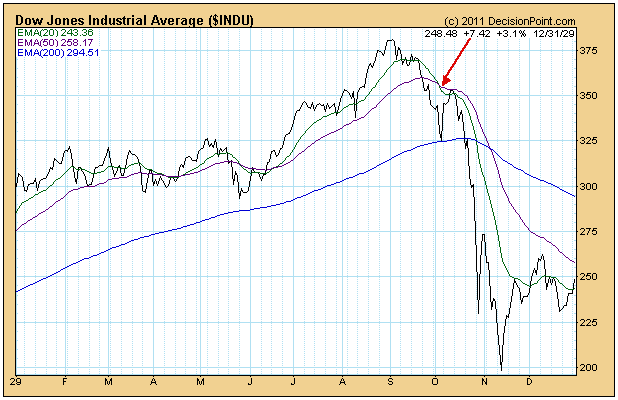

(This is an excerpt from Friday's blog for Decision Point subscribers.) My wife is something of an insomniac, so she listens to a lot of nighttime talk shows -- not the best cure for insomnia, I'll bet... Read More

ChartWatchers March 19, 2011 at 05:46 PM

For the first time since August 2010, the bears are in control of the short-term action... Read More

ChartWatchers March 19, 2011 at 02:01 PM

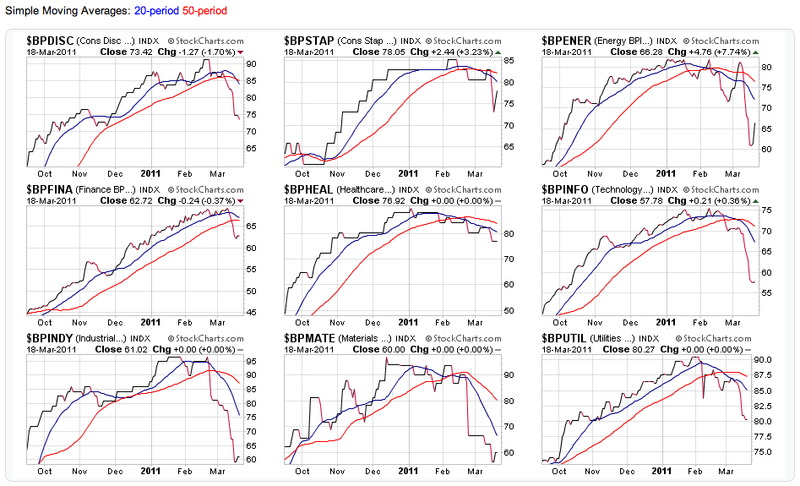

Hello Fellow ChartWatchers! Talk about your "Wall of Worry"! These days there are tons of things to worry about. So are the bulls going to be able to keep climbing? Whenever I want to get a solid, high-level view of the overall market I turn to our trusty Bullish Percent Indexes... Read More

ChartWatchers March 19, 2011 at 09:39 AM

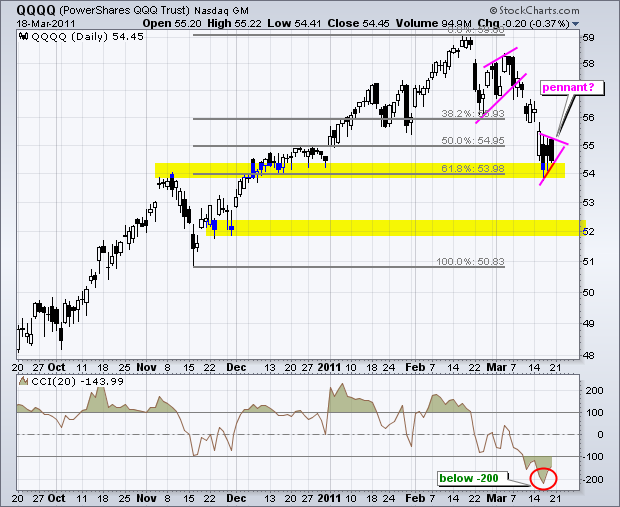

With big declines on Wednesday, the Nasdaq 100 ETF (QQQQ) and the Russell 2000 ETF (IWM) both became oversold and hit potential support zones. The first chart shows QQQQ hitting support around 54 after an 8+ percent decline the last few weeks... Read More

ChartWatchers March 05, 2011 at 10:52 PM

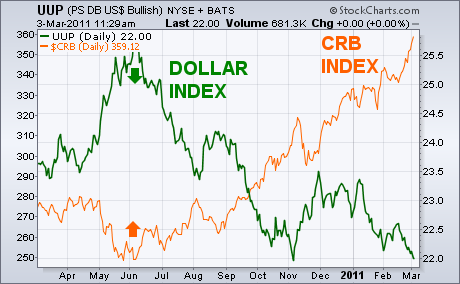

In my Tuesday message, I agreed with the Fed chairman that commodity prices were rising against all currencies. That doesn't mean, however, that the falling U.S. Dollar isn't a major contributor to rising commodities. After all, global commodities are priced in dollars... Read More

ChartWatchers March 05, 2011 at 10:41 PM

(This is an excerpt from Friday's blog for Decision Point subscribers.) The U.S. Dollar Index is in immediate danger again, so lets take a close look at charts from all three time frames, beginning with the daily bar chart... Read More

ChartWatchers March 05, 2011 at 10:32 PM

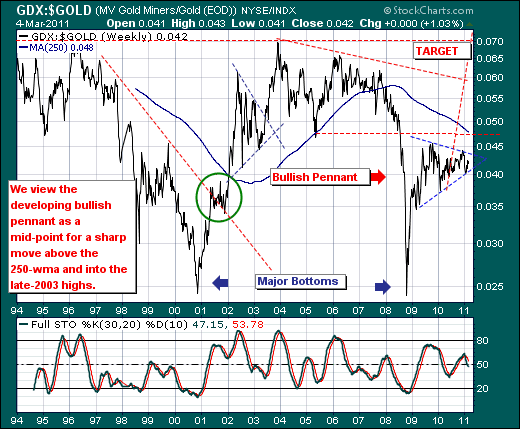

The recent gold price rally to new highs hasn't been impressive when compared to silver's sharp rally; but then again, the race may not always go to the rabbit. And it is this thought that has prompted us to consider the horridly lagging gold stocks (GDX)... Read More

ChartWatchers March 05, 2011 at 10:27 PM

It's hard to believe it's been two years since that infamous 2009 March bottom. I'm going to focus on the NASDAQ for purposes of today's article... Read More

ChartWatchers March 05, 2011 at 03:51 PM

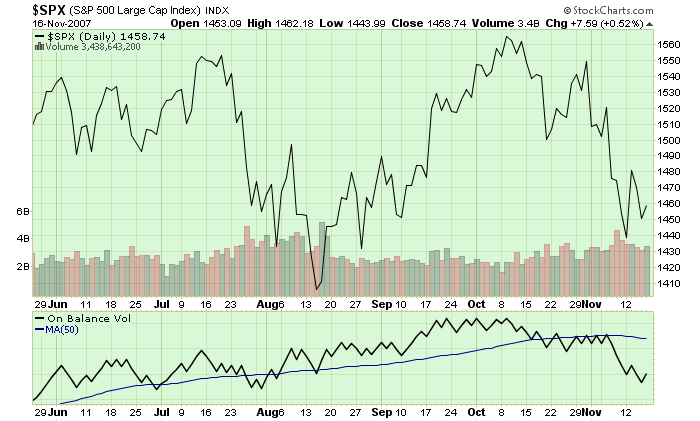

Hello Fellow ChartWatchers! (This is a repeat of an article I wrote in 2007. Seems like now is a great time to review its message... Read More

ChartWatchers March 05, 2011 at 11:20 AM

The S&P 500 ETF (SPY) is hitting resistance from last week's gap down, but may just find support from this week's gap up. The latest round of gaps started with a gap down from a new high on 22-February... Read More