ChartWatchers October 15, 2016 at 02:54 PM

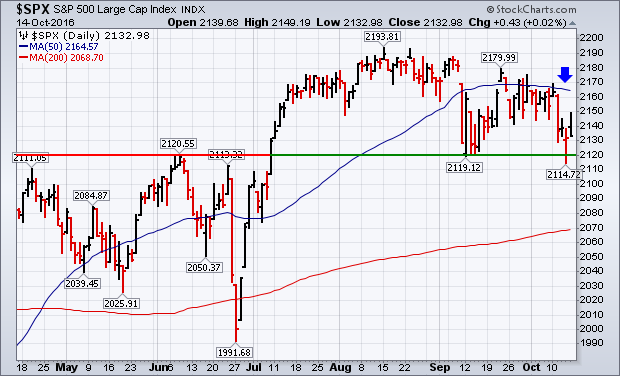

A morning bounce in stocks faded by the end of the day. Chart 1 shows the S&P 500 ending the day at its low. That keeps stocks in a short-term downside correction and well below a falling 50-day average (blue arrow)... Read More

ChartWatchers October 15, 2016 at 01:29 PM

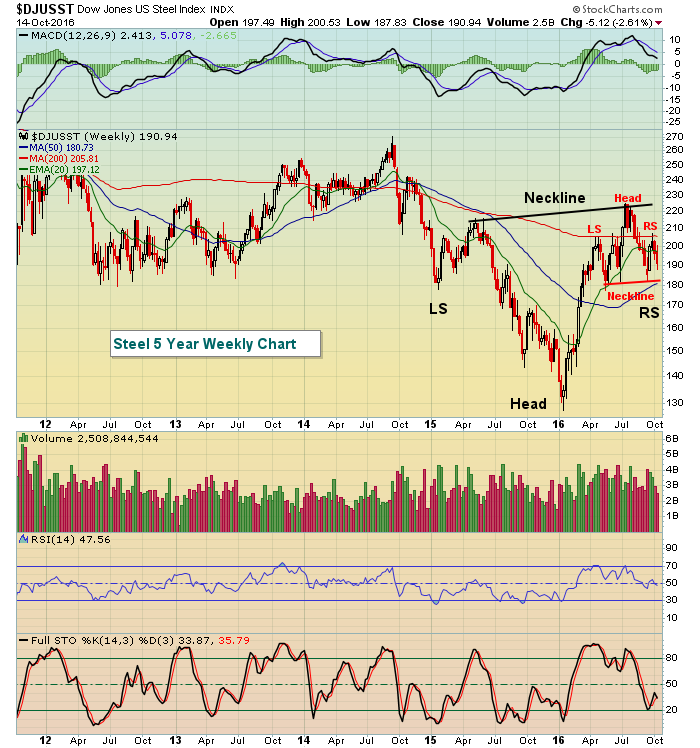

We've entered a very strong historical part of the year for our major indices and most sectors and industry groups. Today, I want to focus on one of the best of the best, the Dow Jones U.S. Steel Index ($DJUSST)... Read More

ChartWatchers October 15, 2016 at 06:16 AM

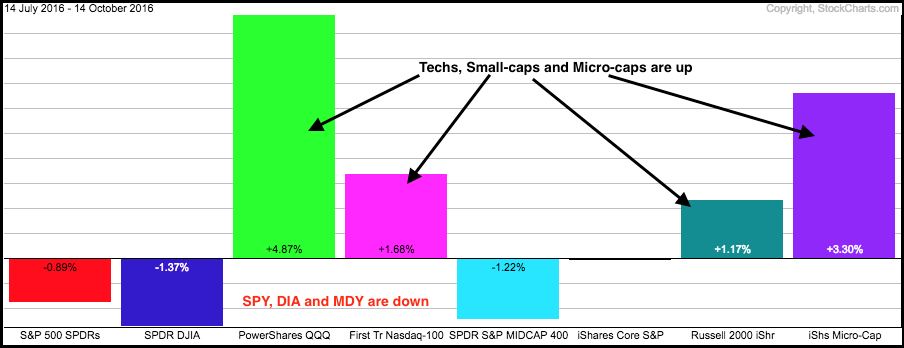

The broader market is incredibly mixed over the last three months. Even though performance divergences reflect a divided market, the major index ETFs are holding above their June highs and I view this as a correction within an uptrend... Read More

ChartWatchers October 15, 2016 at 01:42 AM

The 30-Year Bond ($USB) broke down through a long term uptrend this month but the bigger picture shows something else. There is still a major uptrend channel. However, we appear to be on a big countertrend move starting now... Read More

ChartWatchers October 14, 2016 at 09:00 PM

We're now in the thick of Q3 earnings season when thousands of companies will report their numbers over the next several weeks... Read More

ChartWatchers October 14, 2016 at 08:00 PM

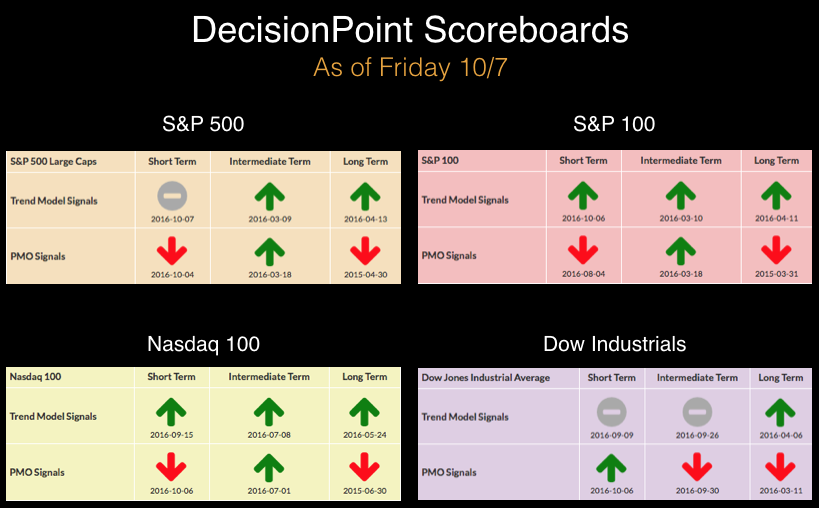

The DecisionPoint Scoreboards had significant changes this week. Note the difference between last Friday's DP Scoreboard and today's. Scoreboards went from very bullish to very bearish in one week... Read More

ChartWatchers October 01, 2016 at 09:52 PM

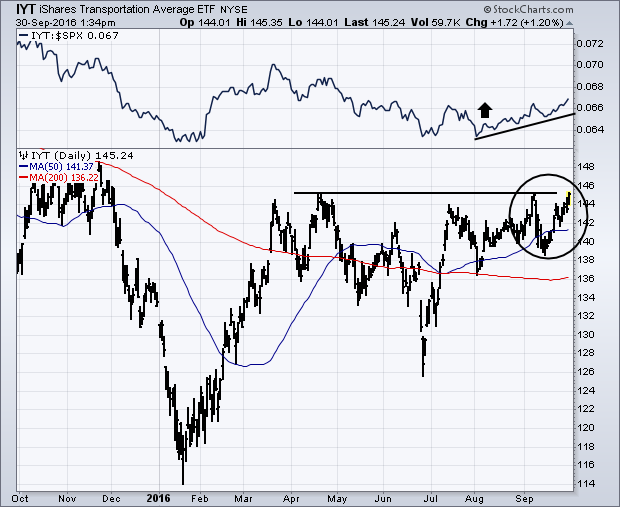

Once again, transportation stocks appear to be on the verge of a bullish breakout. Chart 1 shows Transportation Average iShares (IYT) on the verge of breaking through their April/September highs. Their relative strength ratio (top of chart) also appears to have bottomed... Read More

ChartWatchers October 01, 2016 at 09:44 PM

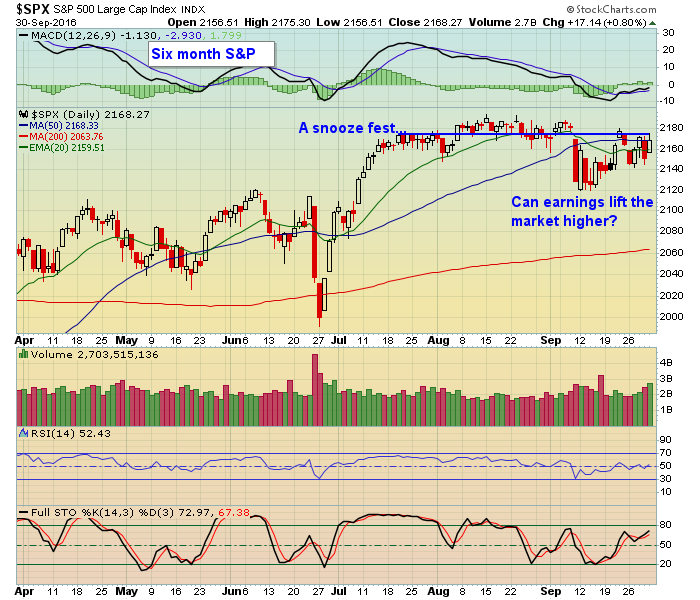

The third quarter has come to an end. It ended on a high note with the S&P gaining 3.3% from the June 30 close to Friday's close. Interestingly, the S&P got to 2168 two weeks into the third quarter which is exactly where it ended on Friday... Read More

ChartWatchers October 01, 2016 at 02:05 PM

Technology stocks (XLK) produced gains of more than 10% in the third quarter of 2016, more than double that of any other sector. Industrials (XLI) were the second best group, posting a quarterly gain of 4.80%... Read More

ChartWatchers October 01, 2016 at 01:23 PM

Hello Fellow ChartWatchers! Well, after 18 years of writing these newsletters - and doing webinars and hosting conferences and writing educational articles - I am reliquishing those duties to others so that I can focus (re-focus?) on my real passion - making the technology behind... Read More

ChartWatchers October 01, 2016 at 11:59 AM

While the world continues to debate the path of every pipeline, investors are not debating the path of the pipeline companies. Three of the larger pipeline companies are in focus this week as another LNG project on the west coast was approved in Canada... Read More

ChartWatchers October 01, 2016 at 07:55 AM

Deutsche Bank dominated the news late in the week, but US banks have been largely unaffected and bullish flags are taking shape in two bank-related ETFs. The charts below show the Bank SPDR (KBE) and the Regional Bank SPDR (KRE) in long-term uptrends... Read More

ChartWatchers September 30, 2016 at 10:09 PM

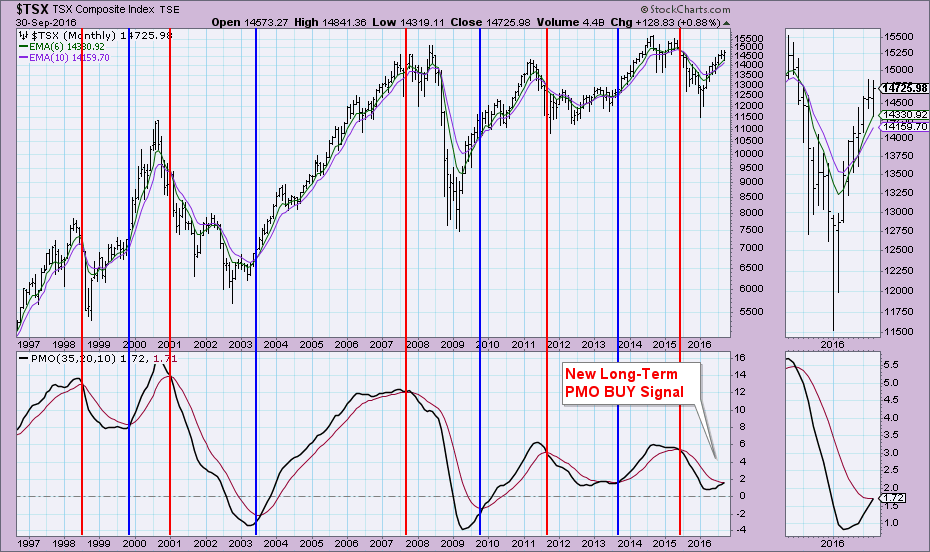

Hopefully I won't be stepping on Greg Schnell's Canadian toes, but as I was going through charts from last Wednesday's webinar, I saw that $TSX just had a new LONG-TERM Price Momentum Oscillator (PMO) BUY Signal... Read More