ChartWatchers February 17, 2018 at 12:25 PM

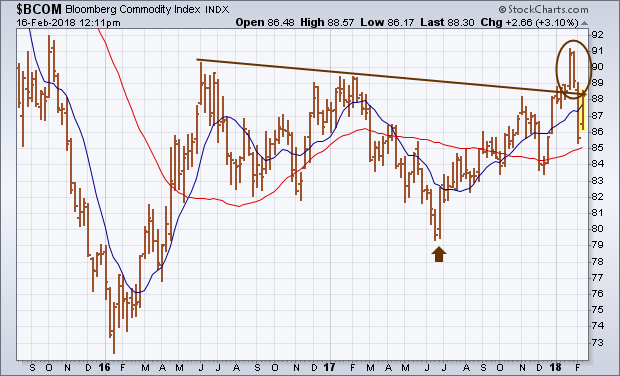

My January 27 message wrote about a bullish breakout in commodity prices to the highest level in two years. I took that as another sign that inflation pressures were starting to build... Read More

ChartWatchers February 17, 2018 at 12:09 PM

I'm sure most traders get tired of being told to be patient when the market or a specific stock is climbing day after day. Missing out on nice rallies can be extremely frustrating. But if there ever was a time when patience paid off big time it was over the past few weeks... Read More

ChartWatchers February 17, 2018 at 11:21 AM

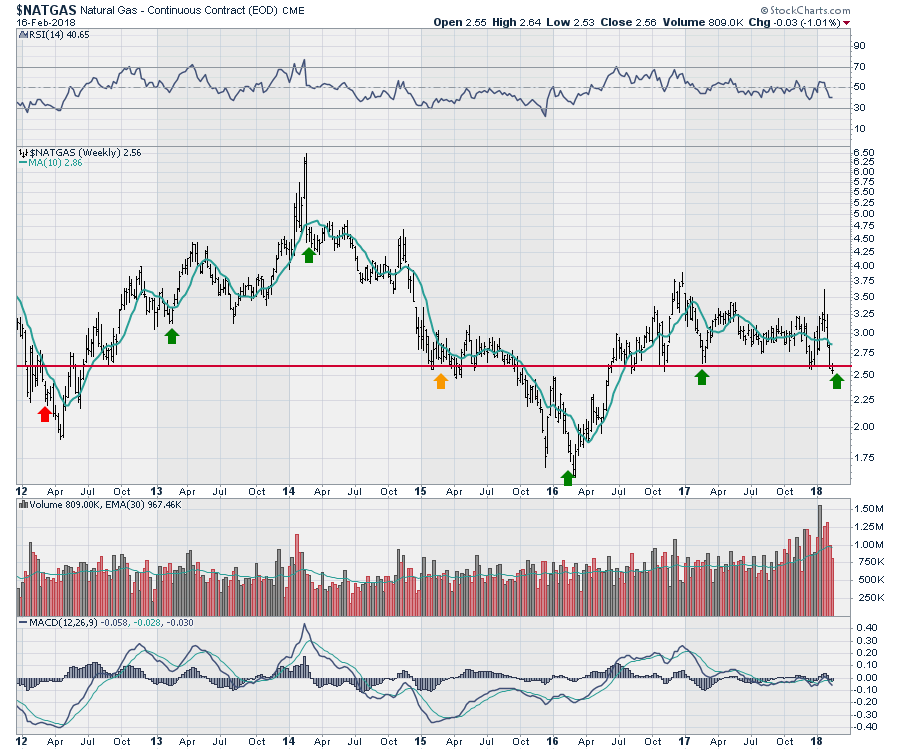

Natural Gas has been testing the $2.60 level for two weeks now. I have placed arrows around the centre of the first quarter in each of the last six years... Read More

ChartWatchers February 17, 2018 at 08:42 AM

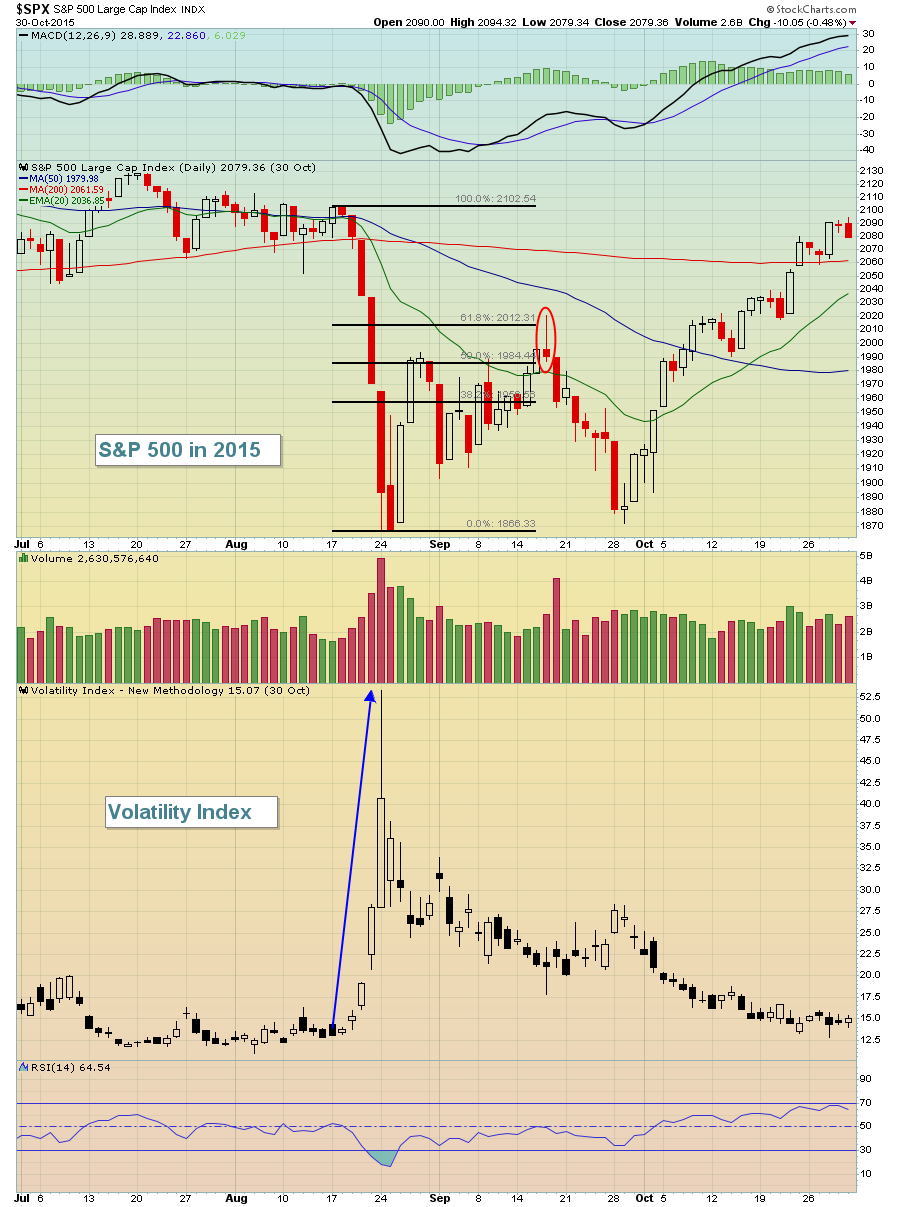

Fear ramped up with the early February selling and a capitulatory bottom (at least short-term) printed. The Volatility Index ($VIX) doesn't hit the 40-50 zone often and, when it does, it typically coincides with a panicked selloff and bottom... Read More

ChartWatchers February 17, 2018 at 05:55 AM

Stocks rebounded this week as the S&P 500 Equal-Weight Index ($SPXEW) recovered most of the losses from the previous week. On a closing basis, the index fell around 10% in nine days and then recovered around half of this loss with a 5... Read More

ChartWatchers February 16, 2018 at 04:56 PM

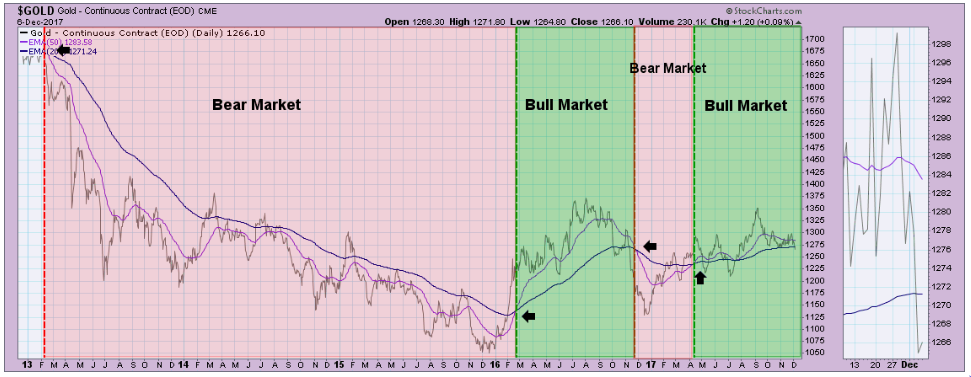

Today on MarketWatchers LIVE, I did a workshop on bull and bear market rules. You'll hear many technicians discuss "bull market rules apply" or vice versa. The question is pertinent and timely right now... Read More

ChartWatchers February 03, 2018 at 07:42 PM

Bond yields are rising a lot faster than a lot of people expected. And that's starting to worry stock holders. The weekly bars in Chart 1 show the 30-Year Treasury Yield rising over 3... Read More

ChartWatchers February 03, 2018 at 07:39 PM

Traders who are "all in" on the long side hate days like this past Friday when the market got slammed big time, with the Dow down 2.6%, the NASDAQ down 2.1% and the S&P down 2%, the worst overall showing in two years... Read More

ChartWatchers February 03, 2018 at 11:45 AM

Identifying The Candidates I've included the month-by-month seasonal information for all NASDAQ 100 ($NDX) stocks in an Excel spreadsheet. In an effort to identify the best seasonal stocks on the NDX, I first considered the number of years history for each stock... Read More

ChartWatchers February 03, 2018 at 10:44 AM

Lithium LIT Rare Earth Metals REMX Steel SLX Coal KOL Book starts shipping next week! Lithium, Steel and Rare Earth Metals all had a pretty good 2017. Each week on Commodities Countdown, I roll through the commodity markets... Read More

ChartWatchers February 03, 2018 at 03:09 AM

Short-term Treasury yields have been moving sharply higher since September with the 5-yr and 2-yr yields hitting multi-year highs over the last few months... Read More

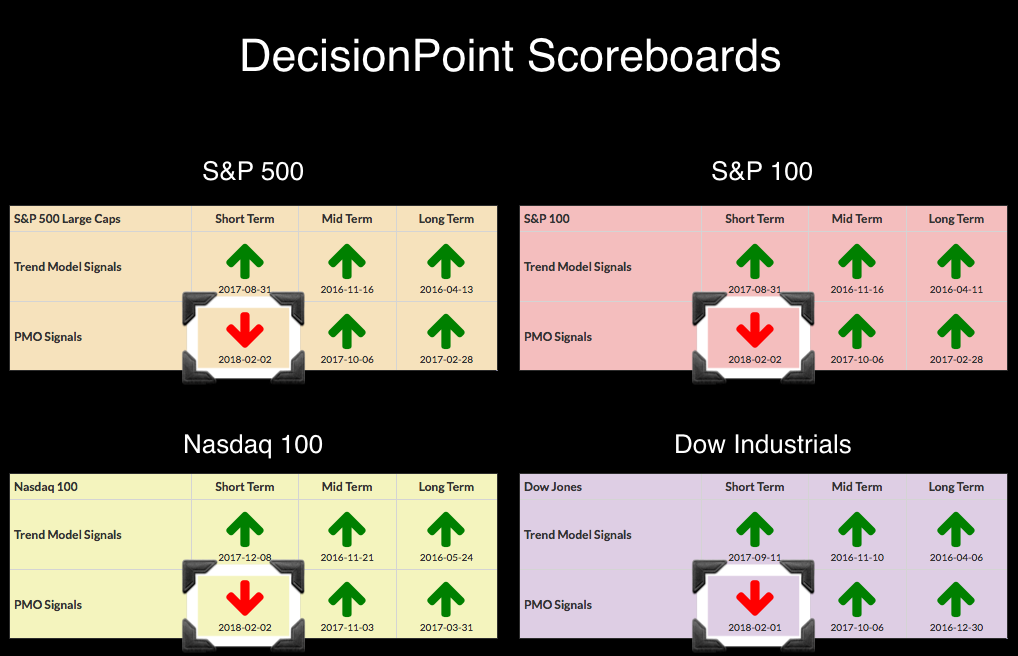

ChartWatchers February 02, 2018 at 06:46 PM

It's been nearly a month since we saw our last signal changes to the DecisionPoint Scoreboards, but with the pullback over the past week, momentum turned negative and now we are seeing new Price Momentum Oscillator (PMO) SELL signals on all four! The Dow actually incurred its PMO... Read More