DecisionPoint November 28, 2014 at 06:53 PM

The market closed slightly lower but it remained within the narrow range of the previous four trading days... Read More

DecisionPoint November 24, 2014 at 06:50 PM

The purpose of a trading model is to define certain conditions that, when met, alert us to consider making a decision to buy or sell. We assume that a large majority of technical analysts use trading models of some kind to assist in their trading decisions... Read More

DecisionPoint November 21, 2014 at 06:45 PM

Note: The DP Weekly Update will now be published every Friday so we can analyze the final weekly charts. Price surged on the open likely helped by China lowering its interest rates for the first time in two years. After that it was all downhill... Read More

DecisionPoint November 20, 2014 at 07:20 PM

It was rightly brought to my attention that I haven't really explained what DecisionPoint Trend Model signals imply, especially the "Neutral" signal... Read More

DecisionPoint November 19, 2014 at 06:49 PM

NOTE: The DP Weekly Update will be moving to Fridays. That way you'll get a review of the weekly charts as well as the regular commentary. After breaking out yesterday, price broke down. The breakdown actually began at the end of yesterday where we noted that it could be problem... Read More

DecisionPoint November 18, 2014 at 07:24 PM

I don't like to toot my own horn, but Chip suggested I do today! Most of you are not aware that the DecisionPoint Trend Model signals have been tracked for many years by Timer Digest, a professional publication for market timers... Read More

DecisionPoint November 17, 2014 at 05:54 PM

We see plenty of indicators that tell us that there is a possibility for a correction, but not all indicators are sending that message. One in particular is the Advance-Decline Line (A-D Line)... Read More

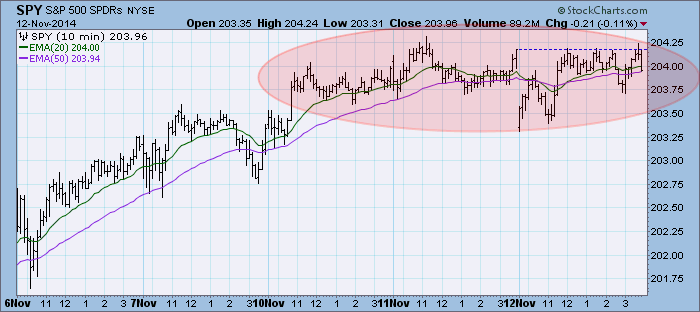

DecisionPoint November 12, 2014 at 05:40 PM

Price continues to consolidate. The market seems to be disinterested in a breakdown. The purpose of the DecisionPoint Daily Update is to quickly review the day's action, internal condition, and Trend Model status of the broad market (S&P 500), the nine SPDR Sectors, the U.S... Read More

DecisionPoint November 10, 2014 at 05:45 PM

We've been hearing how Japan's latest foray into money printing has been such a great help for their stock market, but it is always best to see if the chart matches the story. After rising strongly off the late-2012 low, the Nikkei moved sideways for over two years... Read More

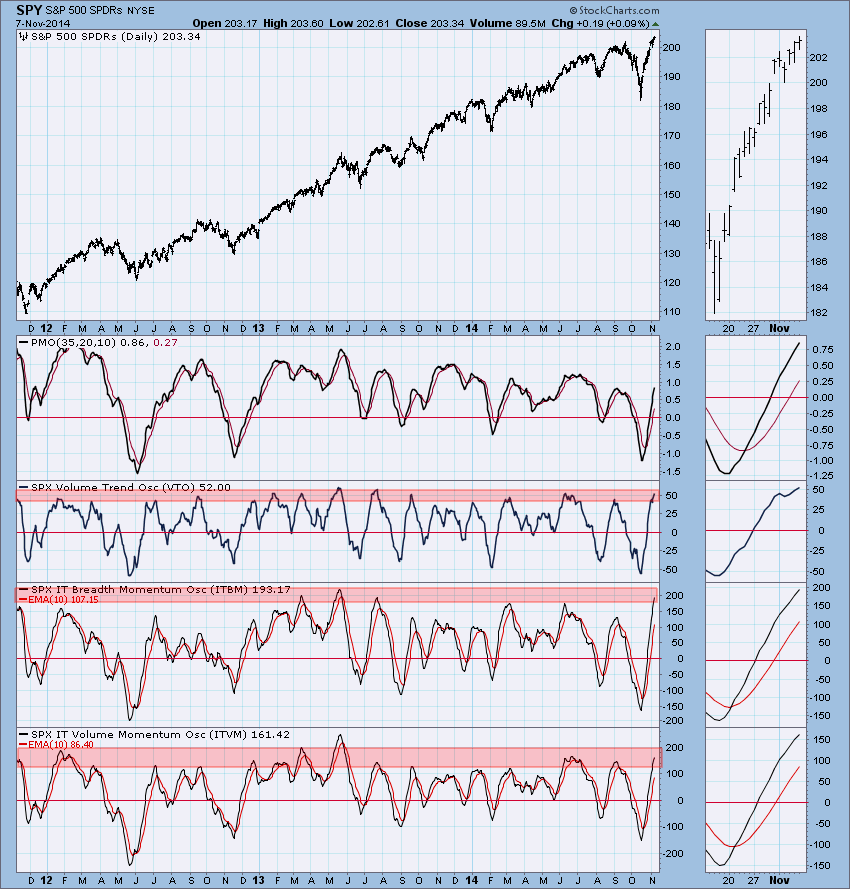

DecisionPoint November 07, 2014 at 06:47 PM

As I wrote my DP Daily Update today, I noticed that our intermediate-term indicators have joined our short-term indicators in very overbought territory... Read More

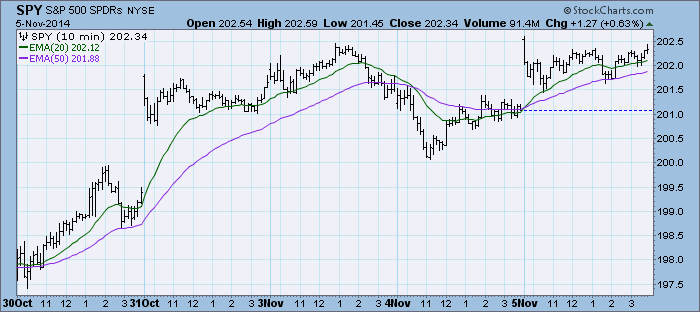

DecisionPoint November 05, 2014 at 06:36 PM

The market was up all day making new all-time highs, but still spent the majority of the day moving sideways... Read More

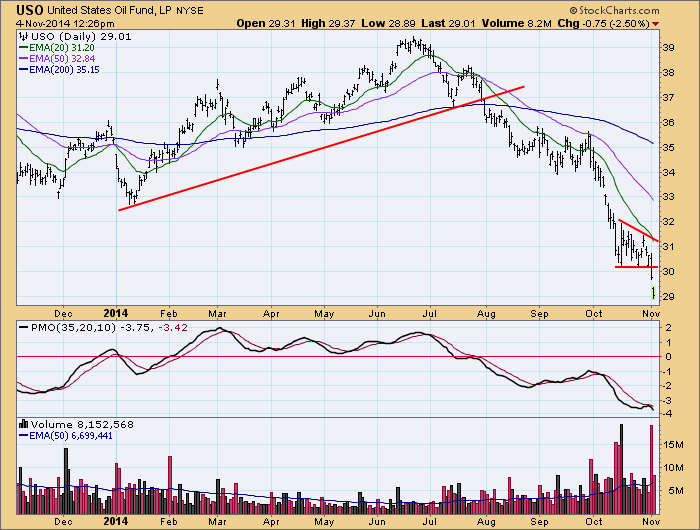

DecisionPoint November 04, 2014 at 01:18 PM

Crude oil has dropped below $80.00 and is currently trading at about $76.50. We use the U.S. Oil Fund ETF (USO) as a surrogate for crude because it incorporates the cost of trading the futures contracts, and provides a simple vehicle for trading crude... Read More