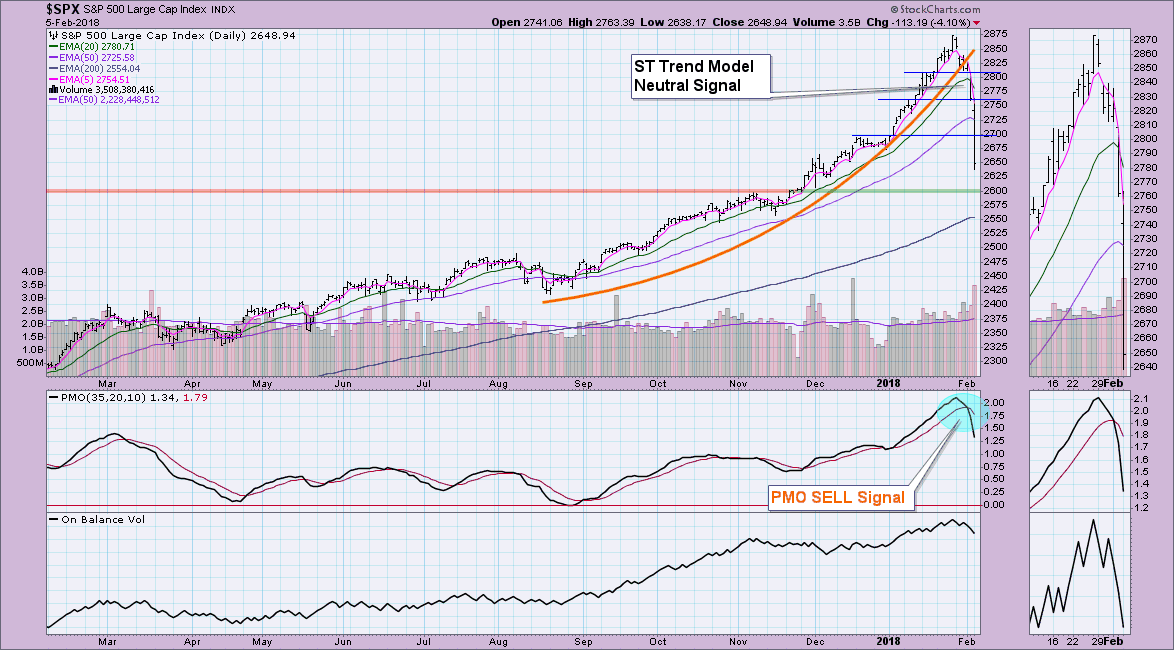

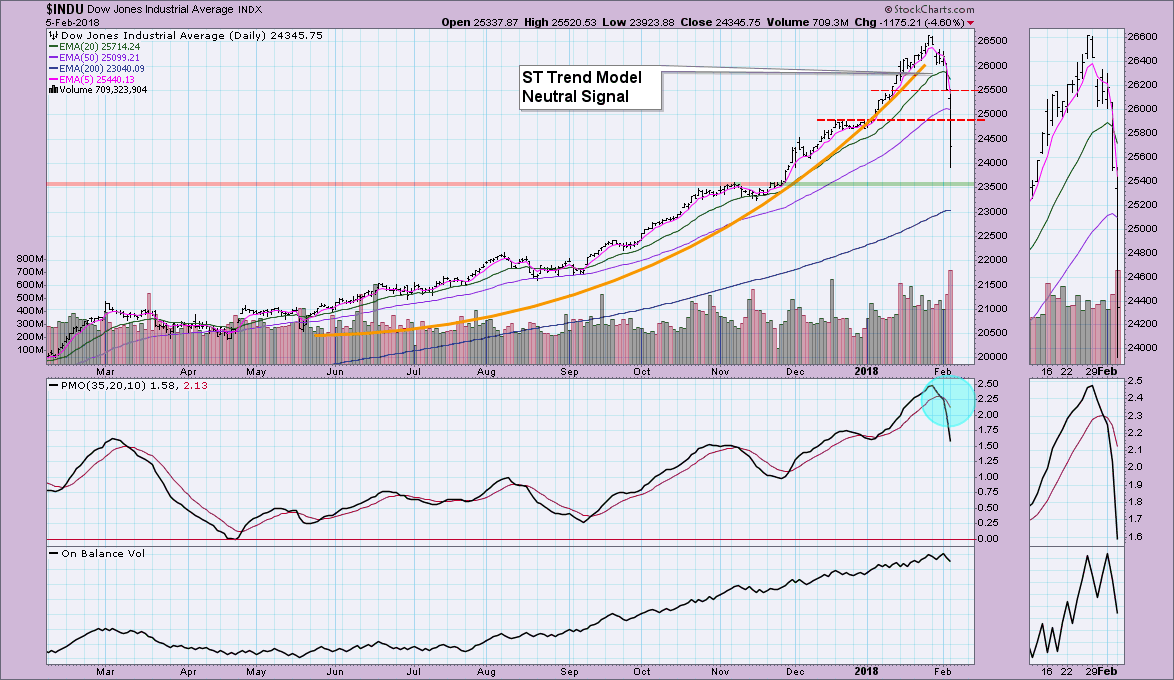

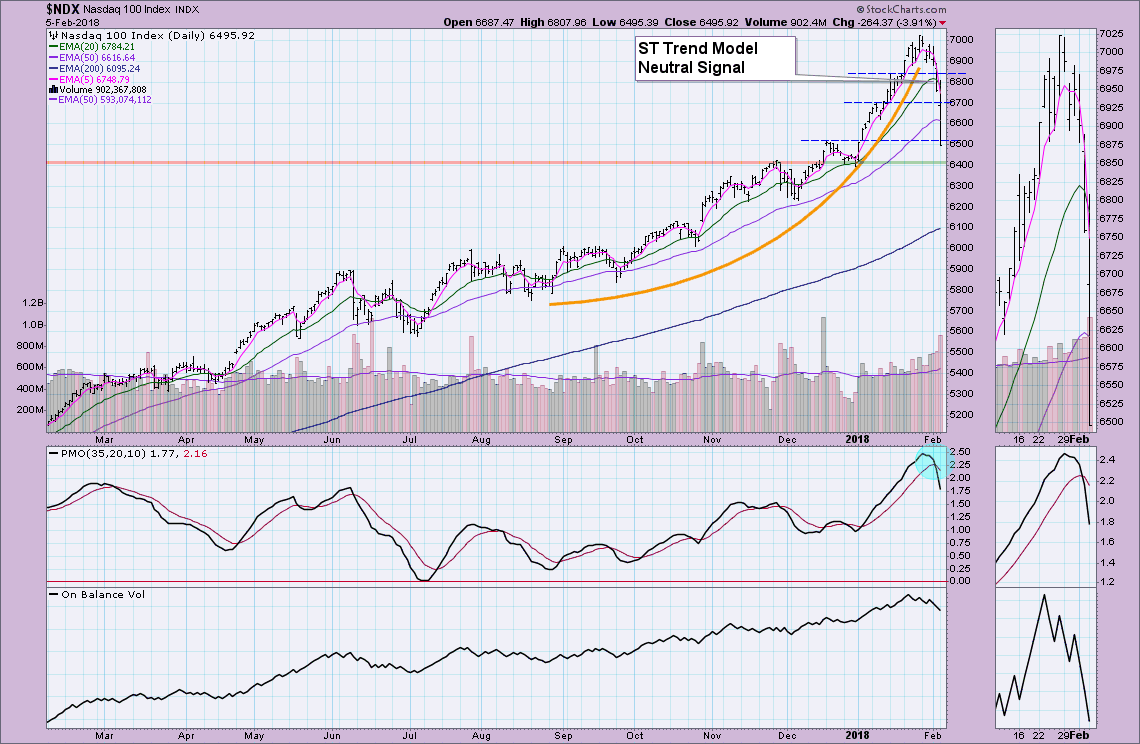

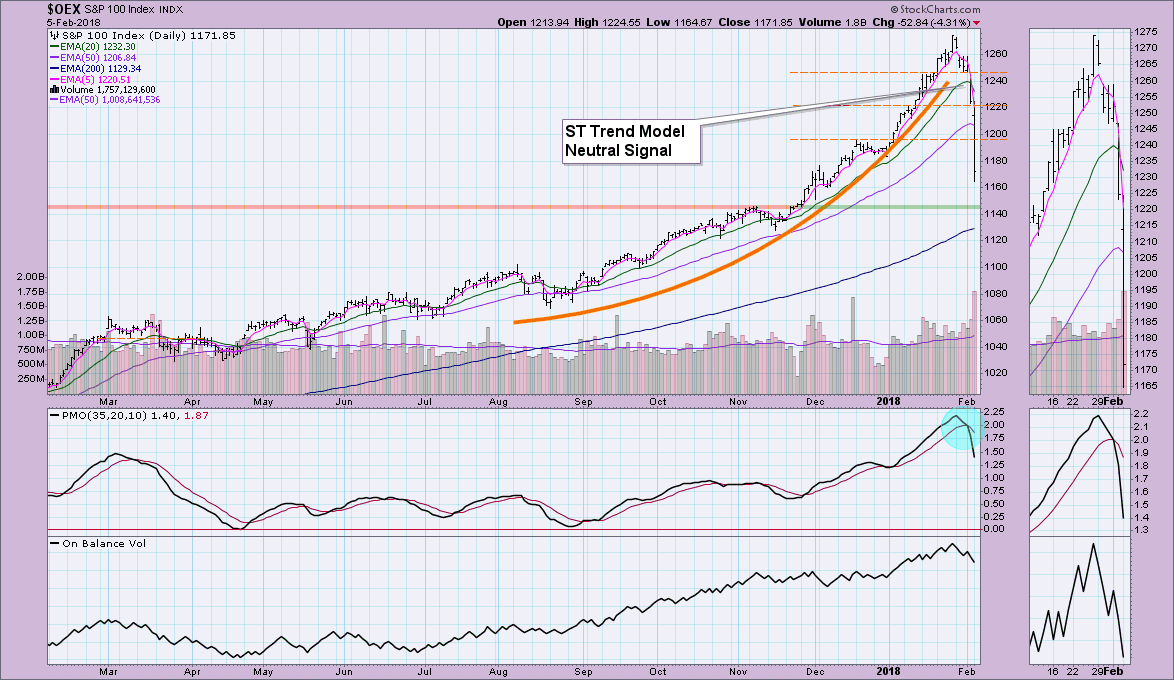

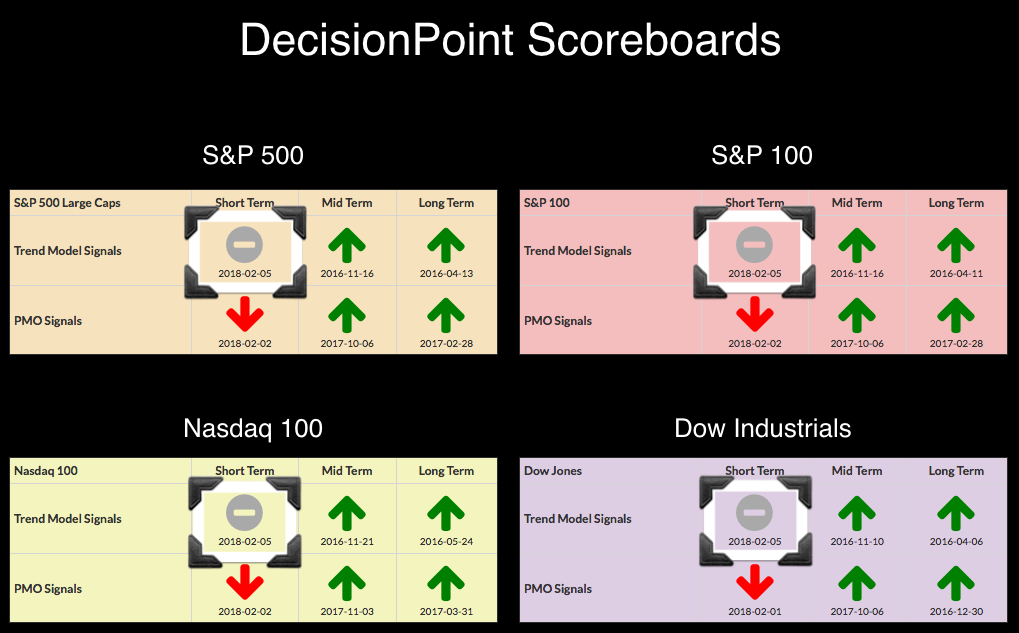

Today all four Scoreboard indexes (NDX, INDU, SPX & OEX) logged new Short-Term Trend Model Neutral signals. These signals arrived when the 5-EMA crossed below the 20-EMA while the 20-EMA was above the 50-EMA. In addition, we saw a new PMO SELL signal on Gold. I've included the charts below for your review.

We honestly shouldn't be overly surprised by the depth of this correction given the parabolic rallies that all of these indexes have been in for some time. I've written quite a few articles on parabolic formations and when they fail, they FAIL, quickly. The good news is that we are finally seeing overbought extremes fall away and this gets us ready for the next round up. Carl and I have both been talking about a corrective move to about 2700 on the SPX and now that level has been taken out. If there is to be more panic selling, support is near. I've marked the likely stopping points for each of the indexes below.

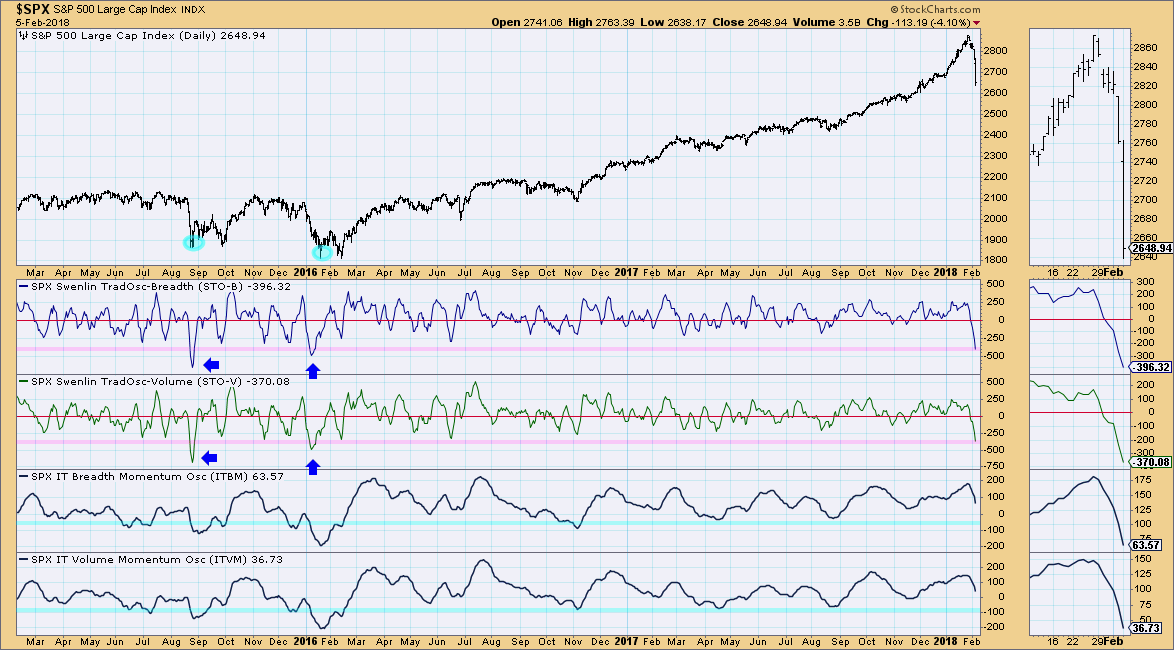

The market in just a few days time has cleared overbought conditions. Sentiment is extraordinarily bearish right now and that is fertile ground for a rebound. My concern is that I don't think we are out of the woods in the intermediate term. You'll note that our ST indicators below have hit levels we haven't seen in years, but the IT indicators have plenty of ground to continue lower. Note when we've seen readings bottom below this current level, it did lead to some upside out of a very oversold level, but the rollercoaster continued on later. I suspect we are looking at something similar.

Gold generally finds favor when the Dollar is struggling and the market is tanking. Carl had already pointed out last Friday that seeing Gold struggle with such a weak Dollar was concerning. It is time for Gold to correct back to the 1300 level and the new PMO SELL signal seems to confirm this. If the market continues to fall, Gold could find temporary support around 1330, but ultimately I'd be looking for a move back to 1300.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**