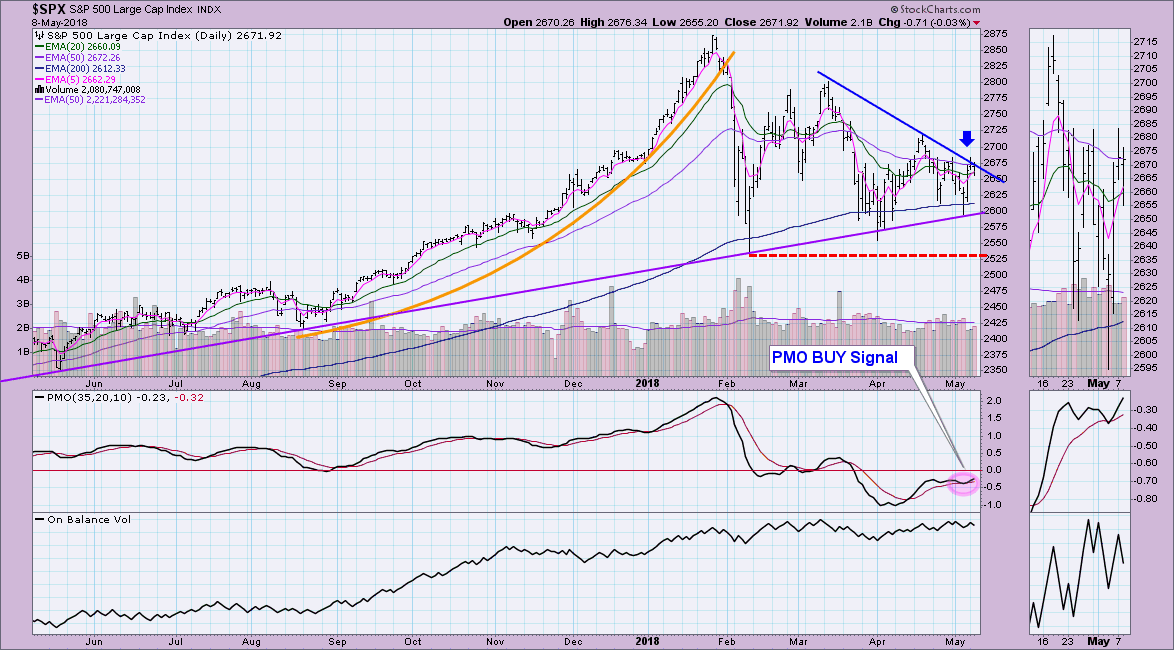

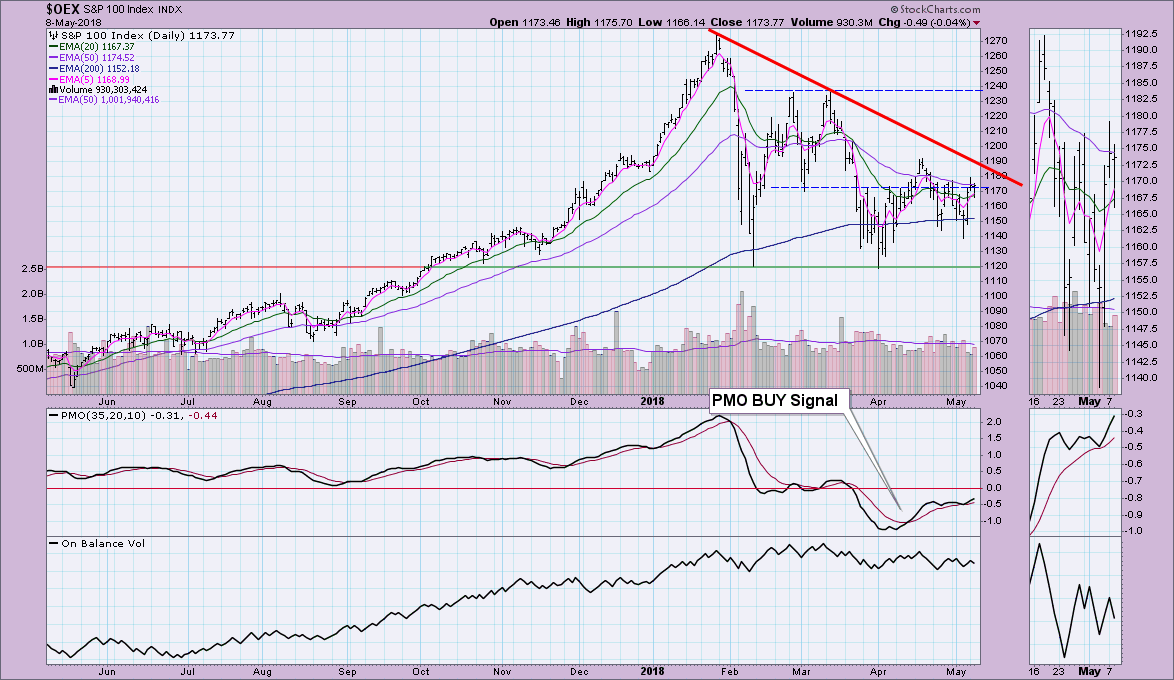

The SPX and OEX both triggered new ST Trend Model BUY signals as the 5-EMAs crossed above the 20-EMAs. However, the charts are less than impressive.

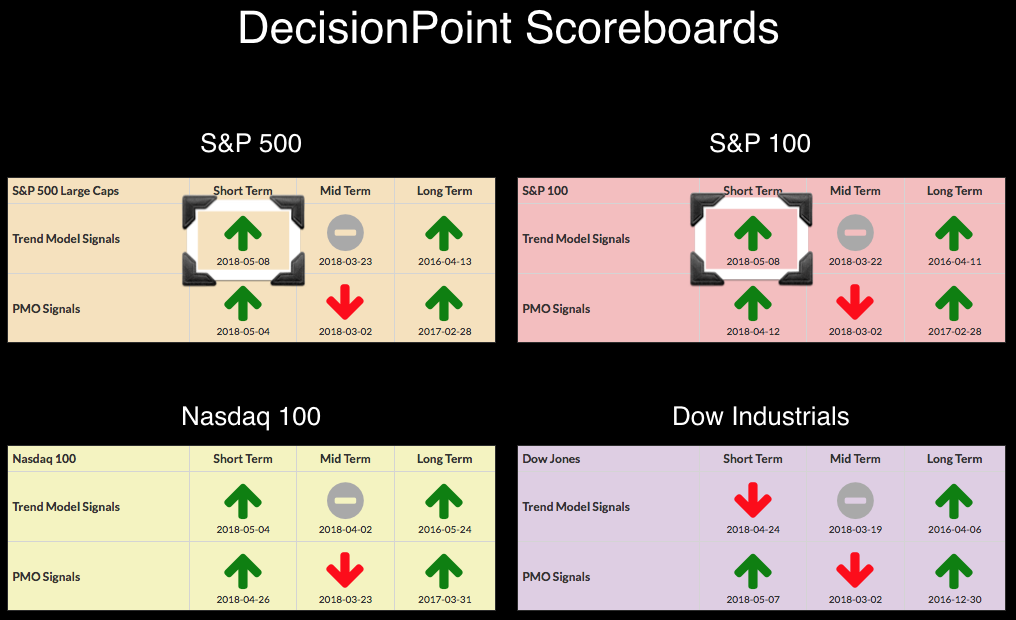

We are seeing new strength on the DecisionPoint Scoreboards with four new PMO BUY signals and now 3 out of 4 indexes carrying ST Trend Model BUY signals. Yet, note on both the SPX and OEX below, price has not been able to penetrate the declining tops trendlines. I'd feel a whole lot better if these signals were arriving on a breakout. The OBV isn't making new highs in the short term either. Given the intermediate-term signals on the Scoreboards are bearish, I'm not ready to get on board the rally to all-time highs train. For me, optimistically, we are in a consolidation phase that isn't over yet. These new buy signals could be signaling an end to the correction, but I'm seeing it more as a short-term rally/reprieve until the next test of the 200-EMA or February low.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**