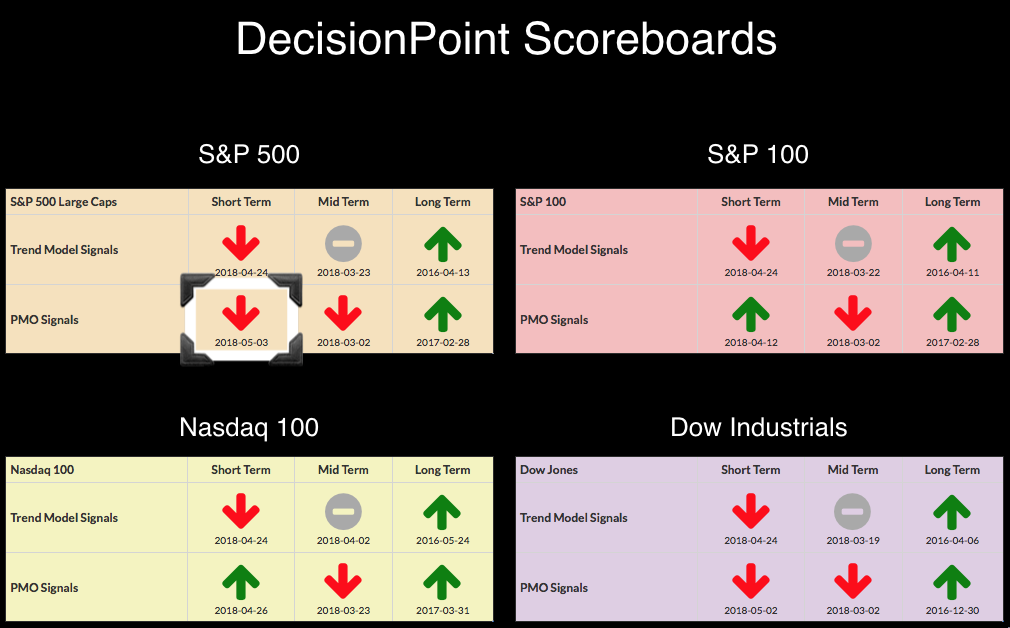

Today the SPX joined the Dow with a new PMO SELL signal. If the correction continues much longer, the OEX and NDX will follow suit.

Today's action left the SPX with a long tail that tested the purple rising bottoms trendline. This test was successful, but the breakdown and trading below the blue ST rising bottoms trendline is concerning. We're seeing the 200-EMA penetrated yet again. If the SPX is to avoid a bear market, it needs to rebound here or at the very least at the February low. It avoided a break below support at the February low back at the end of March. It's time for the market to rally but this new PMO SELL signal suggests it isn't ready just yet. Again, support at Feb low is critical.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**