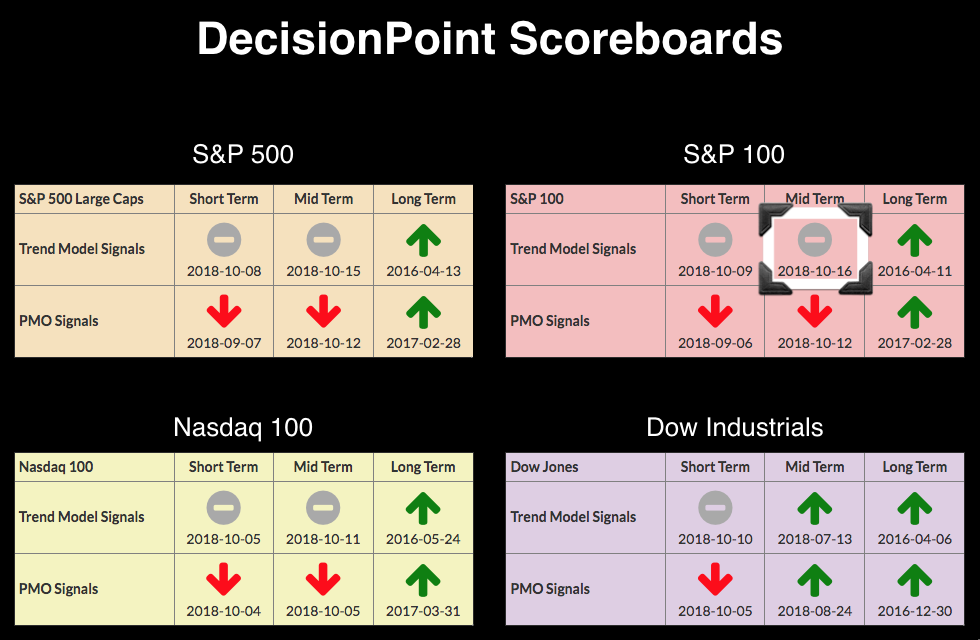

This morning on MarketWatchers LIVE, Tom and I were very cautious regarding today's rally. John Murphy and Arthur Hill are bearish. Carl is undecided but erring on the side of caution. So it was somewhat surprising and cause for a chuckle to see and hear the ridiculously excited big network commentators trumpeting today's rally and calling the end of the correction. Digging into the numbers, I found that volume doesn't support their exuberance or hypothesis that a new market bottom is in. Looking at the DP Scoreboards and seeing the addition of yet another IT Trend Model Neutral signal suggests the ground is not fertile.

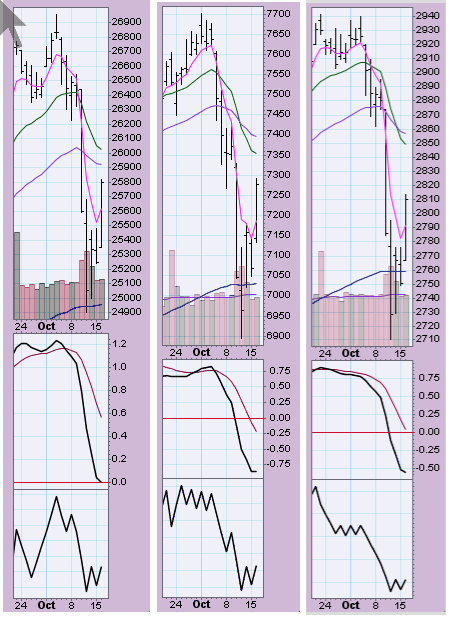

When the 20-EMA crossed below the 50-EMA while above the 200-EMA, an IT Trend Model Neutral signal was generated. Neutral means "in cash" or fully hedged. Carl mentioned on Friday that one way to take the guesswork out of determining a market bottom is to watch the PMO. When it finally turns up, risk will be reduced on reentering. Volume is the big problem for me. Notice the OBV has blipped higher and volume in general has been falling. On a huge day like today, volume should confirm and it didn't.

I noted on the other three Scoreboard indexes (Dow, NDX, SPX respectively) that volume is not confirming either. I've included the thumbnails below. Note the OBV and lack of confirming volume.

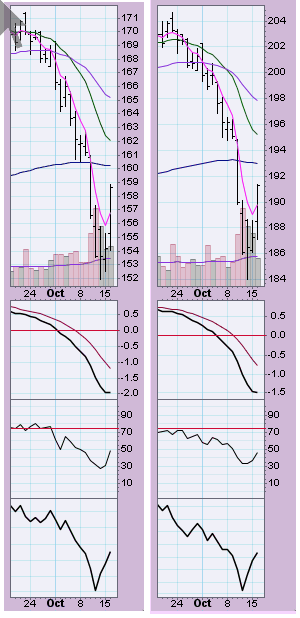

Mid-Caps (IJH) and Small-Caps (IWM) have a far healthier looking OBV. However, you still can still see declining volume since Wednesday's crash and rather unimpressive numbers today.

PMOs are decelerating with today's impressive rally. Unfortunately, volume wasn't all that impressive. I suspect this will be a bull trap, encouraging investors to get back in before the next corrective move. I'll likely use the new found strength as an opportunity to increase cash in anticipation of more downside and future opportunities.

PMOs are decelerating with today's impressive rally. Unfortunately, volume wasn't all that impressive. I suspect this will be a bull trap, encouraging investors to get back in before the next corrective move. I'll likely use the new found strength as an opportunity to increase cash in anticipation of more downside and future opportunities.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**