The Consumer Staples SPDR (XLP) is one of the worst performing sectors year-to-date with a loss greater than 8 percent. The sector is also the second weakest in February because it failed to hold its bounce over the last two weeks.

The Consumer Staples SPDR (XLP) is one of the worst performing sectors year-to-date with a loss greater than 8 percent. The sector is also the second weakest in February because it failed to hold its bounce over the last two weeks.

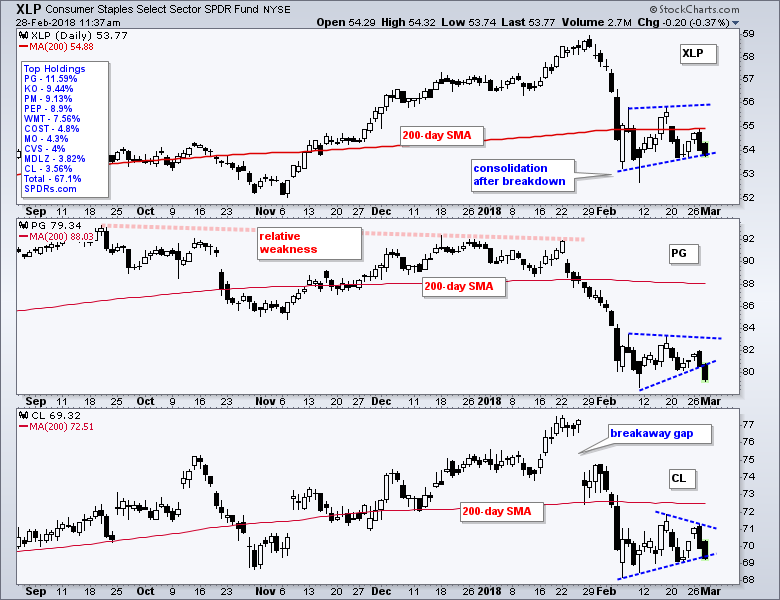

The chart shows XLP with its biggest component (P&G) and its 10th largest component (CL). Procter & Gamble and Colgate are clearly in related businesses and these two are weighing on the 6th largest sector in the S&P 500. XLP accounts for 7.55% of the index.

XLP broke below its 200-day SMA with the plunge in early February and then stalled the rest of the month. This stall looks like a consolidation within a downtrend and this makes it a bearish continuation pattern. A break below last week's low would signal a continuation lower.

The middle window shows PG forming a lower high in December-January and already underperforming XLP, which formed a higher high during this timeframe. PG broke its 200-day SMA in late January and hit a 52-week low in early February. The stock stalled with a triangle into late February and broke the triangle line today.

The lower window shows CL with a breakaway gap in late January and a break below the 200-day SMA in early February. The stock also consolidated with a triangle and is testing the lower line with a two-day decline.

Plan Your Trade and Trade Your Plan.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill