Hilton (HLT) led the market in the second half of 2017 and then took a breather in 2018. This is looking like the pause that refreshes as the stock challenges resistance.

Hilton (HLT) led the market in the second half of 2017 and then took a breather in 2018. This is looking like the pause that refreshes as the stock challenges resistance.

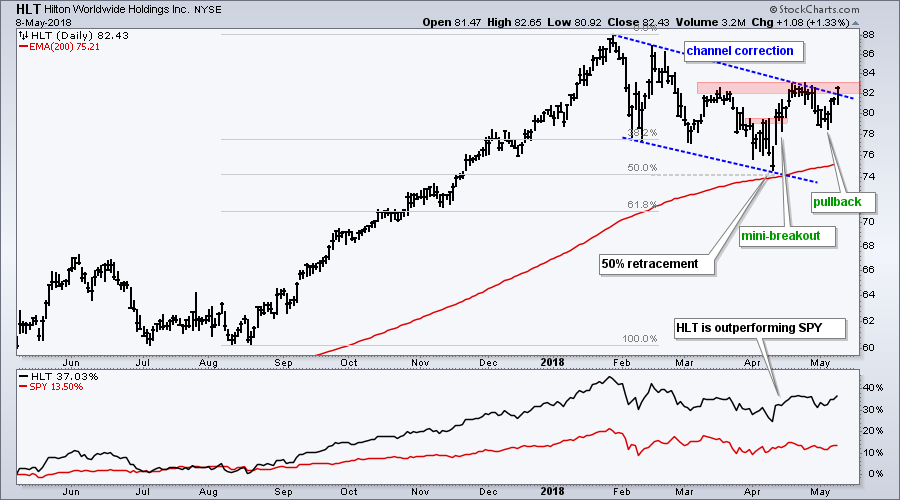

First and foremost - you know the drill - the long-term trend is up and this means I am only interested in bullish setups. HLT hit a new high in January and is above the rising 200-day EMA.

The stock fell back into April as it retraced 50% of its August-January run with a falling channel. Both the retracement amount and the channel are typical for corrections within a bigger uptrend.

The stock surged off the 50% retracement and triggered a mini breakout within the channel. After a small pullback from resistance, the stock again bounced and looks poised to break channel resistance this time.

A breakout would signal a continuation of the bigger uptrend and I would then expect new highs in the stock.

Note that the videos for my weekly show, On Trend, are archived on YouTube (here). Yesterday I covered the SPY, QQQ, the Sector SPDRs and the top components within these ETFs.

Plan Your Trade and Trade Your Plan.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill