The Oil & Gas Equip & Services SPDR (XES) is trading near a potential reversal zone, but the ETF is not keeping pace with strength in oil.

The Oil & Gas Equip & Services SPDR (XES) is trading near a potential reversal zone, but the ETF is not keeping pace with strength in oil.

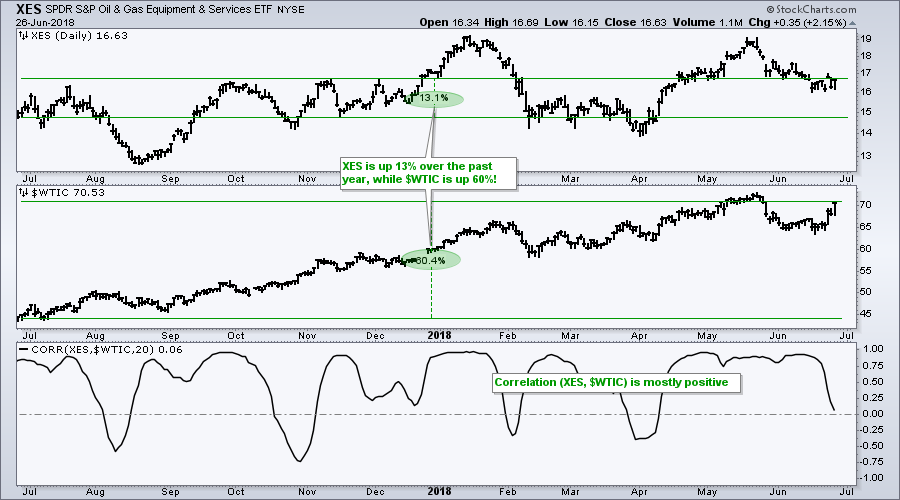

The first chart shows XES, the Light Crude Continuous Contract ($WTIC) and the Correlation Coefficient for the two. XES bounced between 13 and 19 over the past year and is currently just above the midpoint of this range. Perhaps there is a slight uptrend at work here.

Performance wise, XES is up around 13% over the past year and oil is up a whopping 60%. In contrast to the weak uptrend in XES, oil is in a strong uptrend and close to a 52-week high. These two are still positively correlated for the most part, but the performance difference is quite astounding. Perhaps oil prices are not the only price driver for XES.

The next chart focuses on the last four months for the Oil & Gas Equip & Services SPDR (XES). The ETF retraced 50-61.8% of its prior advance with a decline back to the 16 area. XES surged last Friday, but fell back again on Monday, only to bounce again on Tuesday. This pop and drop establishes resistance at 16 and XES needs to clear this level for a breakout.

The indicator window shows RSI with the tiniest of bullish divergences. Notice that XES forged a lower closing low from June 15th to 21st. Meanwhile, RSI formed a higher low and a small bullish divergence. Momentum may be improving on the micro level, but a price breakout at 16 is still needed at the macro level.

On Trend on Youtube

Available to everyone On Trend with Arthur Hill airs Tuesdays at 10:30AM ET on StockCharts TV and repeats throughout the week at the same time. Each show is then archived on our Youtube channel.

Topics for Tuesday, June 26th:

- Measuring Participation after a Big Move

- Spotting Underlying Strength/Weakness

- State of the Market (IJR, XLI/XLF, Seasonality and more)

- Finance Sector versus Healthcare Sector

- Stocks to Watch: MDT, ROST HSIC, ANTM, UTX

- Click Here to Watch

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill