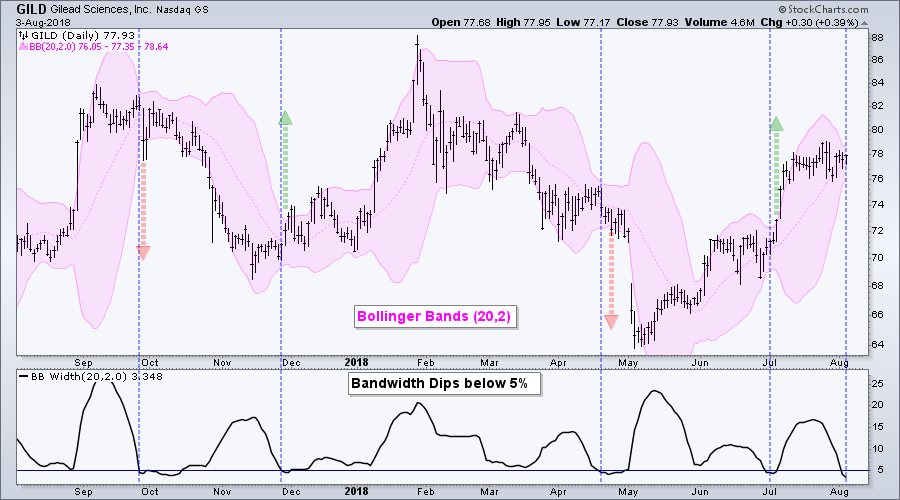

Gilead is in the midst of its fourth Bollinger Band squeeze in the past year. The last four instances foreshadowed pretty strong moves so I will be watching the current squeeze closely for the next directional clue.

Gilead is in the midst of its fourth Bollinger Band squeeze in the past year. The last four instances foreshadowed pretty strong moves so I will be watching the current squeeze closely for the next directional clue.

A Bollinger Band squeeze occurs when the bands contract and the Bandwidth indicator moves to the low end of its range. The chart shows Bollinger Bands shaded in pink and BandWidth in the indicator window. BandWidth measures the difference between the bands as a percentage of the closing price.

Volatility contracts when the Bollinger Bands narrow and this means traders should prepare for a volatility expansion. Note that the Bollinger Bands do not provide any directional clues. Chartists simply need to wait for the direction of the break. A break above the upper band is bullish, while a break below the lower band is bearish.

The chart above shows GILD with the blue vertical lines marking the squeezes, which is when BandWidth dipped below 5%. The red and green lines show the subsequent breaks. The last four breaks resulted in significant short-term moves in the stock. This means chartists should watch 77.35 for a downside break and 78.64 for an upside break.

ChartCon Starts this Friday!

ChartCon and trend following are coming to a screen near you. I will present some trend following strategies complete with backtest results to set expectations. I will also show proven techniques to mitigate risk, increase returns and improve your batting average. Join me and 15 other awesome speakers on August 10th and 11th for two days of empowerment.

Plan Your Trade and Trade Your Plan.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill