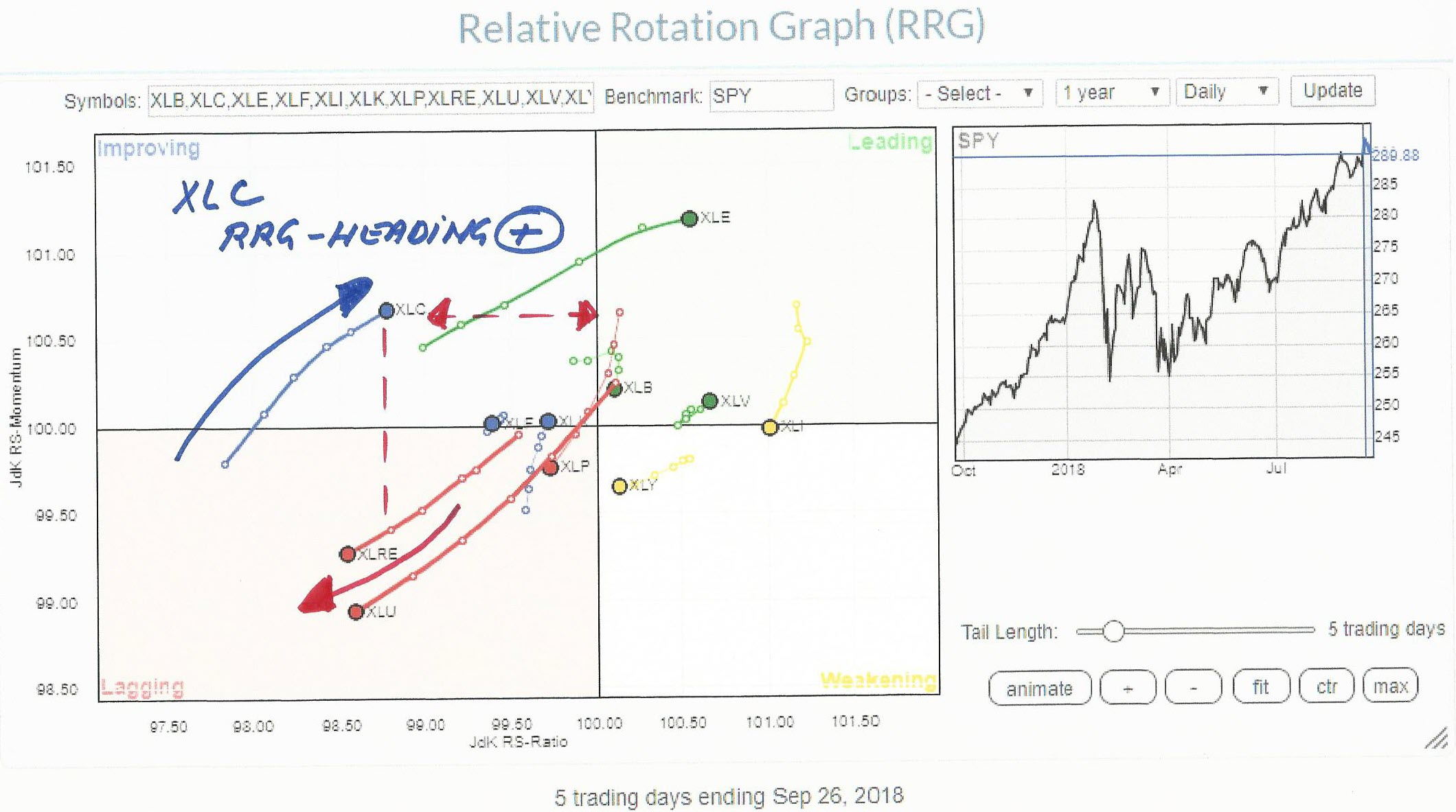

Don't Ignore This Chart! September 27, 2018 at 05:54 AM

On the daily Relative Rotation Graph above, the new XLC sector is positioned inside the improving quadrant. XLC moved into the improving from lagging 5 trading days ago and is now heading higher on both scales at a positive RRG-Heading... Read More

Don't Ignore This Chart! September 26, 2018 at 11:00 AM

Alphabet (GOOGL) fell around 10% from a recent high and this decline looks like a pretty normal correction within a bigger uptrend. Note that GOOGL is the biggest component (23.15%) in the new Communication Services SPDR (XLC). Facebook (FB) is the second largest weighting (17... Read More

Don't Ignore This Chart! September 24, 2018 at 10:22 AM

Regeneron (REGN), a large-cap biotech stock, is part of the Health Care SPDR (XLV) and a top ten holding in the Biotech iShares (IBB), Both ETFs hit 52-week highs recently and show upside leadership... Read More

Don't Ignore This Chart! September 21, 2018 at 09:05 AM

Caterpillar moved above the 200 day moving average this week to get out of the trench it was building. This trench has been a gentle correction from a massive uptrend in 2017. The SCTR is returning to 75 which is a great signal of strength. Notice the SCTR behavior in 2017... Read More

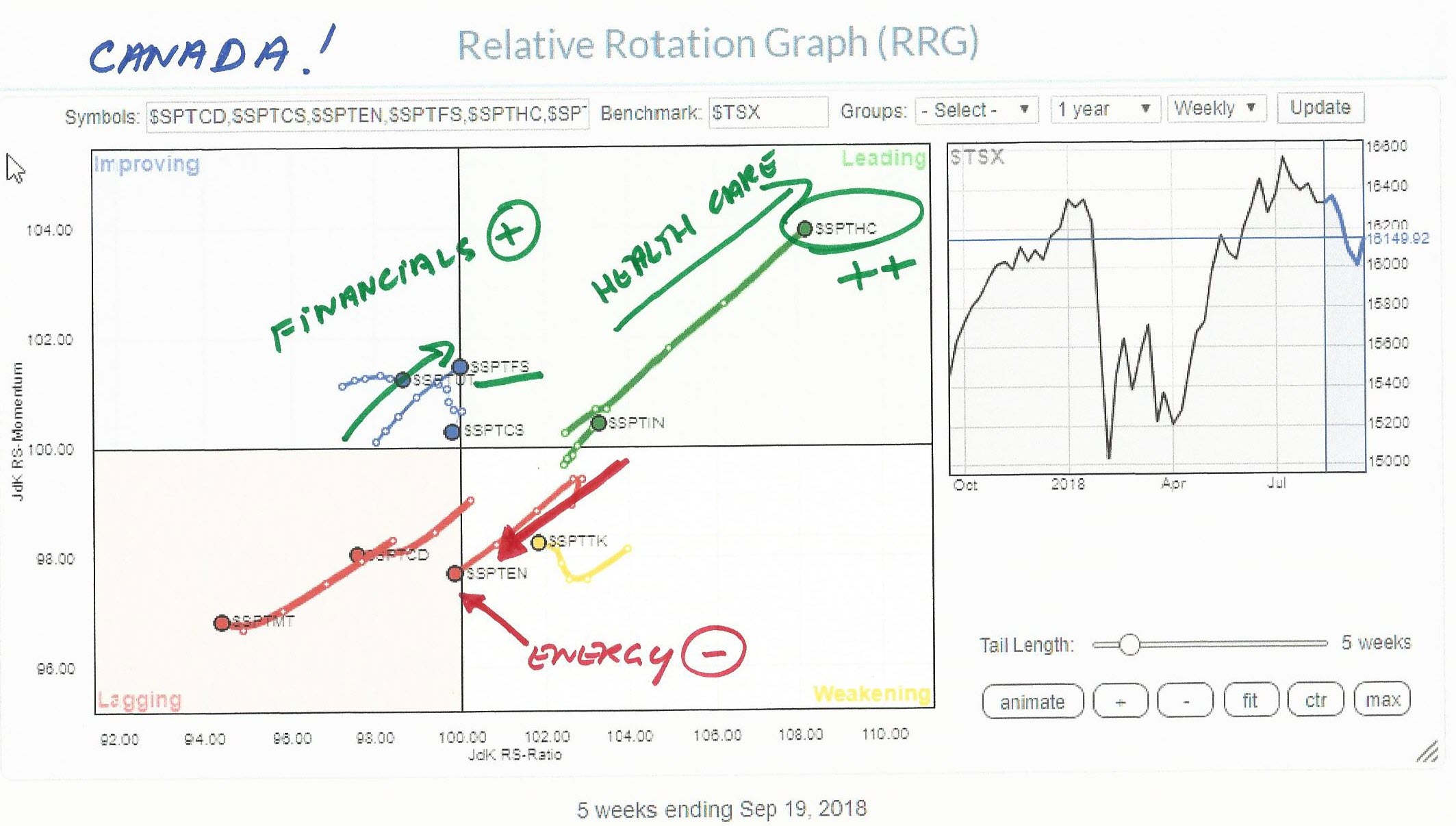

Don't Ignore This Chart! September 20, 2018 at 09:50 AM

While browsing through some pre-populated RRGs on the site I stumbled upon the chart holding Canadian sectors... Read More

Don't Ignore This Chart! September 19, 2018 at 05:25 AM

Disney hit a new high in early August and pulled back into September. The stock is part of a strong sector, consumer discretionary, and this pullback reached a potential reversal area... Read More

Don't Ignore This Chart! September 17, 2018 at 04:49 AM

The Consumer Staples SPDR (XLP) has been leading the market since early May and Procter & Gamble is the largest stock in the sector (12.58%). On the price chart, PG is in the midst of a long-term trend change and the short-term trend is also turning up... Read More

Don't Ignore This Chart! September 15, 2018 at 10:50 AM

United Technologies is a member of the Dow Jones Industrial Average. While this is a high profile group of stocks, the other stocks are commonly stealing the spotlight. This week, United Technologies (UTX) pushed the penthouse button to break above the trading range... Read More

Don't Ignore This Chart! September 12, 2018 at 10:54 AM

Outside of company specifics, the broad market environment and the sector are the biggest influences of a stock's price. The S&P 500 hit a new high recently so we are in a bull market. The Health Care SPDR (XLV) also hit a new high recently and it is one of the leading sectors... Read More

Don't Ignore This Chart! September 11, 2018 at 07:32 PM

The airlines are a mixed bag currently. American Airlines (AAL) has an ugly chart. Alaska on the other hand is leaving the runway and starting to rise above the clouds of 2018. There are new fresh breakouts occurring on this little pullback... Read More

Don't Ignore This Chart! September 07, 2018 at 01:27 PM

Sonic recently (June) broke above a big sideways basing pattern. It looks like Sonic is now ready to break above a consolidation after the sudden surge. The weekly chart also gives us a reason for optimism. The weekly is a clear breakout from years of channel trading... Read More

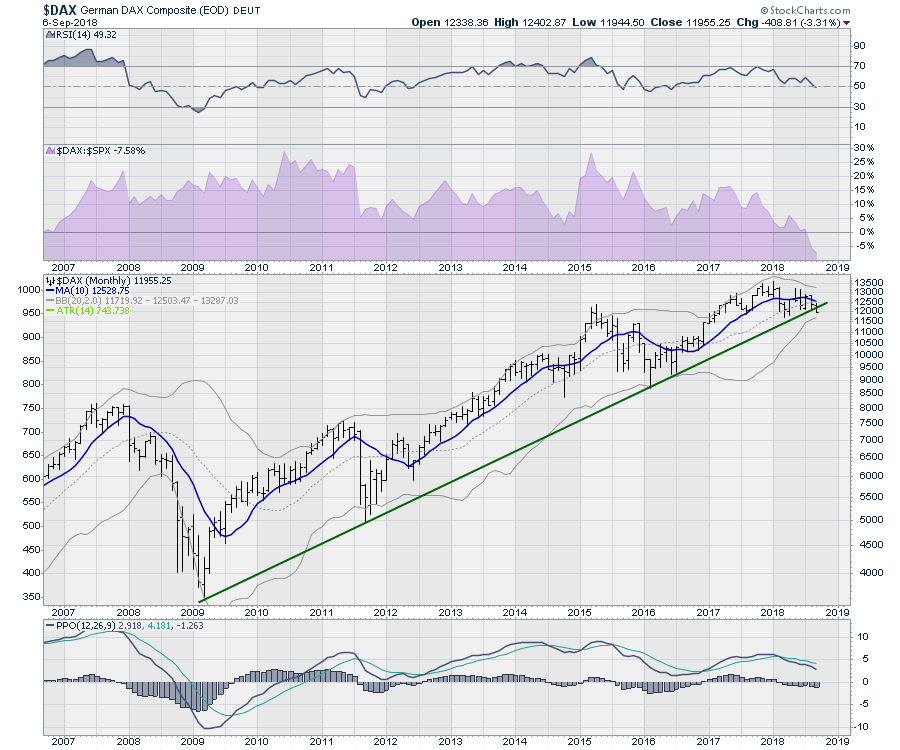

Don't Ignore This Chart! September 06, 2018 at 06:01 PM

While all of the European markets had a tough week, the chart of Germany is snapping a couple of very major trend lines on a weekly and monthly basis... Read More

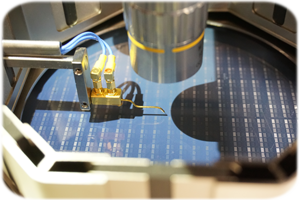

Don't Ignore This Chart! September 05, 2018 at 08:15 AM

The Semiconductor SPDR (XSD) broke out to new highs last week and hit another new high on Tuesday. Despite strength in this broad-based semiconductor ETF, there are still pockets of weakness within the group. Namely, the semiconductor equipment stocks have been weak in 2018... Read More

Don't Ignore This Chart! September 04, 2018 at 12:58 PM

The NASDAQ OMX Group (NDAQ) has consolidated recently for the last few months. For September it looks like it wants to start the month pushing for a break out to the upside. The SCTR shows the company holding in the top quartile... Read More