The S&P 500 is below its 200-day moving average and most country indexes are also below their 200-day moving averages. Two emerging countries, however, stand out in this crowd: Indonesia and the Philippines.

The S&P 500 is below its 200-day moving average and most country indexes are also below their 200-day moving averages. Two emerging countries, however, stand out in this crowd: Indonesia and the Philippines.

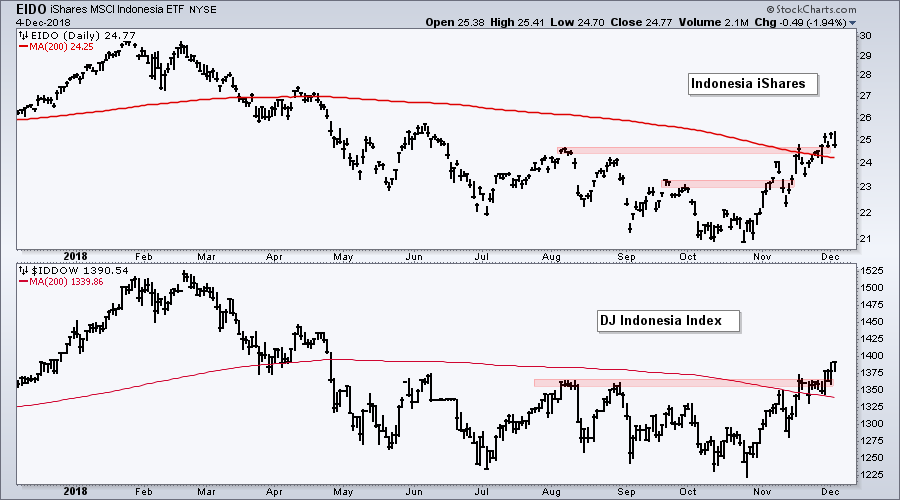

The first chart shows the Indonesia iShares (EIDO) and the DJ Indonesia Index ($IDDOW) with their 200-day SMAs. The index (lower window) found support in the 1225-1250 area from July to October and broke above its summer highs with a surge in November-December. This is one of the few country indexes trading above its summer highs and above its 200-day SMA. The upper window shows the Indonesia iShares for reference. Keep in mind that there is a currency effect when trading international ETFs priced in US Dollar.

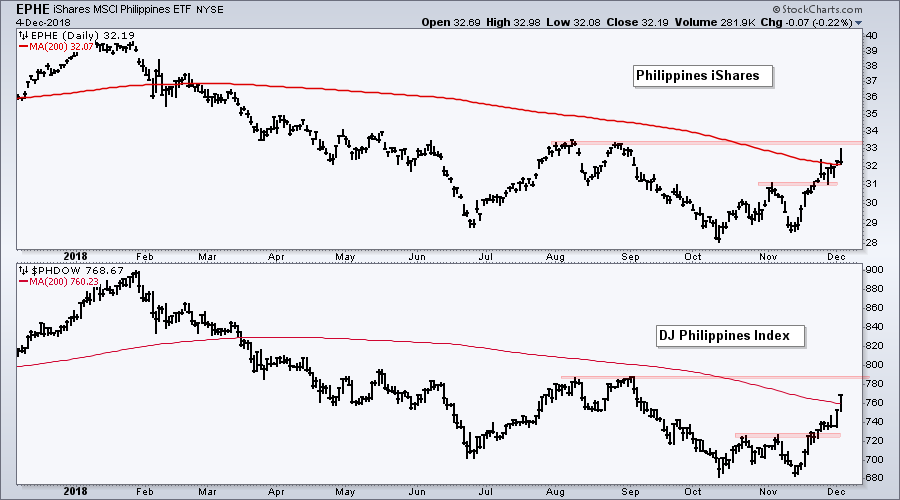

The next chart shows the Philippines iShares (EPHE) in the top window and the DJ Philippines Index ($PHDOW) in the lower window. The index surged above its 200-day SMA on Tuesday, but remains below its summer highs. Thus, the DJ Philippines Index is not as strong as the DJ Indonesia Index.

On Trend on Youtube

Available to everyone, On Trend with Arthur Hill airs Tuesdays at 10:30AM ET on StockCharts TV and repeats throughout the week at the same time. Each show is then archived on our Youtube channel.

Topics for Tuesday, December 4th:

- Measuring Internal Strength on Big Bounces.

- Mind the Gaps and Resistance (SPY,QQQ,MDY,IJR).

- Abnormal Happenings in the Bond Market (plus XLU).

- Finance-related Groups Lagging (plus 8 stocks).

- FAANG Versus Non-FAANG.

- SMA vs EMA and Stocks to Watch.

- Click here to Watch

Plan Your Trade and Trade Your Plan.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill