I maintain a "Strong Earnings ChartList", where I organize those companies who (1) beat Wall Street consensus estimates as to both revenues and earnings per share (EPS), (2) have adequate liquidity (generally trade more than 200,000 shares daily), and (3) have shown solid technical price action. The number of stocks on this list varies, depending on where we are in earnings season and how many companies are able to beat estimates. Currently, I have 329 companies in this ChartList, the most I've ever had. I believe that's a function of our economy being much stronger than is reported. Also, if technical price action is strong, it's generally a reflection of a solid business outlook ahead.

How could I go through this process and have a record number of companies on my list if an impending recession was looming? It's one more reason why I believe all the recession talk is hogwash. It's just my view, so believe what you want to believe.

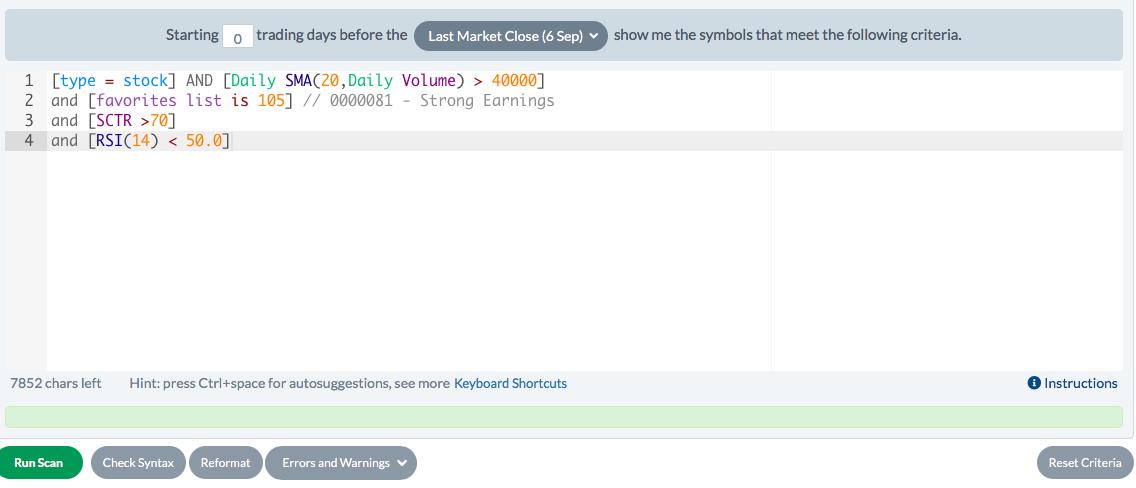

From a trading perspective, I'm most comfortable buying stocks that have solid fundamentals (ie, on my Strong Earnings ChartList), but have pulled back to key price support levels. I could look at all 329 charts or I could run a simple scan that looks like this:

I didn't change the volume requirement. Instead, I used the default. Remember, I've already determined that I'm ok with volume levels when I added individual stocks to my Strong Earnings ChartList. The volume component of this scan could be removed. I then select my Strong Earnings ChartList using the drop down menu under "Scan Components". I include a SCTR (StockCharts Technical Rank) component above 70 to ensure that the companies remain fairly high in terms of relative performance vs. their market cap peers. Finally, I include RSI < 50 to ensure that companies have been selling, or at least consolidating, after prior advances.

My scan returned 27 of my 329 stocks, a very manageable list of charts to review. I'm going to focus on two of them. I review my Industry Group Relative Strength ChartList frequently in order to be aware of the best performing industry groups. I'm much more confident trading the best stocks in the best industries. Call me crazy, but when Wall Street begins to grow very bullish again, I know the leaders within the strongest industries are likely to be very attractive. So that's where, in my opinion, we want to focus. The fact that these stocks have already been selling leaves us with solid reward to risk candidates in the best groups. Bingo!

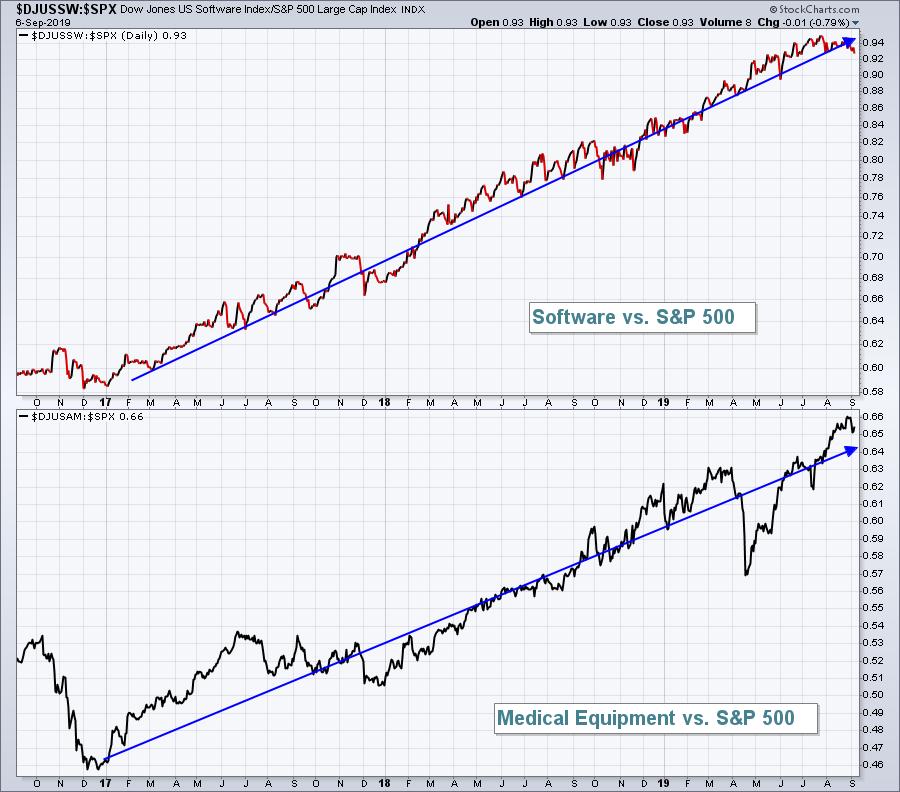

Software ($DJUSSW) and medical equipment ($DJUSAM) have been two of the best industry groups. Need proof?

These aren't absolute charts, they're relative charts. This beats us over the head that software and medical equipment have been two of the best industry groups over the past three years! If your goal, like mine, is to beat the S&P 500, wouldn't you want to invest in companies within groups that are beating the S&P 500?

So getting back to that scan......there are two companies I want to feature. The first is a software stock:

Avalara, Inc. (AVLR):

Keep in mind that AVLR tripled in value in 2019 and deserves a period of consolidation or basing. I'd look for buyers to accumulate in the 75-80 range so I'd use any further weakness as an opportunity to build a position for a high reward (target 95) to risk (closing stop below 74) trade.

NovoCure, Ltd. (NVCR):

We've seen a powerful move in NVCR since early May and it too deserves a period of selling/consolidation. There's likely to be a wider range of support here as NVCR has had few hiccups (bouts of selling) during its advance. But any further selling down to 80 would start to prove quite interesting. I'd recognize the possibility for a further decline to the lower 70s if price support at 80 fails to hold. But ultimately, I see a return to the 100 level, which would result in a very nice trade.

If you like the idea of a Strong Earnings ChartList and scans against that list for trading ideas, I think you'll love the new product/service lineup at EarningsBeats.com. I'll be discussing it tomorrow afternoon at 4:30pm EST and it's completely FREE to everyone. CLICK HERE for more information and how you can join the event. I'd love to see you there!

Happy trading!

Tom