As the broader and sector indexes continue to consolidate and remain in a broad range, it might be worthwhile to consider grabbing some opportunities outside the indexes. Scanning and looking for stock-specific opportunities is often very rewarding. Two stocks, both of which offer short term momentum and some possibilities of decent up moves, are explored below.

HDFC Asset Management Company Ltd (HDFCAMC.IN)

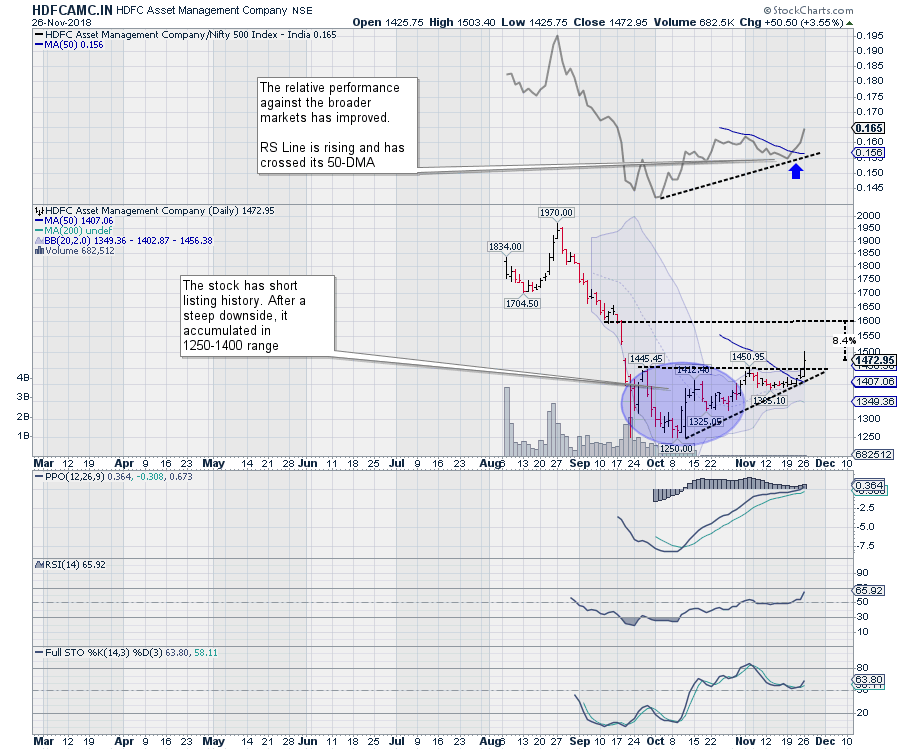

HDFC Asset Management Company (HDFCAMC.IN) listed in August 2018; after making a high of 1970, it saw a steep corrective decline which took the stock near 1250 in late September 2018. The stock spent few weeks thereafter trading in a broad range of 1250-1400 mark. Trading in this zone saw some accumulation in the stock, forming a potential bottom while setting a stage for reversal of trend.

HDFC Asset Management Company (HDFCAMC.IN) listed in August 2018; after making a high of 1970, it saw a steep corrective decline which took the stock near 1250 in late September 2018. The stock spent few weeks thereafter trading in a broad range of 1250-1400 mark. Trading in this zone saw some accumulation in the stock, forming a potential bottom while setting a stage for reversal of trend.

The price pattern formed a bullish ascending triangle during the accumulation period and has shown a breakout from this formation. In the process, the price has closed outside the upper Bollinger band. This increases the possibilities of the breakout continuing and price extending its up move, despite the possibility of the prices temporarily pulling back inside the band.

The RS Line against the broader markets bottomed out few weeks back and is now moving higher. Confirmation of HDFCAMC.IN outperforming the broader markets comes with RS Line moving past its 50-DMA. Relative Strength Index (RSI) has marked its 14-period high, which is bullish and shows a bullish divergence against the price. PPO remains positive.

Though minor consolidation cannot be ruled out, the breakout has a good chance of continuing. If this happens, the stock can potentially return ~8.5% from the current level of 1472. Any move below 1405 will be negative for the stock.

Adani Green Energy Limited (ADANIGREEN.IN)

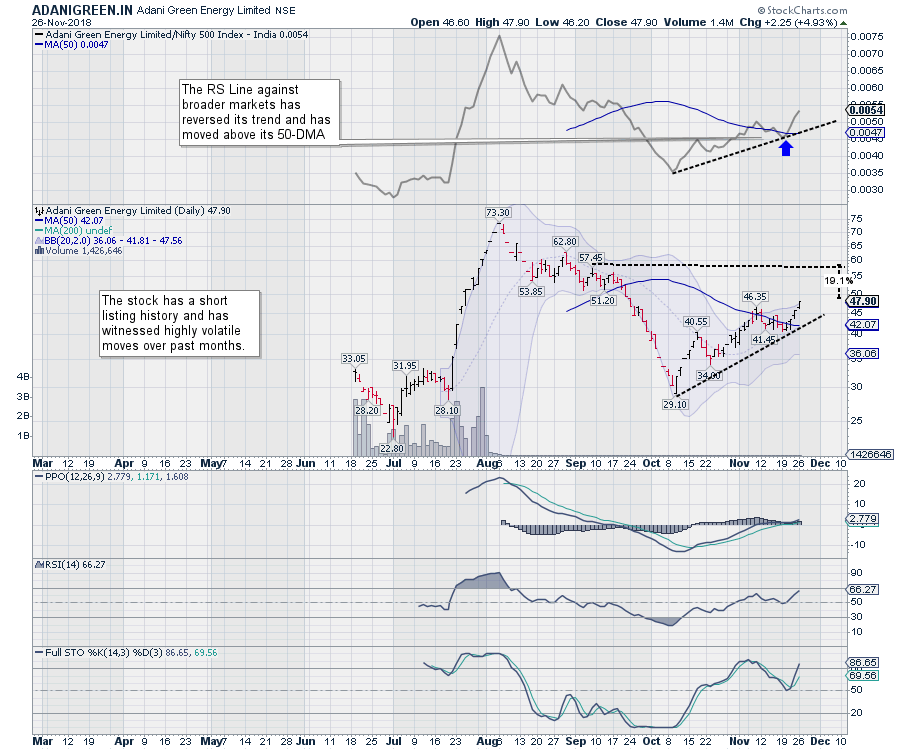

Adani Green Energy Limited also has a short listing history. The stock was listed in June 2018 and, after a ranged trade, saw a sharp up move which took it to 73.30. This happened in a series of upper circuits (stock price frozen with maximum gains on any given day with only buyers and no sellers). However, in the corrective retracement that followed, the stock lost bulk of its gains. By October 2018, it saw itself being traded in the 29-31 range.

Adani Green Energy Limited also has a short listing history. The stock was listed in June 2018 and, after a ranged trade, saw a sharp up move which took it to 73.30. This happened in a series of upper circuits (stock price frozen with maximum gains on any given day with only buyers and no sellers). However, in the corrective retracement that followed, the stock lost bulk of its gains. By October 2018, it saw itself being traded in the 29-31 range.

Since the marking of the 29.10 level, the stock has formed higher tops and higher bottoms and is trading in a rising channel, with all signs pointing to a return of upward momentum. The price has closed outside the upper Bollinger band. This increases the potential for the breakout to continue and price extending its up move, despite the possibility of the prices temporarily pulling back inside the band.

The RS Line against the broader markets bottomed out in October 2018 and is now moving higher. Confirmation of ADANIGREEN.IN outperforming the broader markets comes with RS Line moving past its 50-DMA. Relative Strength Index (RSI) has marked its 14-period high, which is bullish. PPO remains positive.

Some consolidation can be expected, but, the up move has a good chance extending itself. If this happens, the stock can potentially return ~19% from the current level of 47.90. Any move below 42 will be negative for the stock.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia

Disclosure pursuant to Clause 19 of SEBI (Research Analysts) Regulations 2014: Analyst, Family Members or his Associates holds no financial interest below 1% or higher than 1% and has not received any compensation from the Companies discussed.