After many years of writing The Traders Journal, I thought it was time to revisit how investors can best maximize the takeaways from these weekly blogs.

After many years of writing The Traders Journal, I thought it was time to revisit how investors can best maximize the takeaways from these weekly blogs.

First and foremost, the reader should understand that my perspective is somewhat irreverent since it is based on the past 25 years of trading my own account full-time unburdened by the distraction of clients. Some have described my blogs as similar to Harry Potter’s “defense against the dark arts” since one of my objectives is to show individual investors how to make money without drinking the Wall Street Kool-Aid.

Secondly, although each blog can stand on its own, they’ve all been carefully crafted to capture the massiveness of the stock market and decipher it all down to the ten essential stages which I call ‘Tensile Trading’. Each blog is specifically archived into one of these ten stages. When you visit the blog’s Table of Contents, you’ll notice the ten headings that comprise my Tensile Trading roadmap. Together, they organize and boil down the market’s complexity to provide you with a 10-stage complete step-by-step approach to achieving stock market mastery.

Since 2000 when I started teaching investments at the post-college level, this is the key benefit I most often hear from my students. The 10-stage framework allows investors to explicitly compartmentalize what they read, hear or see about investing. Moreover, it facilitates their education, accelerates their growth, and empowers them to assemble a personal methodology that produces attractive high-probability trades.

Thirdly, I am constantly encouraging my readers to be brutally honest about their ‘investor selves,’ and I reciprocate by writing about the numerous mistakes and lessons I’ve taken away from trading my own accounts with the hope that they’ll avoid replicating my mistakes and side-step common investing pitfalls. These takeaways are liberally sprinkled amongst all ten of the Tensile Trading stages.

Finally, my blogs talk a great deal about understanding one’s trading timeframe or horizon. I am not a swing-for-the-fences day trader. My average trades are held for months and sometimes even years. Personally, I have achieved financial security by focusing on increasing my batting average – not by trying to be the homerun hitter. I get to first base more often than not, and my blogs are intended to empower investors with a similar longer-term perspective. My paramount investment mantra is asset protection and deploying carefully calculated correlations that result in a healthy diversification amongst a wide portfolio of assets. I have not only survived a number of what I’ll call “greater fool markets” which lead to the inevitable boom and bust stock market cycles, but I walked away from them with money in my pocket. This is what I write about.

In an effort to offer you a useful guided tour, I’ve chosen a favorite blog from each of the ten stages. I invite you to sit down with a cup of coffee or your favorite glass of wine and step through these ten blogs. I know the exercise will yield some useful ideas as how you might organize your own investing routines and may offer you clarity as to where my weekly blogs fit into your own market methodology. For those serious investors who’d like to dig a bit deeper, let me suggest my six-hour DVD as another option.

http://store.stockcharts.com/collections/dvds/products/tensile-trading

TENSILE TRADING: Your 10 Essential Stages to Achieving Stock Market Mastery

STAGE 1: Money Management

Blog: The Albert Einstein Approach to Stock Market Investing

http://stockcharts.com/articles/journal/2013/04/the-albert-einstein-approach-to-stock-market-investing.html?st=albert+einstein

STAGE 2: The Business of Investing

Blog: Two Traders Talk – Candid Insights Over Lunch

http://stockcharts.com/articles/journal/2014/04/two-traders-talk-candid-insights-over-lunch.html?st=two+traders+talk

STAGE 3: The Investor Self

Blog: The #1 Indicator Professionals Focus On

http://stockcharts.com/articles/journal/2012/07/the-1-indicator-professionals-focus-on.html?st=the+#1+indicator

STAGE 4: Market Analysis

Blog: The Probability Buster Chart

http://stockcharts.com/articles/journal/2014/06/the-probability-buster-chart-improved--strengthened.html?st=probability+buster+chart

STAGE 5: Investing Routines

Blog: Investing Routines – A Pillar of Any Successful Program

http://stockcharts.com/articles/journal/2012/06/investing-routines-a-pillar-of-any-successful-program.html?st=investing+routines

STAGE 6: Stalking the Markets

Blog: This Could Change Your Life! How You Can Mimic Wall Street’s Best & Profit Handsomely

http://stockcharts.com/articles/journal/2016/06/this-could-change-your-life-how-you-can-mimic-wall-streets-best--profit-handsomely.html?st=this+could+change+your+life

STAGE 7: Buying

Blog: Evidence Based Trading for Dummies

http://stockcharts.com/articles/journal/2014/08/evidence-based-trading-for-dummies.html?st=evidence+based+trading

STAGE 8: Monitoring Your Investments

Blog: You Bought It! Now What?

http://stockcharts.com/articles/journal/2012/12/you-bought-it-now-what.html?st=you+bought+it

STAGE 9: Selling

Blog: How I Deal with Trading Losses

http://stockcharts.com/articles/journal/2012/09/how-i-deal-with-trading-losses.html?st=how+i+deal+with+trading

STAGE 10: Re-Examine, Refine

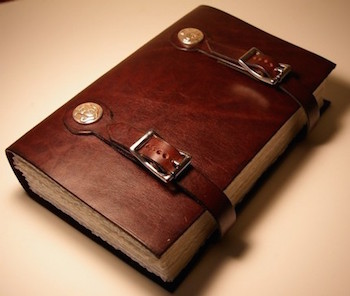

Blog: Pivotal Books in the 25-Year Trading Life of a Stock Market Investor

http://stockcharts.com/articles/journal/2013/10/pivotal-books-in-the-25-year-trading-life-of-a-stock-market-investor.html?st=pivital+books

Trade well; trade with discipline!

-- Gatis Roze

P.S. Click HERE for information on my future appearances & seminars.

October 17th, 2015- ASSET ALLOCATION WORKSHOP with Gatis Roze & Chip Anderson.

P.P.S. For both convenience & consistency, please click HERE to automatically receive my blog once a week as soon as it comes out.