Market Recap for Thursday, September 28, 2017

After early selling on Thursday, U.S. indices mostly rebounded throughout the balance of the day resulting in mostly slight gains by day's end. Materials (XLB, +0.71%) performed quite well after nearly testing its rising 20 day EMA on Wednesday. Financials (XLF, +0.16%) didn't see much in the way of gains, but held onto its Wednesday breakout, a bullish signal as well.

September was a great month for auto parts stocks ($DJUSAT). The group has gained 11.53% over the past month and those gains helped the industry clear significant overhead price resistance. Check this out:

The breakout here after two years of consolidation was quite bullish and I'd look for more strength in the fourth quarter, along with some profit taking along the way. That weekly MACD is very stong now, so look to the rising 20 week EMA for support down the road.

The breakout here after two years of consolidation was quite bullish and I'd look for more strength in the fourth quarter, along with some profit taking along the way. That weekly MACD is very stong now, so look to the rising 20 week EMA for support down the road.

Pre-Market Action

The 10 year treasury yield ($TNX) is flat this morning after a strong push higher throughout the month of September. Gold ($GOLD), on the other hand, has been quite weak in September due to a combination of profit taking after a huge July and August advance and a strengthening dollar in the second half of September. Gold is up a few bucks this morning, but still beneath a key 1300 level. Crude oil ($WTIC) is flat.

In global markets, Asia was mixed, but we're seeing mostly strength this morning in Europe. The German DAX ($DAX) has traded higher nearly every day in September and its down days have been rather insignificant. The DAX is higher by 0.36% thus far today and currently trades at 12750, not far from its intraday high established in June at 12951.

Dow Jones futures are pointing to a slightly lower open, down 23 points with a little more than 30 minutes to the opening bell.

Current Outlook

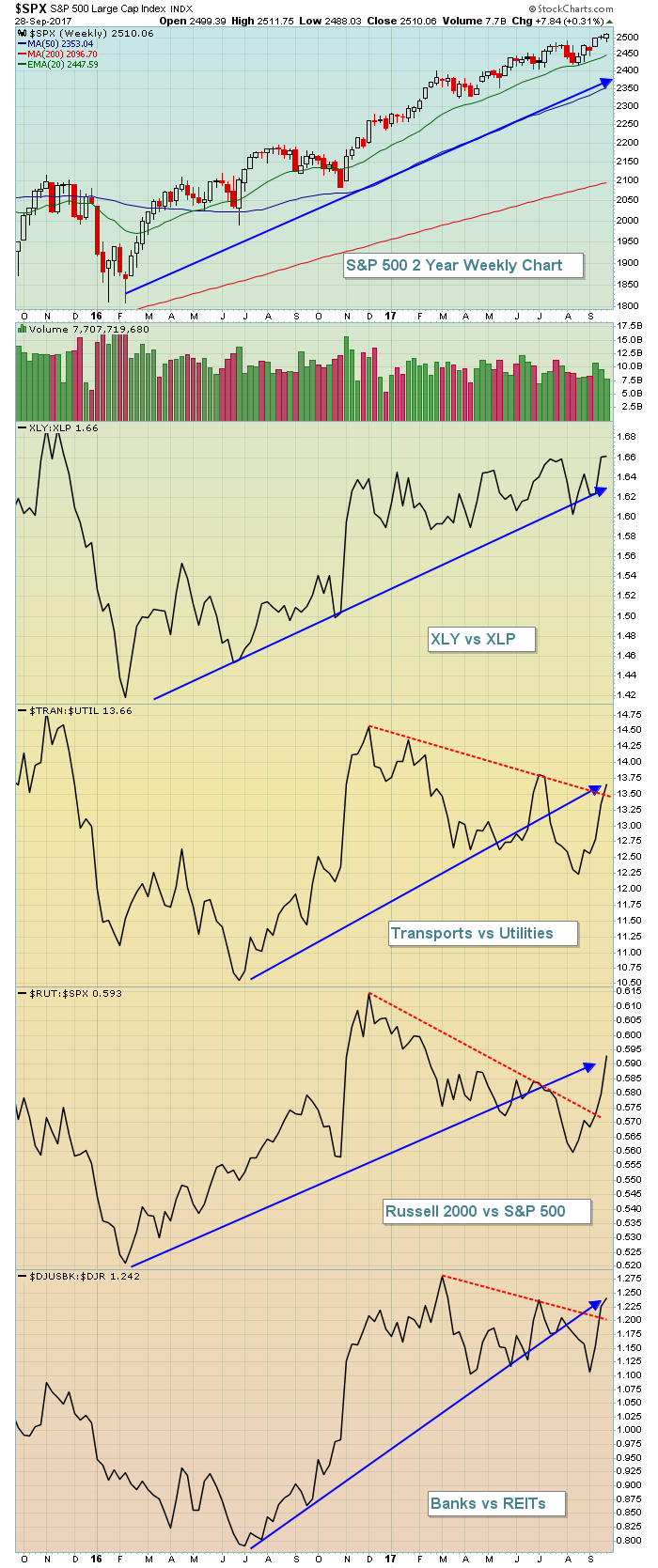

Key relative ratios tell us if money is rotating towards aggressive areas of the market. This "risk on" type of behavior typically supports and sustains bull market advances. Any time I see all-time highs reached on our major indices, I look to these ratios for confirmation that traders are indeed bullish and the rally is likely to be sustained. Check out the current look of these relative ratios:

The rise in the S&P 500 since early 2016 is quite evident. For the most part, we've seen rising trendlines on each of the relative ratios during this period as well. These ratios have, however, shown some hesitation (red dotted lines) in 2017 after significant relative strength just prior. The latest push higher in the S&P 500 has been supported by each of these relative ratios and is sending a signal of full speed ahead for continuing strength, just as we enter the seasonally bullish fourth quarter.

The rise in the S&P 500 since early 2016 is quite evident. For the most part, we've seen rising trendlines on each of the relative ratios during this period as well. These ratios have, however, shown some hesitation (red dotted lines) in 2017 after significant relative strength just prior. The latest push higher in the S&P 500 has been supported by each of these relative ratios and is sending a signal of full speed ahead for continuing strength, just as we enter the seasonally bullish fourth quarter.

Sector/Industry Watch

Transports ($TRAN) have been performing much better over the past 4-5 weeks, breaking out to all-time highs, mostly on the heels of very strong railroad ($DJUSRR) and trucker groups ($DJUSTK). Airlines ($DJUSAR), however, are poised to make a technical breakout of their own:

The 260 level has proven to be a serious pivot area in the past and a breakout now would be supported by historical tailwinds. Price resistance and the 50 day SMA both reside near that 260 level and October is, by far, the best month of the year historically for airlines. One airline, Alaska Air Group (AKS), is featured in the Historical Tendencies section below.

The 260 level has proven to be a serious pivot area in the past and a breakout now would be supported by historical tailwinds. Price resistance and the 50 day SMA both reside near that 260 level and October is, by far, the best month of the year historically for airlines. One airline, Alaska Air Group (AKS), is featured in the Historical Tendencies section below.

Historical Tendencies

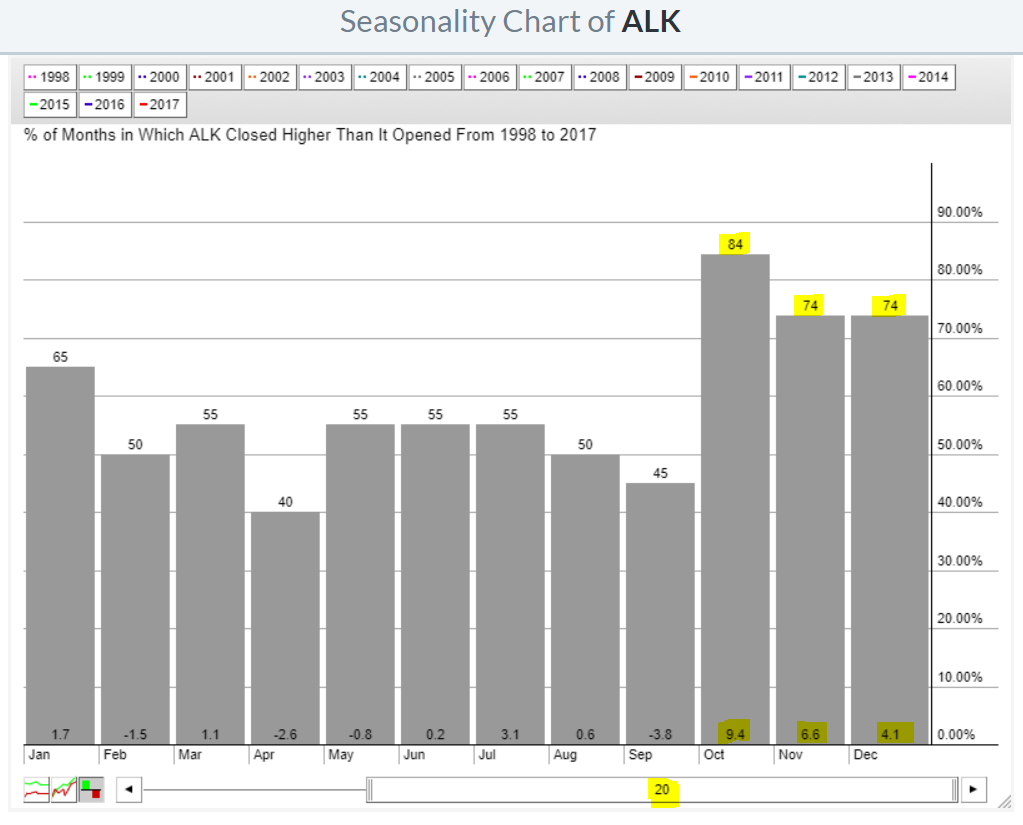

Alaska Air Group (ALK) performs extremely well during the fourth quarter, as do most airlines stocks. But for ALK, the numbers are particularly stunning:

Those fourth quarter numbers look extremely bullish, particularly the average 9.4% gain in October alone, over the past 20 years.

Those fourth quarter numbers look extremely bullish, particularly the average 9.4% gain in October alone, over the past 20 years.

Key Earnings Reports

(actual vs. estimate):

MKC: 1.12 vs 1.07

Key Economic Reports

August personal income released at 8:30am EST: +0.2% (actual) vs. +0.2% (estimate)

August personal spending released at 8:30am EST: +0.1% (actual) vs. +0.1% (estimate)

September Chicago PMI to be released at 9:45am EST: 58.5 (estimate)

September consumer sentiment to be released at 10:00am EST: 95.3 (estimate)

Happy trading!

Tom