Market Recap for Friday, February 9, 2018

For the first time in 18 months, the Dow Jones, S&P 500 and NASDAQ all closed out a week beneath their rising 20 week EMAs. After not seeing a meaningful pullback (more than 3%) for well over a year, our major indices have all given up 10%+ in the past couple weeks, although each of the major indices rallied late last week to cut into those losses. We rallied strongly in the final two hours on Friday as bargain hunters couldn't pass up their first opportunity to buy stocks deeply discounted.

Technology stocks (XLK, +2.45%) soared to lead the late-day buying on Friday. The three technology amigos - semiconductors ($DJUSSC, +3.26%), internet stocks ($DJUSNS, +3.11%) and software ($DJUSSW, +2.80%) - were the biggest reasons for the rebound. The long-term chart on the DJUSSC is particularly interesting:

The good news for the bulls is that the DJUSSC rallied back after an intraweek break below recent price support near 3100. The bad news is that this could end up establishing the right side of a neckline in a topping head & shoulders pattern. It's way too early to tell, but I'd look for a bounce in the semis here, perhaps initially to 3400. Then we'll revisit.

The good news for the bulls is that the DJUSSC rallied back after an intraweek break below recent price support near 3100. The bad news is that this could end up establishing the right side of a neckline in a topping head & shoulders pattern. It's way too early to tell, but I'd look for a bounce in the semis here, perhaps initially to 3400. Then we'll revisit.

Pre-Market Action

The 10 year treasury yield ($TNX) is up 4 basis points this morning to 2.87% as money continues to rotate away from bonds. This is typically very good news for U.S. equities, although stocks weren't able to take advantage of that historical tailwind given the extremely volatile conditions recently. Crude oil ($WTIC) also hit the key $59 per barrel level that I discussed last week and is bouncing this morning, up nearly 2% at last check. This bounce should help to alleviate the big selling in energy stocks of late.

Asian markets were mixed overnight, although Tokyo's Nikkei ($NIKK) was closed for a holiday. In Europe this morning, we're seeing a very strong rally in Germany with the DAX higher by more than 2%. This is welcome news as the DAX had moved perilously close to a significant price support level close to 12,000 before recovering this morning.

U.S. stocks also are looking to add to the strength they found in late trading on Friday, with Dow Jones futures up more than 300 points with 45 minutes left to the opening bell.

Current Outlook

Listen, we needed a correction. It's funny how the psychology changes when we go from overbought to actually pulling back. Everyone recognized the need for some selling two weeks ago. Now that we've seen that selling and a much-needed and much-deserved decline, I keep hearing bear market! Really? Our economy is gaining strength, money is rotating away from defensive bonds (with corresponding yields rising), profits are soaring, the tax reform bill has passed and is encouraging many prominent companies to either increase their investment or increase their employees' wages......and now all of a sudden we're heading for a bear market? Psychology plays such a huge role in investing/trading.

It's easy to get caught up in the day-to-day "noise". CNBC is flashing each one hundred point drop on the Dow Jones like the ball is dropping in Times Square. How can you not be sucked up into all the drama? Here's a suggestion. Take a deep breath, one step back and look at this long-term chart on the benchmark S&P 500:

Have you been waiting for an entry opportunity into one of the strongest bull markets of our lifetime?

Have you been waiting for an entry opportunity into one of the strongest bull markets of our lifetime?

Well...?

Sector/Industry Watch

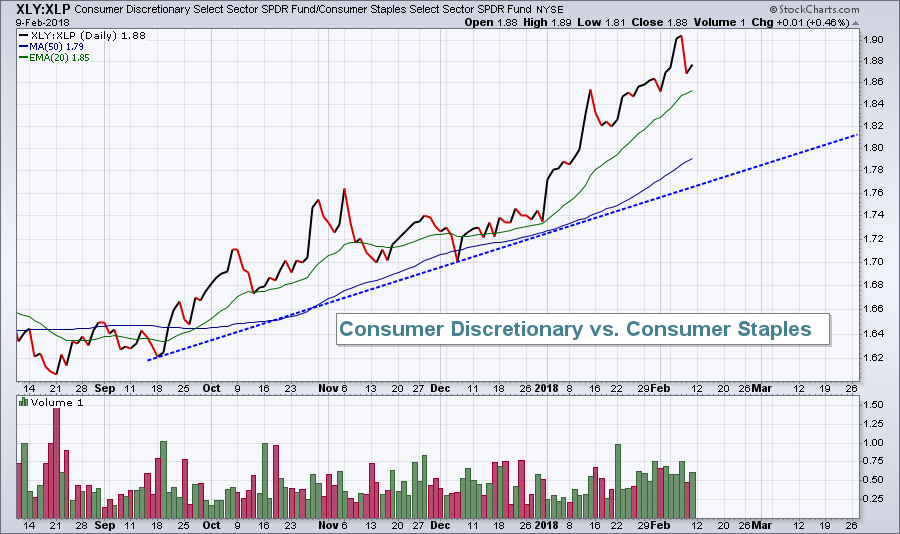

The performance of consumer stocks does not support the notion of an impending bear market. As a bear market approaches, history tells us that money shifts to the more defensive consumer staples area. So if we look at the consumer discretionary vs. consumer staples ratio (XLY:XLP), we should see a declining ratio to suggest that traders are getting defensive. Have a look at this ratio currently:

This ratio has exploded to the upside in 2018. If anything, it might be constructive to see a little weakness in this ratio and allow the stock market to consolidate for awhile. The blue-dotted line above is a relative strength trendline in the XLY vs the XLP. As long as that trendline holds, it'll be very difficult for me to turn bearish.

This ratio has exploded to the upside in 2018. If anything, it might be constructive to see a little weakness in this ratio and allow the stock market to consolidate for awhile. The blue-dotted line above is a relative strength trendline in the XLY vs the XLP. As long as that trendline holds, it'll be very difficult for me to turn bearish.

Monday Setups

I skipped last week's Monday setups for good reason. First of all, we remain in a bull market, albeit one with a much-needed correction under its belt now. But trading last week was particularly dangerous because of the elevated Volatility Index ($VIX) reading. So I abstained from providing setups here. It's important to manage risk and one way to do so is to sit in cash during extreme volatility.

We've now seen a slight piercing of the earlier low in our major indices and we could be ripe for a rebound, so I'll venture back into the setups. The VIX did finish last week at 29 last week, however, so panicked selling could kick in again. Therefore, please consider keeping stops in play on any and all trades. When the VIX hits the 30s and 40s, technical analysis is tossed out the window like stocks. Support levels fail, many times as if they're not even there. Risks remain high.

My featured setup is Varian Medical (VAR). VAR reported excellent quarterly results a couple weeks ago with revenues ($678.5 mil vs $639.47 mil) and EPS ($1.06 vs $.98) easily topping Wall Street consensus estimates. Its stock price surged on the news, gapping roughly 8% higher and quickly hitting 130.00 on massive volume. Since then, and with all the panicked selling last week, VAR has returned to and tested the bottom of gap support and its 50 day SMA. I love the reward to risk here.

(Disclosure: I own shares in VAR)

(Disclosure: I own shares in VAR)

For additional setups for this week, CLICK HERE.

Historical Tendencies

Since 1971, the NASDAQ has produced annualized returns of 46.48% from February 10th through February 15th.

Key Earnings Reports

(actual vs. estimate):

CNA: 1.05 vs .82

FDC: .44 vs .44

L: .83 vs .72

QSR: .66 vs .57

Key Economic Reports

None

Happy trading!

Tom