Market Recap for Tuesday, May 29, 2018

Political uncertainties in Italy and Spain rattled global markets on Tuesday, leaving the Dow Jones with a loss of nearly 400 points on the session. There was a clear flight to safety, underscored by a massive 16 basis point drop in the 10 year treasury yield ($TNX) as it fell to 2.77%. That precipitous drop caused significant selling in financial stocks (XLF, -3.34%), although there was plenty of collateral damage as well. Basic materials (XLB, -1.73%) and industrials (XLI, -1.60%) both absorbed plenty of pain. One day after showing serious relative strength, airlines ($DJUSAR) lost all of that strength, dropping 2.66% on the session.

It was an ugly day and one in which the Volatility Index ($VIX) soared almost 30%, finishing the day back at that pivotal 17 level. The big question as we enter trading on Wednesday will be whether the bears can build on the foundation they laid yesterday. Another day of a rising VIX would certainly help their cause.

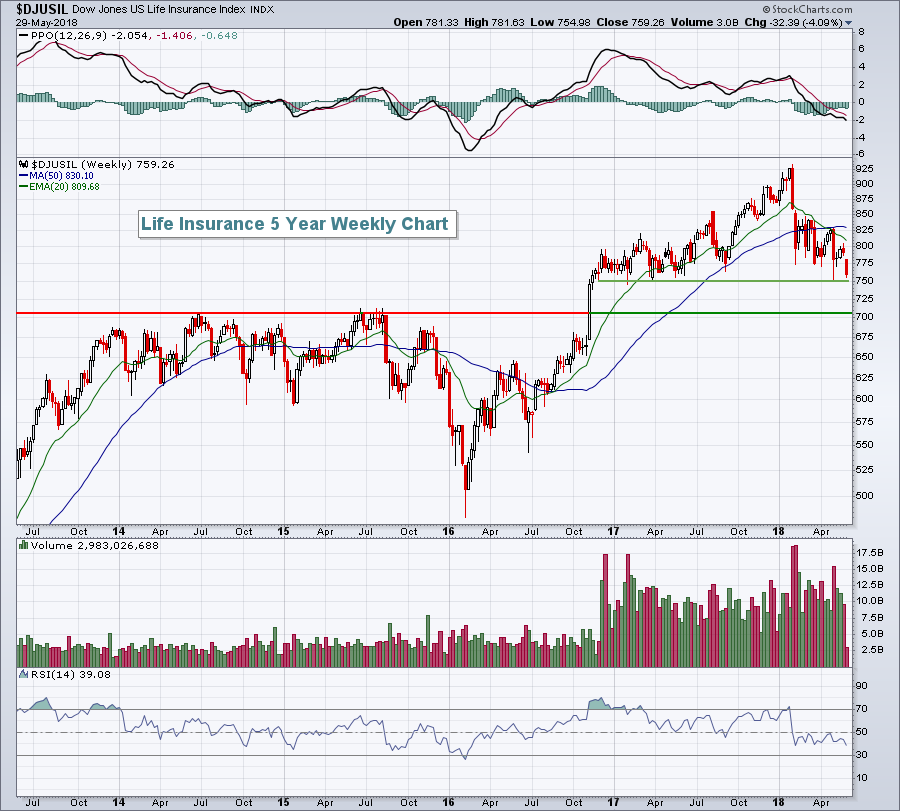

Life insurance ($DJUSIL), already a weak industry, took the brunt of the selling on Tuesday and fell more than 4% to challenge recent lows:

The DJUSIL has fallen nearly 20% since its January high. The good news is that every pullback over the past 20 months has held price support at 750. If that level is lost, a very important long-term support level just above 700 is likely to be tested. Banks also were very weak during Tuesday's session and that industry group is highlighted below in the Sector/Industry Watch section.

The DJUSIL has fallen nearly 20% since its January high. The good news is that every pullback over the past 20 months has held price support at 750. If that level is lost, a very important long-term support level just above 700 is likely to be tested. Banks also were very weak during Tuesday's session and that industry group is highlighted below in the Sector/Industry Watch section.

Pre-Market Action

The 10 year treasury yield ($TNX) is up 8 basis points this morning, erasing half of yesterday's drop. That should provide welcome relief today to a financial sector on the brink of a support breakdown. Crude oil prices ($WTIC) have moved back above $67 per barrel, at least temporarily holding onto $66 per barrel support.

Dow Jones futures are looking for a positive start to the day, up 123 points with 40 minutes left to the opening bell.

Current Outlook

One 2018 theme remains perfectly intact, despite the big selloff yesterday. The U.S. Dollar Index ($USD) is on a tear higher and money is rotating in major fashion away from the multinational companies found on the S&P 500 and into small cap domestic companies found on the Russell 2000:

I believe the dollar rally has just begun, but there is a significant level of resistance near 95 to be aware of. That was the November 2017 high. Clearing that level would suggest the downtrend that began in late-2016 and ran throughout 2017 is over. While the TNX has been tumbling recently here in the U.S., German 10 year treasury yields have been falling even faster, resulting in a rising difference in yields between the two countries. That leads to dollar strength, which in turn typically leads to small cap outperformance. That theme has been a very important one to recognize in 2018 and there's no sign of let up just yet.

I believe the dollar rally has just begun, but there is a significant level of resistance near 95 to be aware of. That was the November 2017 high. Clearing that level would suggest the downtrend that began in late-2016 and ran throughout 2017 is over. While the TNX has been tumbling recently here in the U.S., German 10 year treasury yields have been falling even faster, resulting in a rising difference in yields between the two countries. That leads to dollar strength, which in turn typically leads to small cap outperformance. That theme has been a very important one to recognize in 2018 and there's no sign of let up just yet.

Sector/Industry Watch

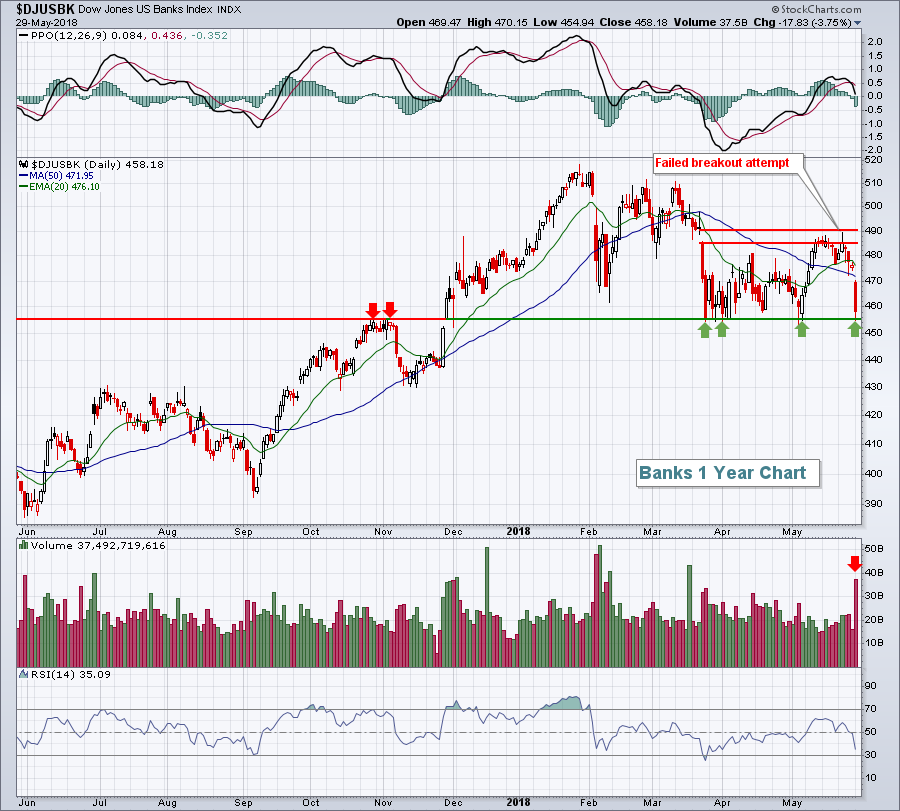

The Dow Jones U.S. Banks Index ($DJUSBK, -3.75%) had one of its sharpest declines in 2018 as the 10 year treasury yield ($TNX) plunged to nearly reach a two month low. If there's a silver lining, it's that the DJUSBK held key short- to intermediate-term price support as reflected below:

It's been a very rough four days for banks since their failed breakout attempt above gap resistance. It's been accompanied by a huge drop in the TNX, so it stands to reason that a bounce in treasury yields would allow the DJUSBK to hold onto support at 450-455 once again. We'll see.

It's been a very rough four days for banks since their failed breakout attempt above gap resistance. It's been accompanied by a huge drop in the TNX, so it stands to reason that a bounce in treasury yields would allow the DJUSBK to hold onto support at 450-455 once again. We'll see.

Historical Tendencies

F5 Networks (FFIV) has produced solid summertime results over the past two decades and is in the midst of a strong uptrend as we approach June. The following represents the average monthly returns of FFIV since 1999:

June: +13.1%

July: +3.7%

August: +2.8%

Key Earnings Reports

(actual vs. estimate):

ADI: 1.45 vs 1.37

BMO: 1.74 vs 1.67

KORS: .63 vs .60

(reports after close, estimate provided):

KEYS: .83

PVH: 2.25

Key Economic Reports

May ADP employment report released at 8:15am EST: 178,000 (actual) vs. 187,000 (estimate)

Q1 GDP - 2nd Estimate - released at 8:30am EST: +2.2% (actual) vs. +2.2% (estimate)

Beige book to be released at 2:00pm EST

Happy trading!

Tom