Market Recap for Wednesday, June 6, 2018

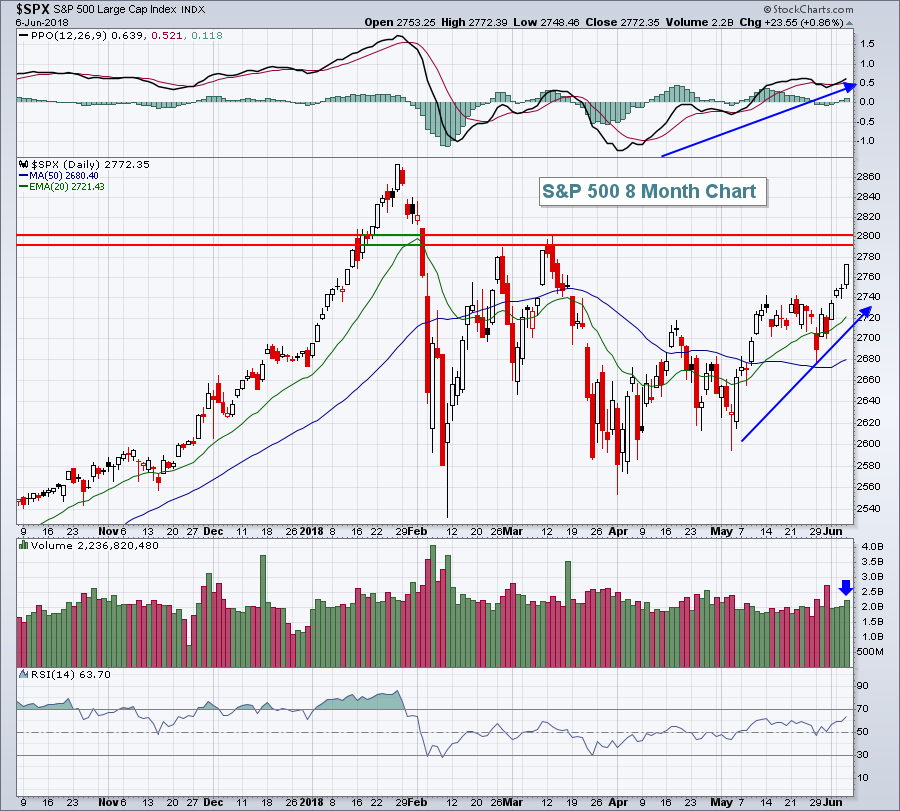

It was another solid bull market rally on Wall Street on Wednesday, this time with the Dow Jones conglomerates leading the action. The Dow Jones Industrial Average gained 346 points, or 1.40%, topping 25,000 and closing at its highest level since the second week of March. All of our other major indices climbed as well with the S&P 500 now on a move toward 2800, a key reaction high area from mid-March:

Momentum is building as it becomes more and more obvious that the 9+ year bull market is resuming after a lengthy period of consolidation.

Momentum is building as it becomes more and more obvious that the 9+ year bull market is resuming after a lengthy period of consolidation.

Materials (XLB, +1.85%) and financials (XLF, +1.82%) were the sector leaders on Wednesday as the 10 year treasury yield ($TNX) rose to 2.98%. That completely stymied utilities (XLU, -2.38%) after that group had enjoyed the recent drop to 2.76% in the TNX. The XLU has broken down once again and I believe is an unattractive area to invest in a rising treasury yield environment. The financials? That's a completely different story. Banks ($DJUSBK) held price support during the steep decline in the TNX and are now surging with the TNX recovery:

At first glance, the performance in the DJUSBK seems strange. The TNX has been mostly rising, which is very positive for banks as their net interest margin expands as rates rise. But the DJUSBK has been mostly in decline in 2018. What gives? Well, keep in mind the ongoing theme the past few months of "smaller is better". The rapid ascent in the U.S. Dollar ($USD) has seen massive rotation away from the larger cap stocks. The DJUSBK is comprised mostly of the larger cap banks. A better measure would be the regional banks (KRE). That's the bottom part of the chart above. Note the breakout to fresh new highs in the KRE? Banks are doing exactly what they're supposed to do, but the rising dollar is skewing performance as traders look to smaller banks for performance.

General Motors (GM) recently gave the automobile industry ($DJUSAU, +3.57%) a quick ride higher. Well, yesterday it was Tesla's (TSLA) turn. TSLA appeared to be on autopilot, gaining 28 points, or 9.74%, to clear its reaction highs near 310. TSLA closed at 319.50 as the DJUSAU was easily the best performing industry group within consumer discretionary (XLY, +0.93%).

Pre-Market Action

It's fairly quiet on the earnings and economic front, but global equity markets are mostly positive and U.S. stocks seem to be feeding off that strength this morning. With roughly 45 minutes left to the opening bell, Dow Jones futures are higher by 61 points.

Current Outlook

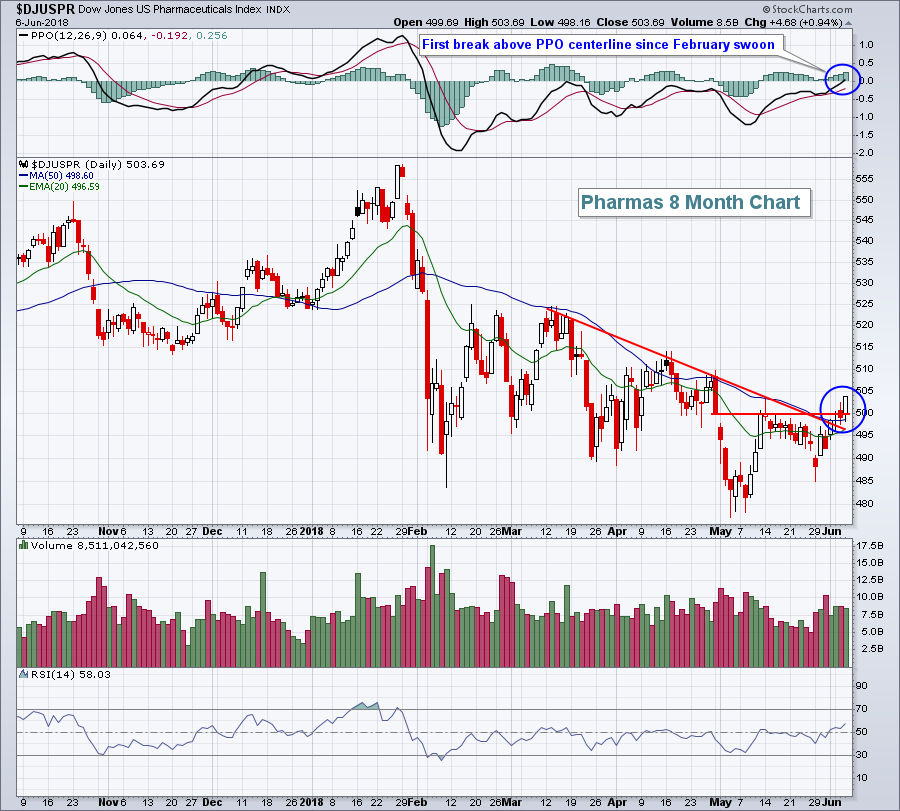

Perhaps the worst area within healthcare (XLV) is pharmaceuticals ($DJUSPR), but even that group made solid bullish strides on Wednesday. Every industry group within healthcare has turned bullish in my view. When the worst industry group begins to look bullish, we should take notice. Also, healthcare has averaged outperforming the benchmark S&P 500 by 0.8% during June over the past 20 years. Only January has produced better relative results for the healthcare sector. Pharmas have been even better, outperforming the S&P 500 by 1.1% during June over that same span. Now check out the trendline break on the DJUSPR:

The move above 500 yesterday cleared an important gap resistance level, in addition to the trendline resistance cleared earlier this week. Throw in the bullish PPO centerline crossover and solid seasonal tendencies and I think there's a recipe here for at least a solid month ahead.

The move above 500 yesterday cleared an important gap resistance level, in addition to the trendline resistance cleared earlier this week. Throw in the bullish PPO centerline crossover and solid seasonal tendencies and I think there's a recipe here for at least a solid month ahead.

Sector/Industry Watch

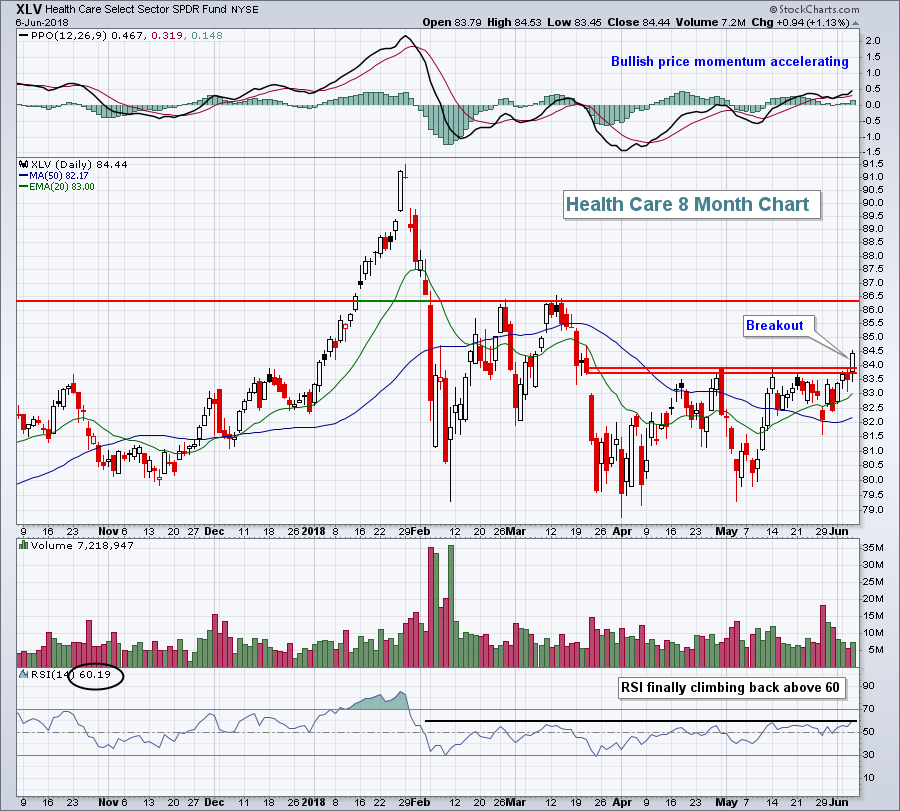

Healthcare (XLV) had been battling overhead gap and price resistance at 84 for the past ten weeks, but it was finally able to clear that pivotal level on Wednesday:

The XLV now appears poised to make a run at 86.50 with accelerating momentum and an RSI that was finally able to push through 60. RSI 60 tends to be a level difficult to pierce during consolidation or downtrends. A move above 60 adds yet another bullish signal to an improving technical picture. Biotechs ($DJUSBT) broke above short-term resistance as that group looks to help lead the XLV higher.

The XLV now appears poised to make a run at 86.50 with accelerating momentum and an RSI that was finally able to push through 60. RSI 60 tends to be a level difficult to pierce during consolidation or downtrends. A move above 60 adds yet another bullish signal to an improving technical picture. Biotechs ($DJUSBT) broke above short-term resistance as that group looks to help lead the XLV higher.

Historical Tendencies

The NASDAQ closed at another all-time high on Wednesday, nearly reaching 7700. Technically, the NASDAQ couldn't look much better. It is facing seasonal headwinds, however. Since 1971, the June 8th (tomorrow) through June 14th (next Thursday) period has produced annualized returns of -22.61% on the NASDAQ.

Key Earnings Reports

(actual vs. estimate):

MTN: 6.17 vs 6.05

SJM: 1.93 vs 2.18

(reports after close, estimate provided):

AVGO: 4.77

COO: 2.83

Key Economic Reports

Initial jobless claims released at 8:30am EST: 222,000 (actual) vs. 225,000 (estimate)

Happy trading!

Tom