Note

I'll be traveling and on vacation this week, so my blog articles will focus on very brief topics regarding current market themes or my own trading strategies. I'll return to my "normal" blog postings regarding market action, outlook, historical tendencies, etc. when I return on Monday, August 20th.

Monday, August 13th

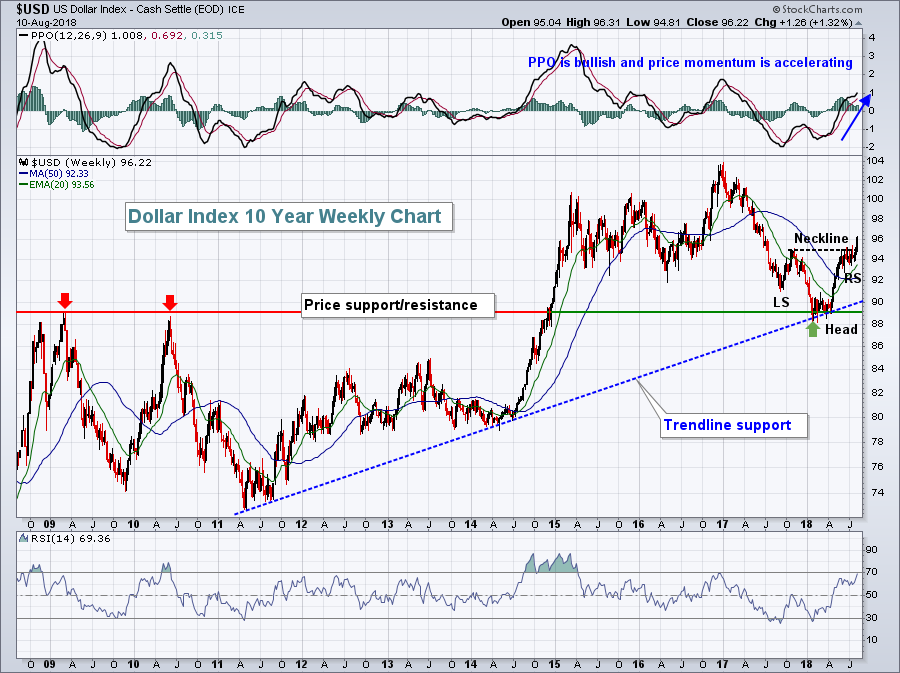

I had been awaiting a dollar breakout and it's happened. The longer-term uptrend held and the inverse head & shoulders pattern has been confirmed with the breakout. The measurement of this pattern is approximately 102 to challenge the high to open 2018:

The measurement is calculated by the distance between the neckline (95) and the bottom of the inverse head (88). The 7 point difference is then added to the neckline breakout level of 95 to arrive at the 102 target. I believe the rise could be very quick, suggesting that the recent couple of day's relative strength in small caps is likely to continue.

The measurement is calculated by the distance between the neckline (95) and the bottom of the inverse head (88). The 7 point difference is then added to the neckline breakout level of 95 to arrive at the 102 target. I believe the rise could be very quick, suggesting that the recent couple of day's relative strength in small caps is likely to continue.

Happy trading!

Tom