Market Recap for Thursday, September 13, 2018

Thursday was a strong day for U.S. equities aside from lackluster performance from small caps (Russell 2000). The NASDAQ led the rally, gaining 0.75% as a rebound in biotechs ($DJUSBT) and semiconductors ($DJUSSC) provided some confidence for traders in those two areas, especially the latter:

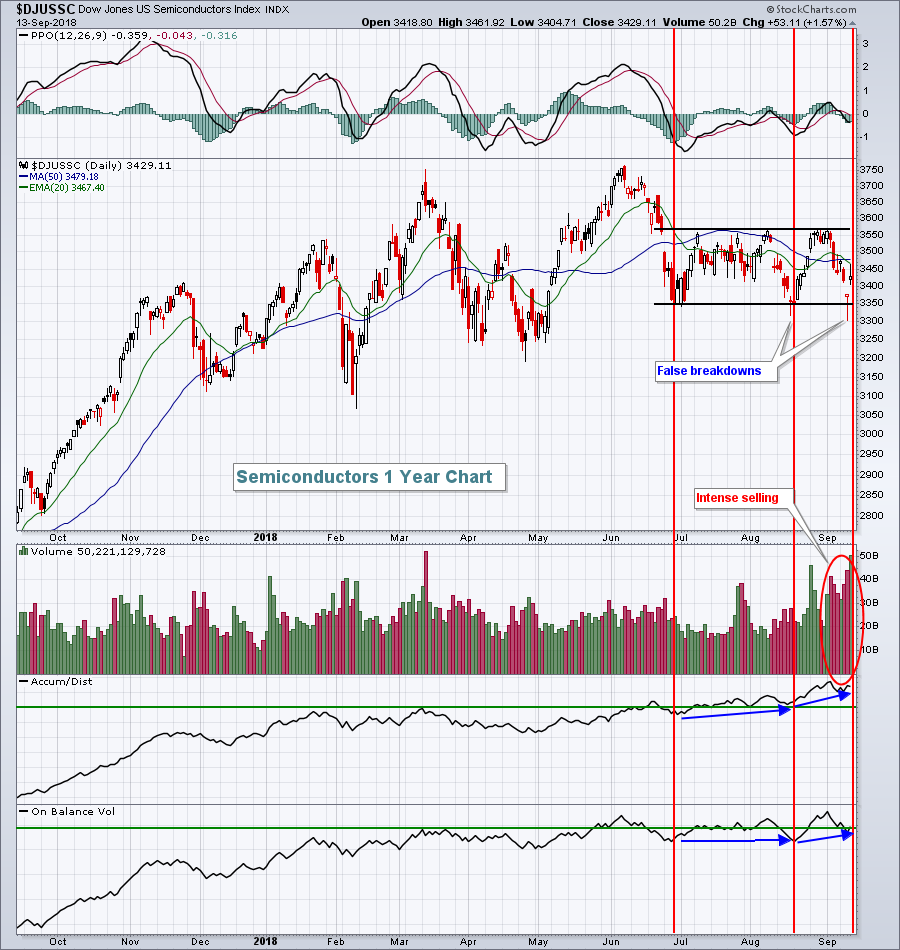

I'm reprinting the DJUSSC chart from yesterday, but highlighting a couple different indicators - the Accumulation/Distribution Line (AD Line) and On Balance Volume (OBV). While price action has been consolidating sideways the past 2-3 months, both the AD Line and OBV are improving, which I find to be a bullish signal. The momentum oscillators that I use - PPO and RSI - ignore volume in their calculations. The AD Line and OBV focus on volume that accompanies price action so they're not bad technical indicators to use to help figure out the directional likelihood in a seemingless direction-less chart like the DJUSSC. The rising bottoms on both of these indicators provides me solid hope that price support will hold and we'll eventually get that breakout above 3565. It provides me the confidence to trade the stronger semiconductor stocks (ie, higher SCTRs). Stocks like AMD, IDTI, SMTC, NVDA should perform well in a rising DJUSSC environment.

I'm reprinting the DJUSSC chart from yesterday, but highlighting a couple different indicators - the Accumulation/Distribution Line (AD Line) and On Balance Volume (OBV). While price action has been consolidating sideways the past 2-3 months, both the AD Line and OBV are improving, which I find to be a bullish signal. The momentum oscillators that I use - PPO and RSI - ignore volume in their calculations. The AD Line and OBV focus on volume that accompanies price action so they're not bad technical indicators to use to help figure out the directional likelihood in a seemingless direction-less chart like the DJUSSC. The rising bottoms on both of these indicators provides me solid hope that price support will hold and we'll eventually get that breakout above 3565. It provides me the confidence to trade the stronger semiconductor stocks (ie, higher SCTRs). Stocks like AMD, IDTI, SMTC, NVDA should perform well in a rising DJUSSC environment.

Computer hardware ($DJUSCR) also performed well on Thursday, mostly following Apple, Inc (AAPL) shares higher. To the downside, it was a not-so-good day for consumer staples (XLP, -0.15%) and financials (XLF, -0.14%). Banks ($DJUSBK, -0.77%) were a notable laggard and are now down 4% or so over the past three weeks. In the meantime, the 10 year treasury yield ($TNX) has been rising and is approaching 3.00% this morning.

Pre-Market Action

Solid gains in Tokyo ($NIKK) and Hong Kong ($HSI) paced gains in Asia overnight, while mostly fractional gains permeate European markets this morning. Here in the U.S., the southeast coast braces for Hurricane Florence amid a disappointing retail sales report.

Dow Jones futures are up 26 points, but well off of earlier highs.

Current Outlook

The U.S. Dollar Index ($USD) has not exactly exploded the way I expected. The inverse neckline breakout occurred near 95 and we did see a quick trip to 97, but the USD has been waffling and trending lower since reaching that level and it's having an impact on both the CRB Index (commodities) and the Russell 2000 (small caps):

I'm becoming more concerned from a short-term perspective that a further drop in the USD will negatively impact small caps in Q4 and help to boost commodities. I'm not as concerned longer-term, but short-term trends matter when you focus on short-term momentum trading. I still overweight my trades toward small caps, but I may gradually change that if the USD cannot hold its 94.25-94.50 support area.

I'm becoming more concerned from a short-term perspective that a further drop in the USD will negatively impact small caps in Q4 and help to boost commodities. I'm not as concerned longer-term, but short-term trends matter when you focus on short-term momentum trading. I still overweight my trades toward small caps, but I may gradually change that if the USD cannot hold its 94.25-94.50 support area.

Sector/Industry Watch

I find it infinitely more profitable to trade companies that are not only trending higher, but outperforming their peers and the benchmark S&P 500. Want to see the opposite? Check this out....

This is the poster child of what I try to avoid. A sector that's underperforming the S&P 500. Then an industry group that's underperforming its weak sector peers. Why not go for the trifecta and find a company that's underperforming its industry peers?

This is the poster child of what I try to avoid. A sector that's underperforming the S&P 500. Then an industry group that's underperforming its weak sector peers. Why not go for the trifecta and find a company that's underperforming its industry peers?

As a short-term momentum trader, I simply stay away from groups like this. Sure, they'll have their occasional days in the sun, but how much risk are you willing to take to try to time that sunshine?

Historical Tendencies

The Dow Jones U.S. Tires Index ($DJUSTR) is in the midst of its worst historical consecutive calendar months of the year. September (-4.7%) and October (-2.3%) have averaged losing 7% during these two months over the past two decades. Technically, there's little to be excited about currently. Check out the Sector/Industry Watch section above for more details.

Key Earnings Reports

None

Key Economic Reports

August retail sales released at 8:30am EST: +0.1% (actual) vs. +0.4% (estimate)

August retail sales less autos released at 8:30am EST: +0.3% (actual) vs. +0.5%(estimate)

August industrial production to be released at 9:15am EST: +0.4% (estimate)

August capacity utilization to be released at 9:15am EST: 78.3% (estimate)

July business inventories to be released at 10:00am EST: +0.5% (estimate)

September consumer sentiment to be released at 10:00am EST: 97.0 (estimate)

Happy trading!

Tom