Market Recap for Friday, November 30, 2018

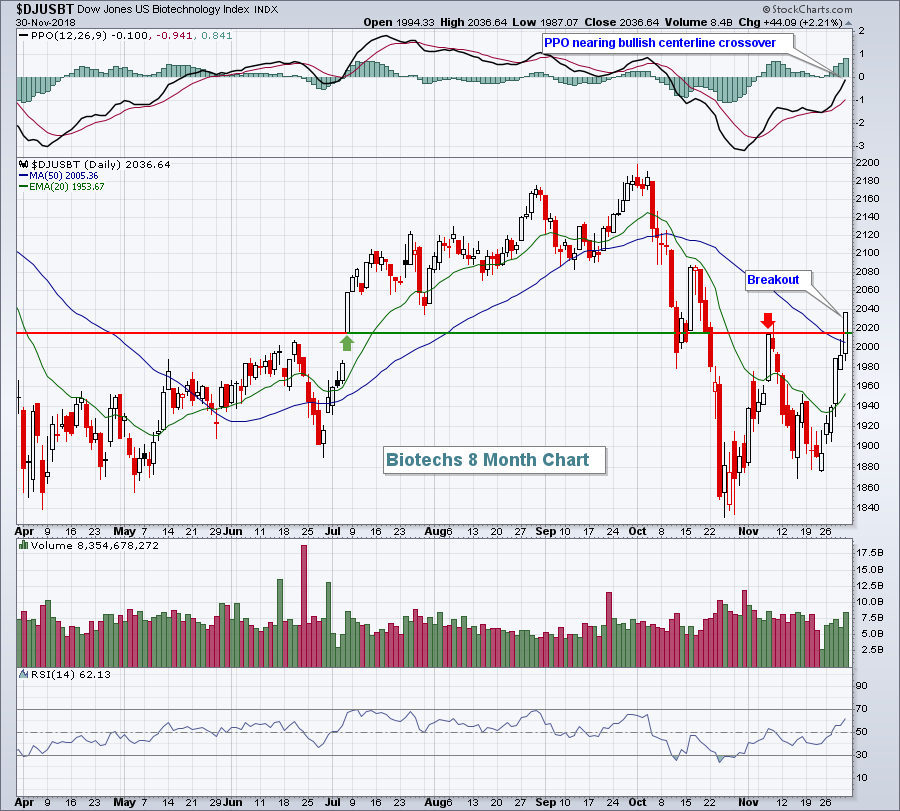

Friday's strength capped off a very solid week for the bulls, one in which the Dow Jones gained more than 1250 points. Strength was found everywhere although healthcare (XLV, +2.03%) and utilities (XLU, +1.48%) were the big winners to end the week. While biotechs ($DJUSBT, +2.21%) surged to highs not seen in more than a month (see Sector/Industry Watch section), pharmas ($DJUSPR, +1.31%) were actually able to close at all-time highs, underscoring the relative strength that the group's enjoyed since May:

There were two losing sectors on Friday as both energy (XLE, -0.18%) and communication services (XLC, -0.16%) failed to follow the overall market higher. The former's weakness stemmed from crude oil prices ($WTIC), which simply have not bounced off of very oversold conditions. The XLE has, however, managed to hold onto intermediate-term support near 64.

There were two losing sectors on Friday as both energy (XLE, -0.18%) and communication services (XLC, -0.16%) failed to follow the overall market higher. The former's weakness stemmed from crude oil prices ($WTIC), which simply have not bounced off of very oversold conditions. The XLE has, however, managed to hold onto intermediate-term support near 64.

In communication services, media agencies ($DJUSAV, -0.99%) paused after testing key overhead price resistance:

Despite the Friday weakness, media agency stocks have been extremely strong. I'd look for a breakout here sooner rather than later, especially if the overall market strength continues.

Despite the Friday weakness, media agency stocks have been extremely strong. I'd look for a breakout here sooner rather than later, especially if the overall market strength continues.

Pre-Market Action

The start to the week for global equities got a boost over the weekend when the trade war experienced a "cease fire". The United States and China agreed to delay further tariffs for 90 days as the two countries try to iron out their differences.

Asian markets saw a significant boost overnight with China's Shanghai Composite ($SSEC, +2.57%) and Hong Kong's Hang Seng Index ($HSI, +2.55%) leading the charge. European markets also are higher with the German DAX ($DAX) climbing 2.02% at last check.

Crude oil prices ($WTIC) are currently up 3.87% to near $53 per barrel.

Dow Jones futures are higher by 435 points with a little more than 30 minutes to go to the opening bell.

Current Outlook

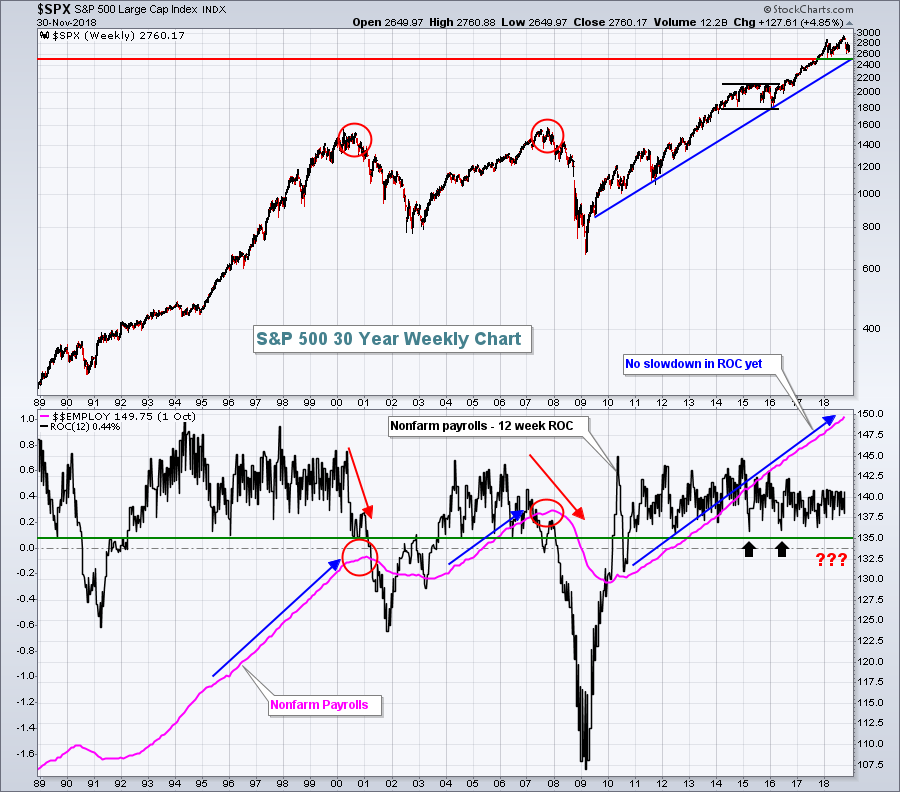

The bulls do not want to see a let up in jobs growth. This Friday, we'll get the latest on nonfarm payrolls ($$EMPLOY) and it won't be just "any ole report". Job growth to a bull market is akin to water to a plant. Without it, the other dies. A potential early warning signal for a bear market is a slowdown in job growth and guess what? We can chart that right here at StockCharts.com using the rate of change (ROC) indicator:

How cool is this chart? Hone in on those red circles above. Notice how the ascent in the nonfarm payrolls number begins to slow? Both of these examples resulted in a steep drop in the ROC, piercing below the zero line. They were early warning signals for the last two bear markets. Back in 2014 through 2016, the ROC deteriorated, but remained above the zero line and price support on the S&P 500 just above 1800 was never lost. That never materialized into a bear market and job growth accelerated once again and the bull market resumed. Currently, the ascent in jobs appears to be intact, so we'll want to watch this Friday's report to see if there's any deterioration. A slowdown wouldn't necessarily signal a bear market, but it would be another great big check mark in the bears' column.

How cool is this chart? Hone in on those red circles above. Notice how the ascent in the nonfarm payrolls number begins to slow? Both of these examples resulted in a steep drop in the ROC, piercing below the zero line. They were early warning signals for the last two bear markets. Back in 2014 through 2016, the ROC deteriorated, but remained above the zero line and price support on the S&P 500 just above 1800 was never lost. That never materialized into a bear market and job growth accelerated once again and the bull market resumed. Currently, the ascent in jobs appears to be intact, so we'll want to watch this Friday's report to see if there's any deterioration. A slowdown wouldn't necessarily signal a bear market, but it would be another great big check mark in the bears' column.

Do me a favor. If you haven't already, scroll to the bottom of this article and subscribe to my blog for FREE by typing in your email address and clicking the green "Subscribe" button. Because my blog is free, the only way I know that my blog provides you value is for you to subscribe. You won't be spammed and you'll receive my blog articles the moment they're published via the email address you provide. I'd really appreciate it. :-)

Sector/Industry Watch

During last week's rally, all 11 sectors rose, from healthcare's (XLV) 6.95% jump to a more tame rise of 2.44% for materials (XLB). Biotechs ($DJUSBT, +7.54%) led healthcare with a very solid weekly gain. In the process, the DJUSBT also broke above its early November reaction high:

The 2015 level had served as key price support/resistance and we were able to clear that level on Friday. I suspect we'll see continuing strength from biotechs so long as the that price support level now holds.

The 2015 level had served as key price support/resistance and we were able to clear that level on Friday. I suspect we'll see continuing strength from biotechs so long as the that price support level now holds.

Monday Setups

Horizon Pharma (HZNP) reported excellent quarterly earnings results on November 7th as follows:

Revenues: $325.3 mil vs $314.7 mil

EPS: $.65 vs $.50

HZNP gapped higher and continued to strengthen the next trading session, rising more than 15% from the previous close. It's been trending lower ever since and closed near key support on Friday:

The RSI has dipped back into the 40s, typically a nice entry point into an uptrending stock. I like the gap support zone between 19.50-20.00 with an ultimate short-term price target of 22.50.

The RSI has dipped back into the 40s, typically a nice entry point into an uptrending stock. I like the gap support zone between 19.50-20.00 with an ultimate short-term price target of 22.50.

Historical Tendencies

The latest nonfarm payrolls will be released Friday morning (Dec 7th) before the opening bell. A historically difficult period runs from December 7th through December 15th, especially for the small cap Russell 2000, which has produced an annualized return of -41.20% during this period since 1987. So if last week's rally continues into this week, you might consider becoming a bit more defensive as the week wears on. The S&P 500 and NASDAQ are also nearing bearish historical periods, though they've started a bit later than the Russell 2000 as follows:

S&P 500 (since 1950): -28.15% (Dec 11-Dec 15)

NASDAQ (since 1971): -51.13% (Dec 9-Dec 15)

Key Earnings Reports

None

Key Economic Reports

November PMI manufacturing index to be released at 9:45am EST: 55.4 (estimate)

November ISM manufacturing index to be released at 10:00am EST: 57.2 (estimate)

October construction spending to be released at 10:00am EST: +0.4% (estimate)

Happy trading!

Tom