Market Recap for Wednesday, March 27, 2019

Wall Street rebounded from steep intraday losses, but still ended the session in negative territory. The NASDAQ was the weakest index, falling 0.63%. The S&P 500, Russell 2000 and Dow Jones dropped 0.46%, 0.39%, and 0.13%, respectively. Industrials (XLI, +0.11%) was the lone sector to finish with a gain. Airlines ($DJUSAR, +1.92%) enjoyed a monster day, although there's still plenty of work to do technically for this group:

Airlines have been extremely weak on both an absolute and relative basis. Currently, yesterday's strength appears to be nothing more than an oversold and overdue bounce.

Airlines have been extremely weak on both an absolute and relative basis. Currently, yesterday's strength appears to be nothing more than an oversold and overdue bounce.

Meanwhile, a weak biotech space ($DJUSBT, -1.49%) weighed on healthcare stocks (XLV, -0.83%), the worst sector performer on the day. Biotechs continue to tread water in a trading range as we await further directional clues:

Given the prior uptrend, I'm assuming we'll see a breakout to the upside. Still, pay attention to that key price support range from 1925-1950 as the loss of this zone could spell further short-term trouble for an area that really hasn't participated in the 2019 rally.

Given the prior uptrend, I'm assuming we'll see a breakout to the upside. Still, pay attention to that key price support range from 1925-1950 as the loss of this zone could spell further short-term trouble for an area that really hasn't participated in the 2019 rally.

Pre-Market Action

Treasury yields are holding steady this morning, while both gold ($GOLD, -0.8%) and crude oil prices ($WTIC, -1.70%) are under pressure. Asian markets were mixed overnight, though there was clear weakness in the Tokyo Nikkei ($NIKK, -1.61%). In Europe, we're seeing modest gains, helping to reverse U.S. futures, which were down earlier. With 30 minutes left to the opening bell, Dow Jones futures have moved into positive territory, up 3 points at last check.

Current Outlook

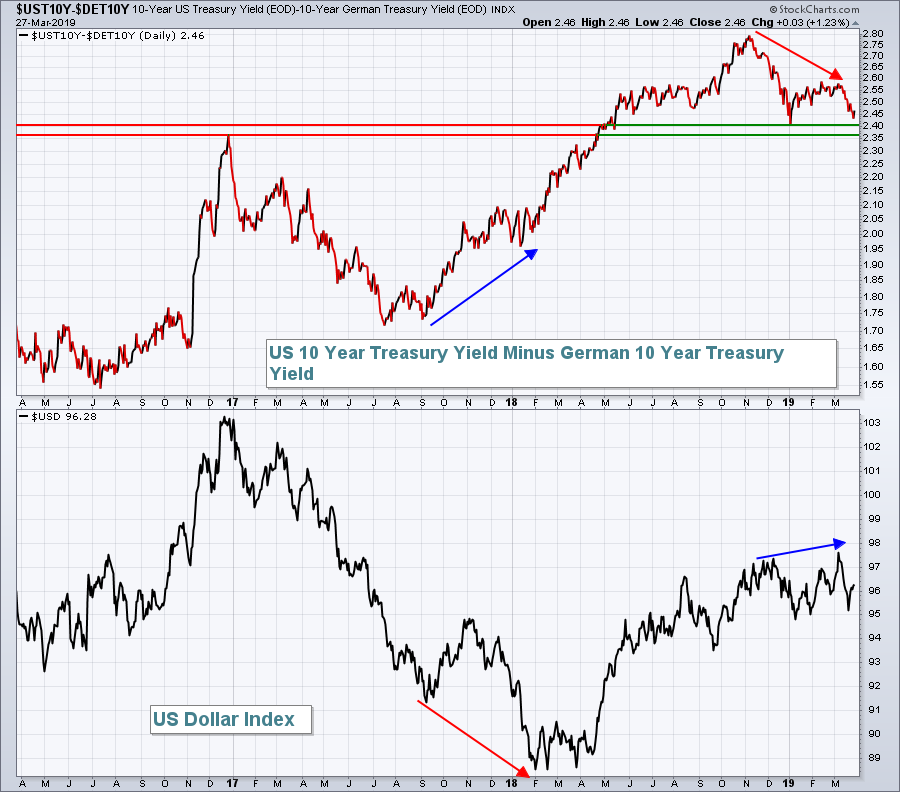

The direction of the U.S. Dollar Index ($USD) is important for several reasons, but most notably a rising USD can be a major headwind for energy (XLE) and materials (XLB). Energy has been benefiting from surging crude oil prices ($WTIC), but its relative strength is being limited by the rising dollar environment. We have a divergence in play right now between the direction of treasury yields here in the U.S. vs. Germany and the USD:

The USD may reverse and turn lower if we lose that yield differential support near 2.35-2.40. As you can see from the above, as the differential rises, so too does the USD generally. It makes sense because if treasury yields are rising faster here in the U.S., it's a sign of a stronger economy. A stronger economy should result in a stronger currency.

The USD may reverse and turn lower if we lose that yield differential support near 2.35-2.40. As you can see from the above, as the differential rises, so too does the USD generally. It makes sense because if treasury yields are rising faster here in the U.S., it's a sign of a stronger economy. A stronger economy should result in a stronger currency.

Sector/Industry Watch

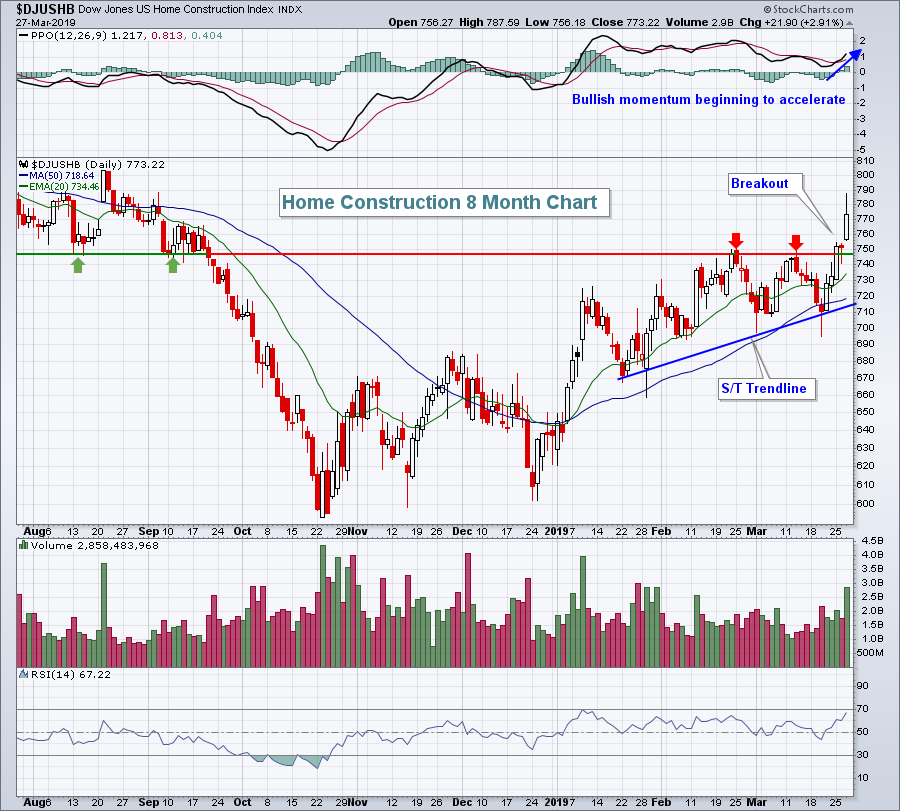

While the 10 year treasury yield ($TNX) decline has been very worrisome to me, one industry is certainly benefiting from the sudden rate drop - home construction ($DJUSHB, +2.91%). We saw another 2019 breakout in this group yesterday as the TNX dipped below 2.40%, extending its month-long decline:

Note the increasing volume on yesterday's advance, further confirmation that institutional accumulation is taking place - a very bullish signal. Up nearly 9% over the past month, the DJUSHB has easily been the best performing industry group in March.

Note the increasing volume on yesterday's advance, further confirmation that institutional accumulation is taking place - a very bullish signal. Up nearly 9% over the past month, the DJUSHB has easily been the best performing industry group in March.

Historical Tendencies

While the end of March does not carry the same historical strength as the end of other calendar months, it's still worth mentioning the type of strength we typically see as we move from one calendar month to another. Since 1971 on the NASDAQ, here are the annualized returns for each of the following calendar days of the month:

28th: +23.35%

29th: +18.67%

30th: +10.41%

31st: +51.25%

1st: +61.60%

2nd: +32.28%

The strength continues through the 6th calendar day of the month, but historical gains are not as robust as we move deeper into the calendar month.

The reason for this considerable strength? Think window dressing as portfolio managers buy top performing stocks to make them look a lot smarter than they actually are AND money flows. Many employers hold back 401(k) money and send it to investment firms at payroll time, which many times coincides with the first of the month.

Key Earnings Reports

(actual vs. estimate):

ACN: 1.73 vs 1.57

(reports after close, estimate provided):

SAIC: .89

RH: 2.83

Key Economic Reports

Q4 GDP (final) released at 8:30am EST: 2.2% (actual) vs 2.2% (estimate)

Initial jobless claims released at 8:30am EST: 211,000 (actual) vs 225,000 (estimate)

February pending home sales index to be released at 10:00am EST: -0.8% (estimate)

Happy trading!

Tom