Market Recap for Friday, March 29, 2019

The U.S. stock market rallied on Friday, putting an exclamation point on its best calendar quarter in 10 years. Of course, this strength came on the heels of an incredibly dismal quarter to end 2018. Healthcare (XLV, +1.20%) and industrials (XLI, +1.08%) led the bullish assault, while energy (XLE, -0.15%) and real estate (XLRE, -0.03%) trailed the field.

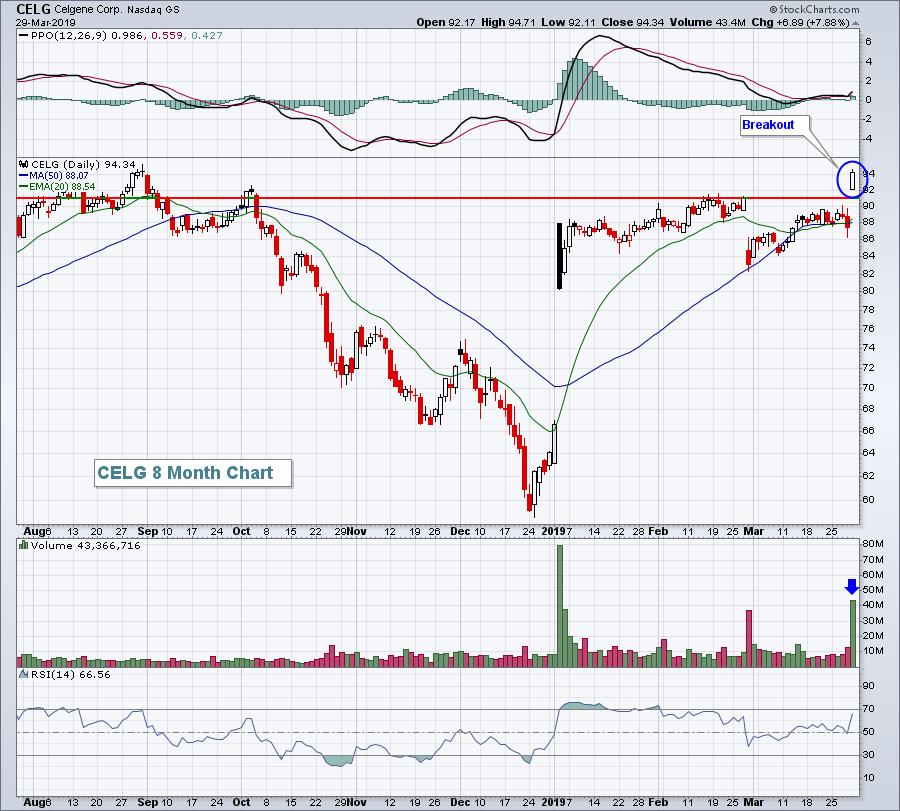

Most areas within healthcare were strong, but biotechnology ($DJUSBT, +1.89%) and medical supplies ($DJUSMS, +1.83%) were the clear winners. A huge winner in biotech was Celgene (CELG, +7.88%), breaking above key price resistance:

An influential shareholder spoke out in favor of Bristol Myers Squibb's (BMY, -0.27%) takeover of CELG, sparking renewed enthusiasm in the stock. BMY, meanwhile, fell fractionally on the report.

An influential shareholder spoke out in favor of Bristol Myers Squibb's (BMY, -0.27%) takeover of CELG, sparking renewed enthusiasm in the stock. BMY, meanwhile, fell fractionally on the report.

Viking Therapeutics (VKTX, +16.80%) was a much smaller biotech company that also saw a breakout on Friday:

I'm a big fan of heavier, confirming volume supporting a breakout. CELG and VKTX both meet that criteria.

I'm a big fan of heavier, confirming volume supporting a breakout. CELG and VKTX both meet that criteria.

Pre-Market Action

Global markets are rallying as Asian markets surged overnight, followed by more strength in Europe. U.S. futures are also strong with Dow Jones futures up more than 200 points with roughly 30 minutes left to the opening bell.

Crude oil ($WTIC) is once again very strong as well, nearing $61 per barrel and up 1.25% in early trading.

Current Outlook

One of my favorite gauges to evaluate market strength and sustainability is the relative strength of each of our aggressive sectors - technology (XLK), consumer discretionary (XLY), communication services (XLC), industrials (XLI), and financials (XLF). I want to see leadership from the majority, if not all, of these sectors. I realize we'll have relative pullbacks from time to time, so it's important for me to see if key relative support levels are holding in an overall longer-term uptrend. Here is what each of these relative ratios looks like currently:

We can argue that financials have been unusually weak, which they have, but their longer-term relative trend remains higher. If investors are bailing out of aggressive stocks to prepare for a recession, you wouldn't know it from looking at the above chart.

We can argue that financials have been unusually weak, which they have, but their longer-term relative trend remains higher. If investors are bailing out of aggressive stocks to prepare for a recession, you wouldn't know it from looking at the above chart.

Sector/Industry Watch

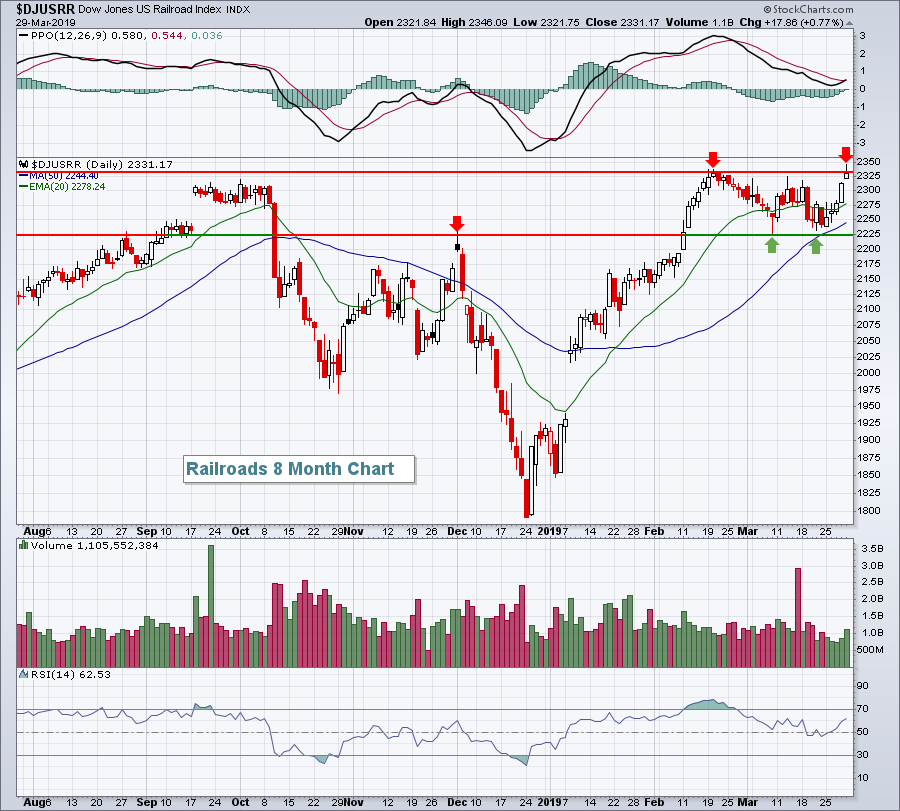

Railroads ($DJUSRR, +0.77%) are a proxy of our domestic economy and they continue to perform extremely well:

There was a false breakout on Friday and that can result in short-term weakness. However, the PPO recently reset near the centerline and is now pointing higher, indicative of strengthening bullish momentum. A breakout today or in the very near-term in railroads would be a bullish development for U.S. equities.

There was a false breakout on Friday and that can result in short-term weakness. However, the PPO recently reset near the centerline and is now pointing higher, indicative of strengthening bullish momentum. A breakout today or in the very near-term in railroads would be a bullish development for U.S. equities.

Monday Setups

For this week, I like Fabrinet (FN):

It's approaching key price and trendline support after having seen a month of profit taking. Note that the RSI is at 42, typically a solid entry level in an uptrending stock. I'd be careful on a high volume breakdown beneath 50. Otherwise, I'd look for a return to the 59 level, my target.

It's approaching key price and trendline support after having seen a month of profit taking. Note that the RSI is at 42, typically a solid entry level in an uptrending stock. I'd be careful on a high volume breakdown beneath 50. Otherwise, I'd look for a return to the 59 level, my target.

Historical Tendencies

The 1st calendar day of the month is historically the best. Since 1950 on the S&P 500, the 1st calendar day of ALL months has produced annualized returns of +46.78%, more than 5 times the average annual return of 9% over the same period.

Key Earnings Reports

None

Key Economic Reports

February retail sales released at 8:30am EST: -0.2% (actual) vs. +0.3% (estimate)

February retail sales less autos released at 8:30am EST: -0.4% (actual) vs. +0.4% (estimate)

March PMI manufacturing to be released at 9:45am EST: 52.5 (estimate)

January business inventories to be released at 10:00am EST: +0.5% (estimate)

March ISM manufacturing index to be released at 10:00am EST: 54.2 (estimate)

February construction spending to be released at 10:00am EST: -0.2% (estimate)

Happy trading!

Tom