Market Recap for Thursday, April 4, 2019

Our major indices rallied again on Thursday with the benchmark S&P 500 rising for a 6th consecutive session and closing at a 2019 high. The S&P 500's close of 2879 was just 61 points shy of the all-time high of 2940.91 set on September 21, 2018. Leadership came from materials (XLB, +1.01%), energy (XLE, +0.83%) and consumer discretionary (XLY, +0.81%). Technology (XLK, -0.42%) took a rare day off as software stocks ($DJUSSW, -1.19%) lagged badly:

Software has shown tremendous relative strength, though, so I'd expect any underperformance to be temporary, setting up the potential for highly profitable trades. I'd stick with leaders in the group.

Software has shown tremendous relative strength, though, so I'd expect any underperformance to be temporary, setting up the potential for highly profitable trades. I'd stick with leaders in the group.

Tesla (TSLA, -8.23%) tumbled after the automaker said its Q1 deliveries would be much lower than expected. Longer-term price support near the 250 level continues to hold, however. Automobiles ($DJUSAU, -1.63%) have felt the effects of TSLA's weakness as the group remains in a steep downtrend that began in January 2018. The DJUSAU hit a high of 240 that month and currently trades at 185. That's horrific action considering that the S&P 500 is higher than it was at that time.

Pre-Market Action

The much-awaited nonfarm payrolls report arrived this morning, this time with very good news. Jobs came in higher than expected, but not high enough to rattle the Fed. Wage inflation was nearly non-existent and the prior month's 20,000 total was revised slightly higher to 33,000. All in all, it was a huge win for the stock market. The 10 year treasury yield ($TNX) is up another 3 basis points this morning to 2.54% and is nearly 20 points off the recent bottom of 2.35% set on March 27th. Money is rotating away from treasuries and finding a home in equities. I'm looking for all-time highs in U.S. stocks and believe it'll likely happen sooner rather than later.

The China Shanghai Composite ($SSEC) is continuing to surge higher, rising another 5% in the past week alone. There are plenty of rumors swirling regarding a US-China trade deal sometime later this month and both equity markets are acting as if it's a foregone conclusion.

U.S. futures are higher once again, this time with the Dow Jones futures up just over 100 points with 30 minutes left to the opening bell.

Current Outlook

Nonfarm payrolls were released this morning (they were better than expected - see Key Economic Reports section below) and it's a good idea to watch closely the first Friday of every month. One report doesn't make a trend, but twelve do. Therefore, I pay attention to the 12 period rate of change (ROC). When that ROC begins to turn lower, especially when it turns negative, you definitely want to be cautious with equities. Nonfarm payrolls can be tracked on StockCharts.com using the ticker symbol "$$EMPLOY". Here's a long-term picture of how important following this number can be:

Selloffs in U.S. equities while jobs show a rising 12 month ROC are usually just noise in a bull market advance. We can have a couple disappointing reports without seeing significant deterioration in the ROC. If the ROC were to make a significant breakdown beneath the 1.4 level above (green line), then we'd need to re-evaluate.

Selloffs in U.S. equities while jobs show a rising 12 month ROC are usually just noise in a bull market advance. We can have a couple disappointing reports without seeing significant deterioration in the ROC. If the ROC were to make a significant breakdown beneath the 1.4 level above (green line), then we'd need to re-evaluate.

Until then, it's full speed ahead.

Sector/Industry Watch

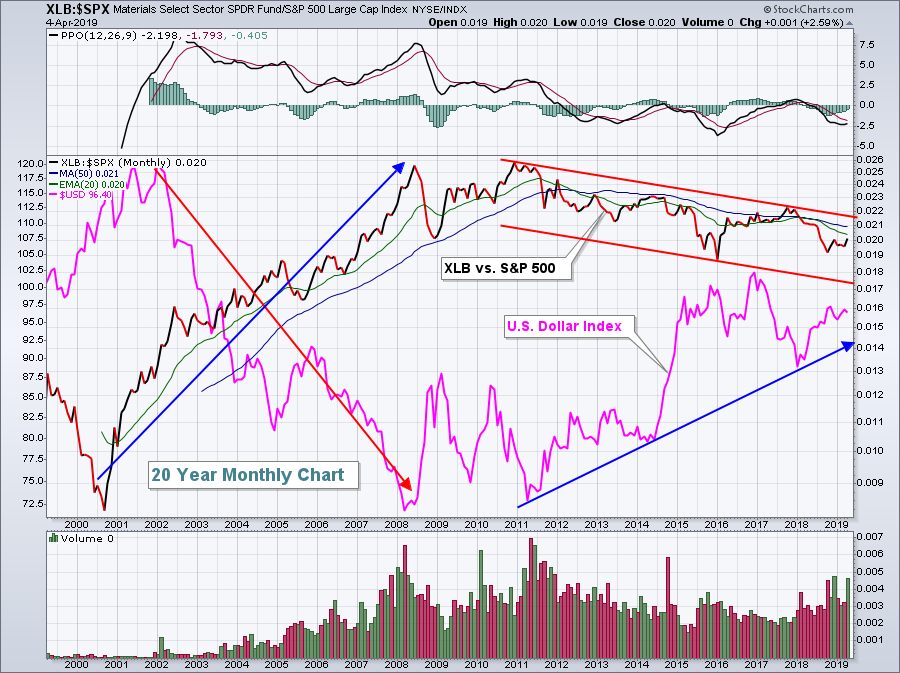

Materials stocks have shown leadership the past couple sessions as the U.S. Dollar Index ($USD) has pulled back. Still, the overall longer-term 8 year uptrend in the USD remains intact so relative strength in the XLB may be short-lived. The XLB has a history of underperforming the benchmark index in a rising USD environment:

Since the 2011 bottom, the USD has been uptrending. It's indisputable given the above chart. During that period, the XLB has struggled on a relative basis. The ETF has moved higher on an absolute basis, but has fallen on a relative basis. So yes, the XLB has outperformed the past couple sessions, but would I overweight this group? Not a chance.

Since the 2011 bottom, the USD has been uptrending. It's indisputable given the above chart. During that period, the XLB has struggled on a relative basis. The ETF has moved higher on an absolute basis, but has fallen on a relative basis. So yes, the XLB has outperformed the past couple sessions, but would I overweight this group? Not a chance.

Historical Tendencies

Most everyone likes Fridays and Wall Street is no exception. Fridays have produced annualized returns of more than 25% since 1971 on the NASDAQ. They've advanced approximately 60% of the time, as opposed to the overall likelihood of an advance (on all days) of 55%. There's a clear bullish tendency on Fridays, but they don't provide us a guarantee of an advance. It's simply a tendency.

Key Earnings Reports

None

Key Economic Reports

March nonfarm payrolls released at 8:30am EST: 196,000 (actual) vs. 170,000 (estimate)

March private payrolls released at 8:30am EST: 182,000 (actual) vs. 168,000 (estimate)

March unemployment rate released at 8:30am EST: 3.8% (actual) vs. 3.8% (estimate)

March average hourly earnings released at 8:30am EST: +0.1% (actual) vs. +0.2% (estimate)

Happy trading!

Tom