Market Recap for Tuesday, May 7, 2019

It was a wicked day on Wall Street. It felt more like December 2018 than May 2019. Volatility surged for a second consecutive day and sellers swamped buyers. Volume accelerated as it generally does during market selloffs and a bit of panic was felt intraday. If there was any good news, it was the Dow Jones' 170 point rally in the final 20 minutes to cut a 640 point loss to 473. Nonetheless, it was an awful day.

Building trade fears were once again the culprit as the U.S. and China can't seem to iron out a final deal. There are rumors swirling that China has reneged on earlier trade promises. The reason honestly doesn't matter. All that matters is that fear is growing and that's never a good thing on Wall Street.

Technology (XLK, -2.15%) and industrials (XLI, -2.02%) were hardest hit. Apple, Inc. (AAPL, -2.70%) closed slightly beneath its 20 day EMA for the first time since January and that sent computer hardware stocks ($DJUSCR, -2.58%) reeling. Here's a look:

I'll be watching today to see if AAPL finds buyers. If the most widely followed stock cannot find support here, the overall market could be in further short-term trouble.

I'll be watching today to see if AAPL finds buyers. If the most widely followed stock cannot find support here, the overall market could be in further short-term trouble.

Defensive groups managed to outperform as you might expect on a day like yesterday. Utilities (XLU, -0.31%) and consumer staples (XLP, -0.99%) were two of the top performers, though all sectors were lower on the session.

Pre-Market Action

It looks like it could be more of the same today as Dow Jones futures were lower by 125 points with a bit more than 30 minutes left to the opening bell. There are no significant economic reports and key earnings reports are slowing down. Unfortunately, that means all eyes are on the trade war. Just a few moments ago, President Trump tweeted that China "is coming this week to make a deal". That has quickly lifted traders' spirits so we'll see if a quick uptick in futures (now only down 66 points) can drive equity prices higher today.

The 10 year treasury yield ($TNX) remains stuck as it's down another basis point to 2.44%, breaking to a 5-6 week low.

There was plenty of selling overnight in Asia with most indices there down more than 1%. Europe is mixed this morning.

Current Outlook

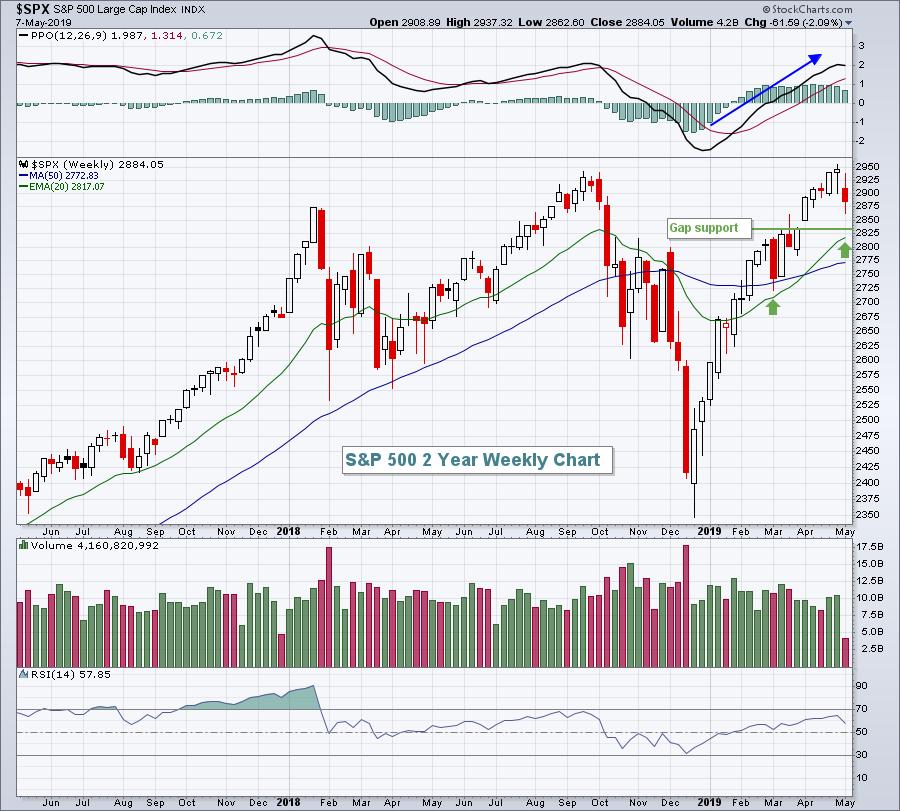

Yesterday, I reviewed the S&P 500 on an hourly chart, suggesting that we watch the 2900 closely. That support was lost and the selling accelerated very quickly as our benchmark index finished at 2884 after reaching 2862 intraday. The daily chart shows a stubborn negative divergence still present so a drop to test its rising 50 day SMA, currently at 2856, is the first point of support to consider. But let's not forget that when a PPO is rising, a drop to test the rising 20 period EMA is quite normal and healthy. So let's check out the longer-term weekly chart:

Here are the various support levels I'm considering:

Here are the various support levels I'm considering:

The 50 day SMA (reset): 2856

Prior closing resistance (now support): 2854

Weekly gap support (above): 2834

20 week EMA: 2817

That's a lot of support between 2817 and 2856. I see more short-term selling, but a big reversal in this range would be good news for the bulls, while a decisive move beneath would indicate the bears have regained control. We must be mindful of the surging Volatility Index ($VIX, +25.13%), which I review below.

Sector/Industry Watch

When the market sells off like it has the past two sessions, I move quickly to an analysis of the VIX. We've seen the VIX rise more than 50% over the last 48 hours and that's always scary. It's scary because the market always sells off faster than it rises. The VIX closed at its highest level since January. One huge reason why the stock market has seen little selling is that the VIX has been low and in a steady downtrend. The renewed trade fears have changed all that. Here's an illustration of the volatility surge:

Over the past year, the VIX has had several tops near 18 with intraday spikes well above that level, but failing to close there. Those tops in the VIX have marked very significant bottoms in the S&P 500. Honestly, I don't like the VIX close yesterday at 19.32. That suggests to me that we haven't yet seen the VIX high and S&P 500 bottom. Therefore, I'd look for a reversing candle on the VIX and a price reversal on the S&P 500, preferably in the range of support noted in the Current Outlook section above.

Over the past year, the VIX has had several tops near 18 with intraday spikes well above that level, but failing to close there. Those tops in the VIX have marked very significant bottoms in the S&P 500. Honestly, I don't like the VIX close yesterday at 19.32. That suggests to me that we haven't yet seen the VIX high and S&P 500 bottom. Therefore, I'd look for a reversing candle on the VIX and a price reversal on the S&P 500, preferably in the range of support noted in the Current Outlook section above.

One final note on the above chart. We should always be wary of a stock market rise with a corresponding rise in the VIX. The blue directional lines from April 2019 into May show exactly that. It tells us that market participants are getting nervous despite higher equity prices. That rising fear can be problematic as it surely was this time.

Historical Tendencies

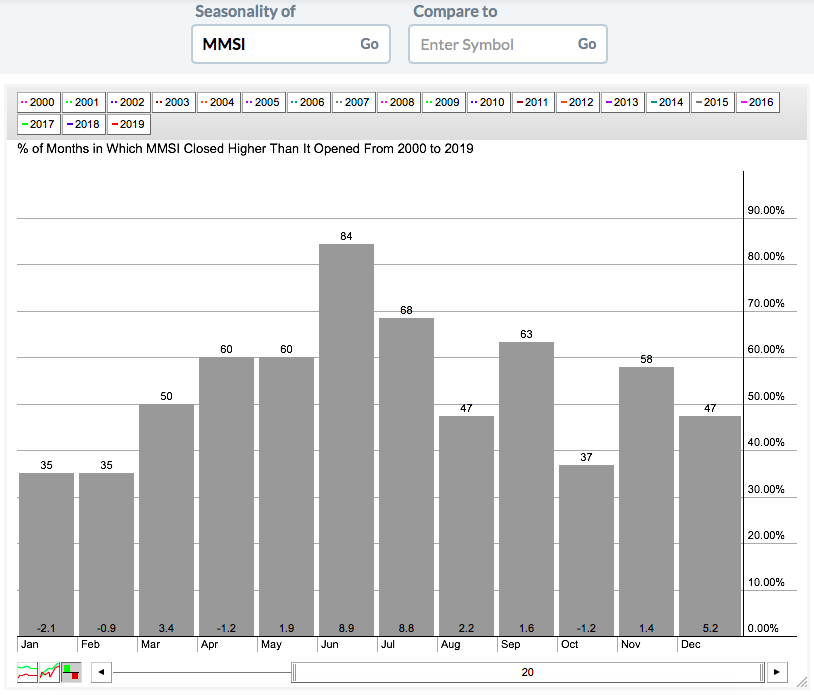

Medical supplies ($DJUSMS) has found renewed strength the past few weeks and one small cap stock in the space is entering a very strong historical period. Merit Medical Systems (MMSI) loves the next few months, building to a seasonal crescendo in June and July:

Over the past twenty years, MMSI has averaged gaining 20.6% during the May through July period.

Over the past twenty years, MMSI has averaged gaining 20.6% during the May through July period.

Key Earnings Reports

(actual vs. estimate):

ATHM: .87 vs .80

CBRE: .79 vs .59

COTY: .13 vs .12

GOLD: .11 vs .10

HMC: (.07) vs .53

MCHP: 1.48 vs 1.39

MCK: 3.69 vs 3.66

MPC: (.09) vs .01

MPLX: .61 vs .59

TRI: .36 vs .23

(reports after close, estimate provided):

ANGI: .00

CTL: .27

CVNA: (.57)

DIS: 1.59

ET: .36

ETSY: .14

EVRG: .42

FNV: .28

FOXA: .64

IAC: .40

PBR: .22

PRGO: .94

ROKU: (.24)

SLF: .91

Key Economic Reports

None

Happy trading!

Tom