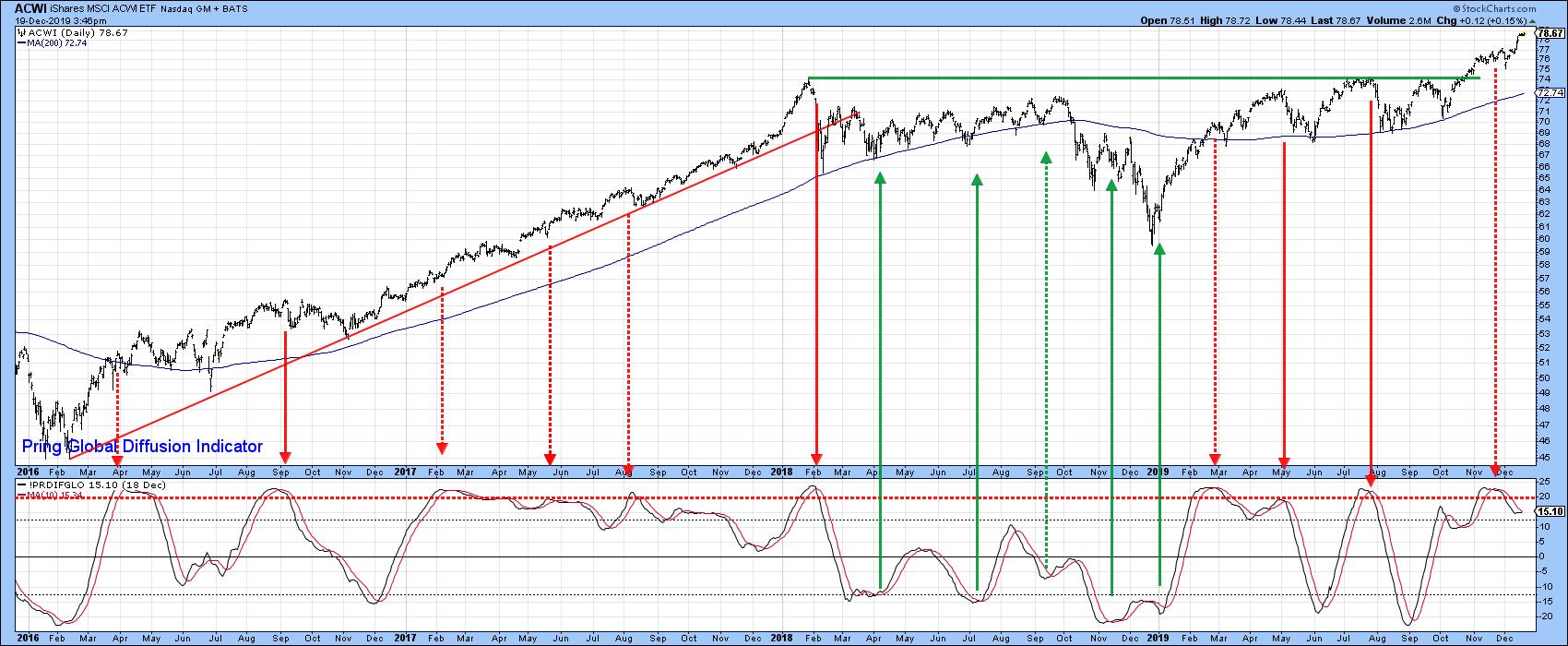

Right now, stocks are very overextended and likely due for a correction. In Chart 1, for instance, you can see that my Global Diffusion indicator has just triggered a sell signal from an extreme level. The solid red arrows show that the MSCI World Stock ETF (ACWI) has usually responded to such an event with a sell-off. However, the dashed ones tell a different story. That's because they were triggered during a strong bull market. Indeed, the price has so far failed to respond in a negative way to the most recent signal. That suggests that the current advance is packing a lot of upside momentum and that the short-term indicators will continue to thumb their noses at such bearish technical events. In my experience, that's a typical characteristic of a powerful young bull market. The first sell signal triggered in the chart in the spring of 2016 is a classic example. These failed bearish signals are the exception, rather than the rule, but there are several other charts that suggest this bull has only just begun.

Chart 1

Most of these indicators come from an improvement in the trend of several of my confidence indicators that I actively follow in my monthly Intermarket Review and as strategist for Pring Turner Capital. Let's take a closer look.

Confidence is Breaking Out All Over

Technicians closely follow sentiment indicators in order to have a better understanding of what the crowd may be thinking. Generally speaking, this data is used from a contrarian aspect, as most groups of investors are usually wrong at major turning points. An alternative is to monitor not what people say they are but what they are actually doing. In this respect, it is possible to come up with relationships that act as a proxy for such swings in confidence.

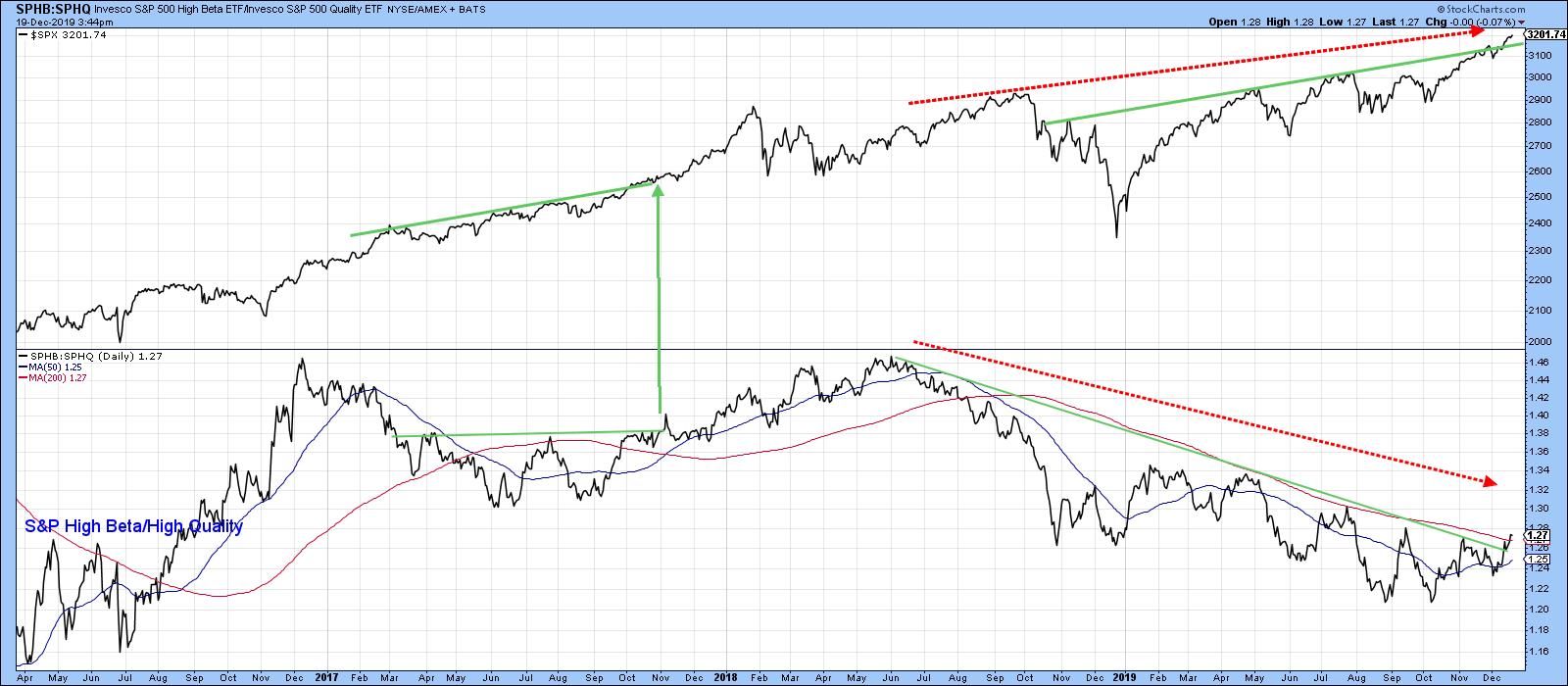

One possibility is to compare the performance of a risky item with one that is far more defensive. An example might be the ratio between the S&P High Beta to the S&P High Quality stocks. The two ETF symbols are SPHB and SPHQ, as plotted in Chart 2. It is apparent that confidence, as monitored by this relationship, peaked in 2018 and has been slowly deteriorating since. In the latest sessions, though, the ratio has violated its 2018-2019 downtrend line and 200-Day MA, suggesting that it is headed higher. In other words, a new trend favoring the more risky high beta stocks is underway. The current setup looks to be similar (and actually stronger) than that indicated by the two trend line breaks in late 2017. There is one other important takeaway from the chart, which lies with the fact that while the S&P has been making its way higher since the soring of 2018, this confidence ratio has not. That's not a good sign from a long-term point of view, but there is always the hope that it might get cleared up as we move forward. Since the current indicated trend is up, I am not currently worried about this potential discrepancy. However, if down the road the ratio fails to confirm the new high in the Index, that will be the time to become concerned.

Chart 2

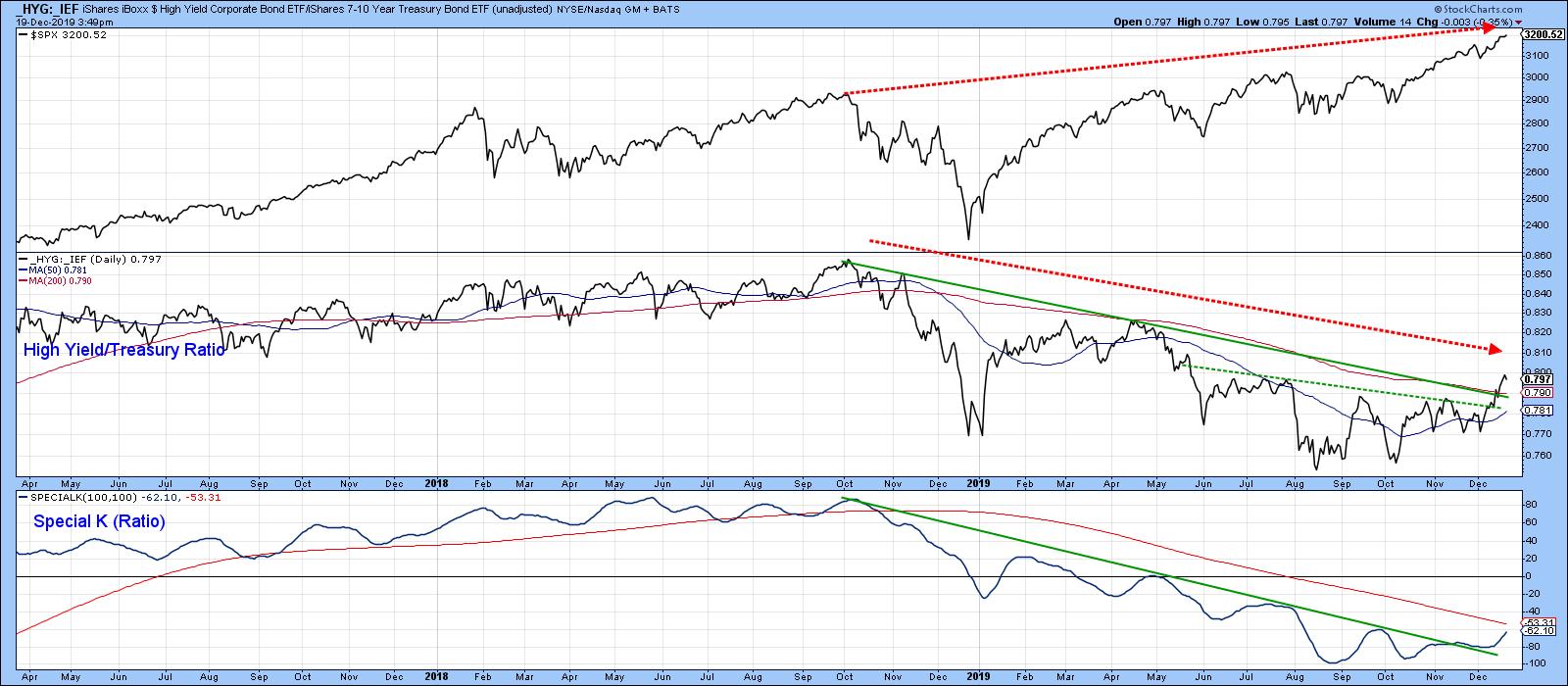

Swings in confidence also show up in the bond market in the form of credit spreads. In Chart 3, for instance, the SPX is compared to the ratio between the iBoxx High Yield Corporate and the iShares 7-10-year Treasury Bond ETF (HYG/IEF). Note that both series have been plotted using the underscore. In that way, interest and dividends are excluded from the calculation. Once again, the two thick dashed red arrows are pointing up the potential for a large negative divergence, as we saw in the previous chart. However, the ratio itself has completed a base, broken above its 2018-19 downtrend line, and has also managed to clear its 200-day MA. More importantly, the Special K has violated its 2018-19 down trend line. All these factors suggest that a major uptrend in this confidence relationship is underway.

Chart 3

Editor's Note: This is an excerpt of an article that was originally published in Martin Pring's Market Roundup on Friday, December 6th at 3:09pm ET. Click here to read the full article, which includes Charts 4-6.

Good luck and good charting

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates.