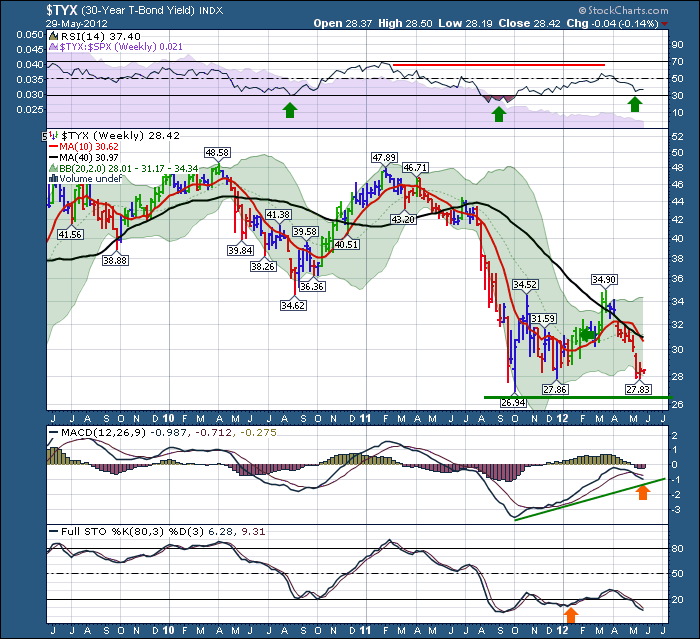

Either all the world is insane together as this MACD says the yield momentum is improving. (the mass physcology of crowds) Or somehow Europe prints money and the world is just fine. Who knows...but this will be a great clue. The long bond yield could be making a final low with a much higher MACD which would be a very bullish signal to buy something like TBT. While this trade has not set up yet, it definitely needs to be monitored full time. See the $COMPQ for OCT 4, 2011 MACD as an example.

Notice how high the MACD is currently, even though the price is almost the same as the previous low. This positive divergence shows very little incentive to expect this long bond (short yield) trade to continue to work. If this can make a higher histogram on the weekly chart, I would be looking to buy TBT or Short TLT. The reason this trade is so hard is that we see so many forecasts of a global recession, so how could this be the time to short the long bond price and go long a rising yield? Well, it might have something to do with operation twist ending and the US economy still ok enough that QE is not required. I won't debate if the Fed will start more QE, but all that to say, keep watching this chart for a higher Histogram. It might be an interesting place to put a trade on with a beautiful close stop if you are wrong.

Good Trading,

Greg Schnell, CMT