Latest News

The Mindful Investor8h ago

S&P 500 Makes a New All-Time High By End of June?

We've been covering the signs of weakness for stocks, from the bearish divergences in March, to the mega-cap growth stocks breaking through their 50-day moving averages, to even the dramatic increase in volatility often associated with major market tops Read More

GoNoGo Charts8h ago

DEFENSE IS ON THE FIELD | GONOGO SHOW APRIL 26, 2024

The S&P500 trend conditions have continued this week in "NoGo" conditions despite relief rallies. Alex Cole and Tyler Wood, CMT identify intermarket forces including rising rates ($TNX) and a strong US Dollar (UUP) that can provide headwinds to risk assets Read More

The MEM Edge9h ago

MEM TV: Wait For This Before Getting Back In

In this episode of StockCharts TV's The MEM Edge, Mary Ellen reviews the key drivers for this week's volatile period, including Core PCE and GDP numbers. She takes a look at where the S&P 500 and NASDAQ closed for the week and whether it's safe to put new money to work Read More

The Final Bar9h ago

Spotting Downturns Early: Daily or Weekly Charts?

In this edition of StockCharts TV's The Final Bar, Dave answers viewer questions on spotting downturns in daily vs. weekly charts, using the Relative Rotation Graphs (RRG) to identify actionable ideas, and comparing the NYSE Composite Index ($NYA) to the S&P 500 Index ($SPX) Read More

ChartWatchers12h ago

S&P 500 & Nasdaq Composite Approach Critical Resistance; Watch for These Important Levels!

A tug-of-war with no clear winner—that's what the stock market seemed to be playing this week. With a Fed meeting, key economic data, and more earnings on top, will a winner emerge next week? It was an interesting week in the stock market Read More

Don't Ignore This Chart!12h ago

Analyzing Alphabet's Surge — Here's How to Get In Earlier Next Time

Using technical indicators to identify stocks fundamentally undervalued but technically strengthening is a common practice Read More

DecisionPoint14h ago

META's Reverse Island - Two More Mag Seven Islands to Monitor

Whenever we see price gapping up or down, as happened with META in February, we prepare for the possibility of an island reversal. After the gap up, price forms a cluster, the island, and we ponder the possibility of a gap down to complete the reversal Read More

Don't Ignore This Chart!1d ago

Analyzing the SPY: How to Know When the Pullback is Over

Last week, investors were spooked by geopolitical tensions and expectations of interest rates remaining higher for longer. The fear sent investors selling equities, resulting in the broader indexes breaking below their upward trendlines Read More

Dancing with the Trend1d ago

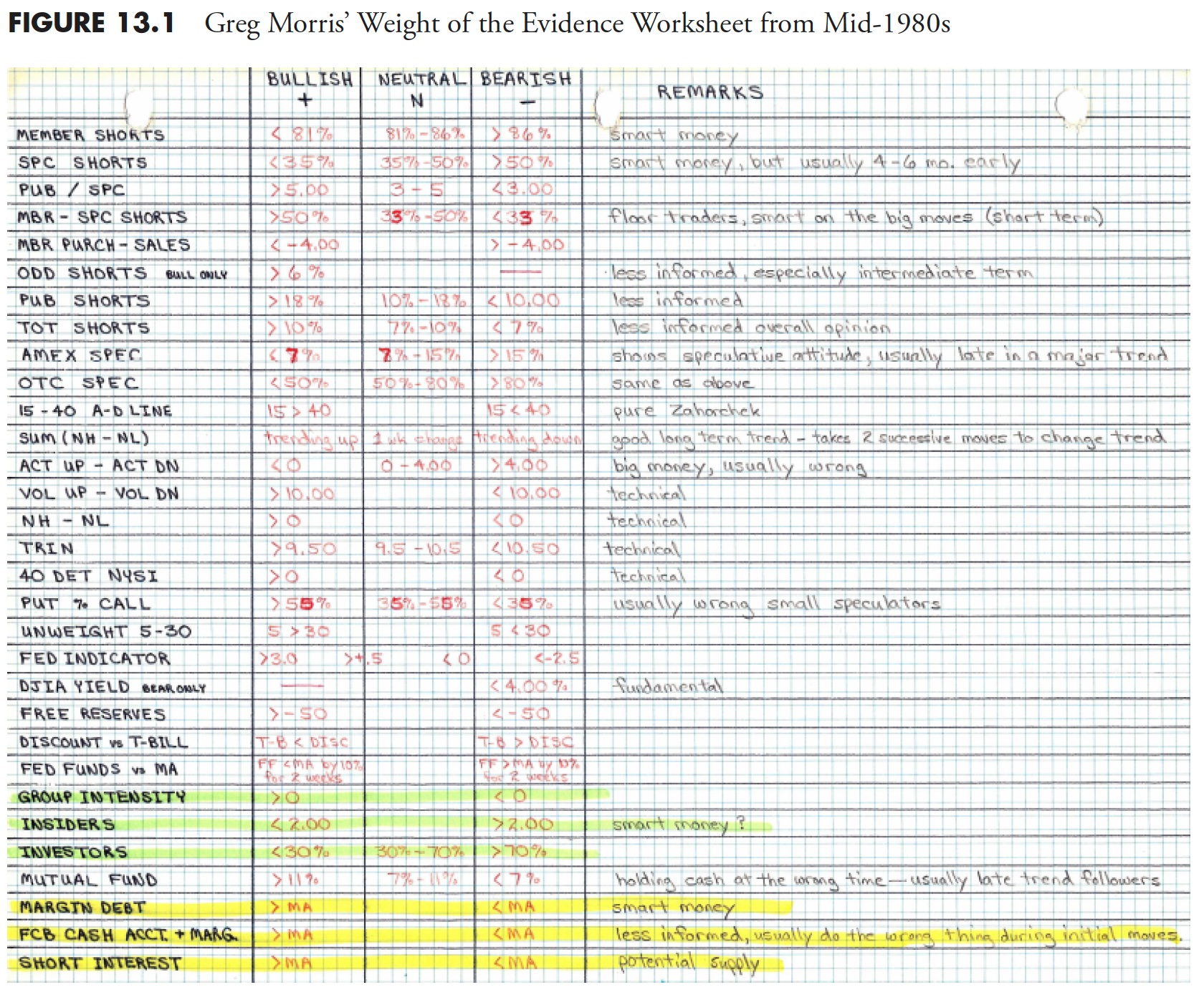

Rules-Based Money Management - Part 2: Measuring the Market

Note to the reader: This is the eighteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful Read More

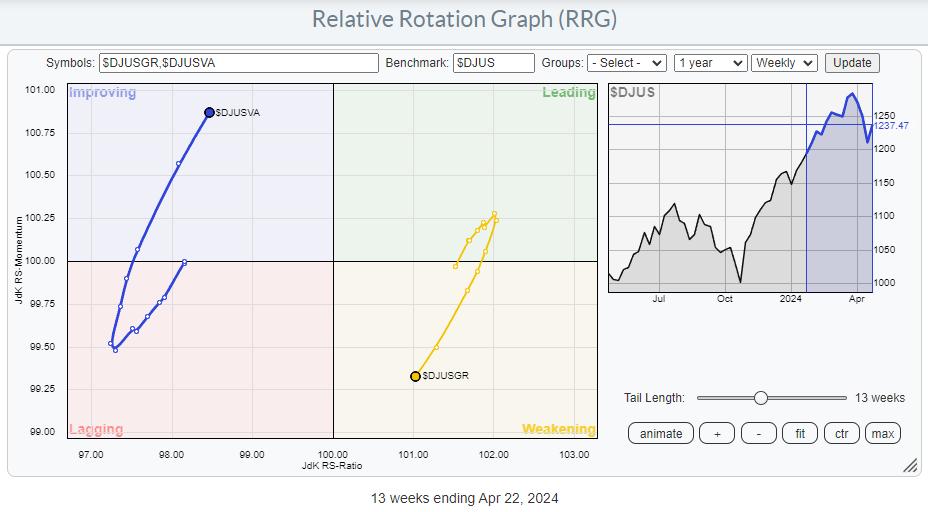

RRG Charts2d ago

10% Downside Risk For Stocks as Value Takes The Lead

Value Taking the Lead from Growth The weekly RRG above shows the rotation for Growth vs. Value stocks, with the DJ US index as the benchmark. The recent rotation clearly shows the rotation out of growth into value taking shape and picking up steam Read More

The Final Bar2d ago

Three Sectors are Showing Strength, Three are Not

In this edition of StockCharts TV's The Final Bar, Dave welcomes Ryan Redfern, ChFC CMT of Shadowridge Asset Management. David highlights companies reporting earnings this week, including TSLA, V, ENPH, STLD, STX, ODLF, and GD Read More

Don't Ignore This Chart!2d ago

What's Really Driving Tesla's Surprising Stock Surge?

Tesla's (TSLA) first-quarter earnings reported after Tuesday's market close was lackluster, bordering on disastrous. Yet the stock jumped 16% Wednesday morning, ripping open a wide breakaway gap from the previous day's close Read More

Stock Talk with Joe Rabil2d ago

Pinpoint the Next Buying Opportunity in SPY

On this week's edition of Stock Talk with Joe Rabil, Joe uses the MACD to analyze SPY and shares what to look for to find the next buy point. Joe then analyzes stocks including ADBE, XOM, and CRM. This video was originally published on April 24, 2024 Read More

The Final Bar3d ago

Buy the Dip or Sell the Rip?

In this edition of StockCharts TV's The Final Bar, Dave welcomes Bret Kenwell of eToro. Bret shares the levels he's watching for AAPL and AMD, speaks to this week's bounce higher, and points out why Energy still shows long-term strength Read More

Members Only

Martin Pring's Market Roundup3d ago

Are We There Yet?

Back in early February, I wrote an article entitled "Only a Fool Would Try to Call a Correction in a Bull Market, So Here Goes" Read More

The Final Bar4d ago

Weak Charts Keep Getting Weaker

In this edition of StockCharts TV's The Final Bar, Dave examines names making moves in the market like Tesla (TSLA), Verizon (VZ), and Nucor (NUE) Read More

DecisionPoint4d ago

DP TRADING ROOM: Find Shorts Using the Diamond Dog Scan

Today Erin shared her Diamond Dog Scan that she uses to find shorting opportunities. She was able to uncover five possible shorts. She discusses each chart and let's you know what she looks for in a good short Read More

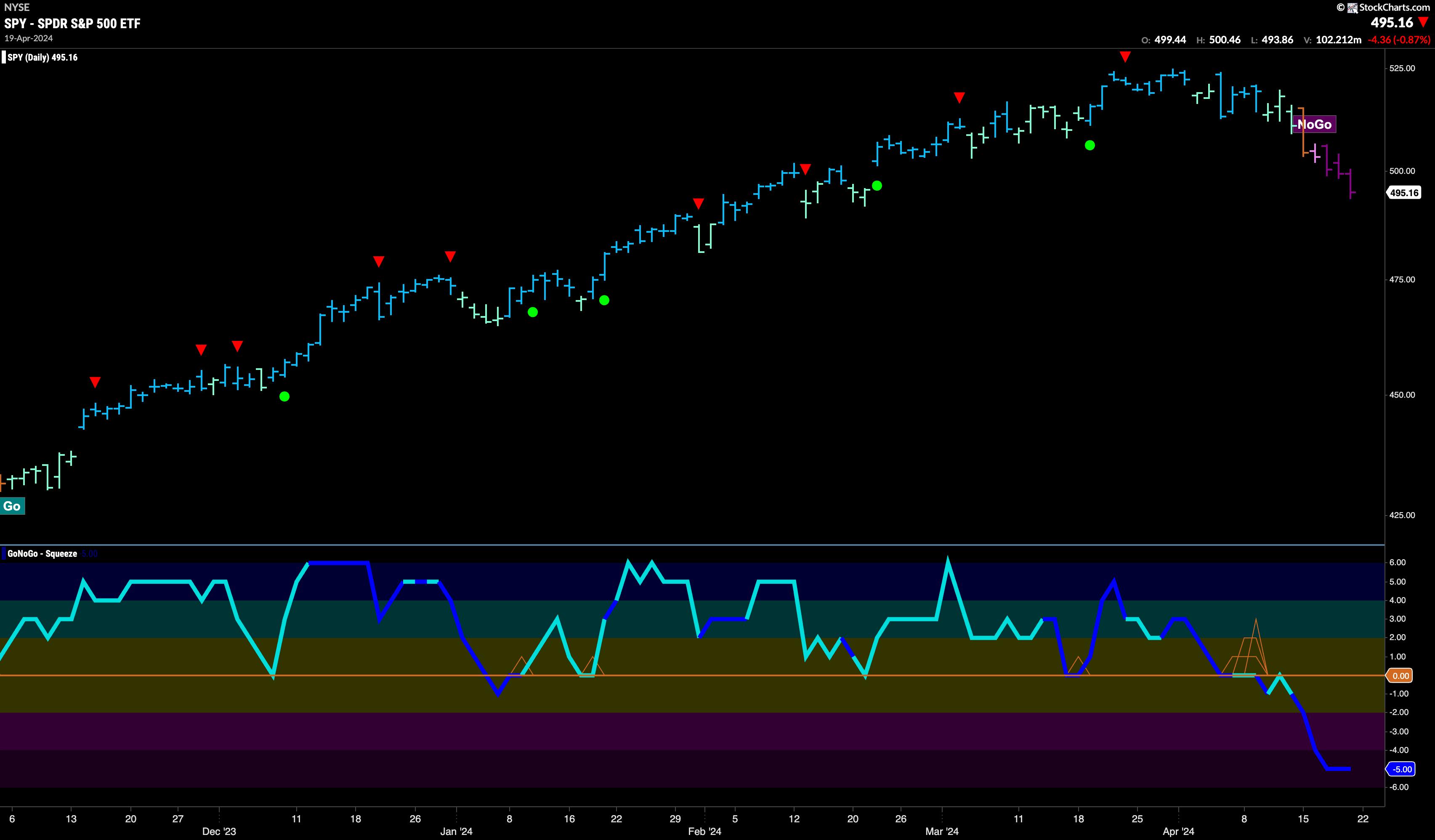

GoNoGo Charts4d ago

Equities Struggle in Strong "NoGo" as Materials try to Curb the Damage

Good morning and welcome to this week's Flight Path. The equity "Go" trend is over. We saw a pink "NoGo" bar following an amber "Go Fish" bar of uncertainty and then that was followed by strong purple bars as the week continued Read More

Analyzing India6d ago

Week Ahead: Mild Technical Pullbacks Likely; NIFTY Remains Prone to Selling Pressure at Higher Levels

In the truncated week, the markets looked largely corrective, as the key indices lost ground during the week Read More

Art's Charts6d ago

Getting Perspective and Dealing with Volatility

The S&P 500 is down 5.5% this month and volatility is rearing its ugly head. This is a good time to get some perspective by putting the move into context. My goal is to see the forest, as opposed to a few trees Read More

The Mindful Investor1w ago

Breakdown in Mega-Cap Growth Confirms Bear Phase

While our major equity benchmarks showed incredible strength in Q1 2024, breadth conditions have been deteriorating since mid-March Read More

The MEM Edge1w ago

MEM TV: Capitulation Signals for a Market BOTTOM

In this episode of StockCharts TV's The MEM Edge, Mary Ellen reviews the negative shift that's evolved over the past week in the market and highlights key signals of capitulation you should be watching for Read More

StockCharts In Focus1w ago

How to Chart In Multiple Timeframes Like A PRO

On this week's edition of StockCharts TV's StockCharts in Focus, Grayson shows you how to chart the same symbol in multiple timeframes with ease using ChartStyles and StyleButtons Read More

ChartWatchers1w ago

S&P 500 Approaches 100-Day Moving Average: Is Now an Attractive Time to Buy Stocks?

What a difference a week makes. Last week, the stock market changed its tune from up, up, up, to up, down, up, down. That made it feel like investors were uncertain, yet the CBOE Volatility Index ($VIX) wasn't high enough to confirm the fear Read More

The Final Bar1w ago

Top 10 Stocks to Watch April 2024

In this edition of StockCharts TV's The Final Bar, Dave and Grayson run through top 10 charts to watch in April 2024! Together they cover breakout strategies, moving average techniques, relative strength, and much more Read More

DecisionPoint1w ago

Netflix Gets Island Reversal On Earnings

Netflix (NFLX) earnings were released today, and the news was good. . . except for one little thing. They also suspiciously announced that, starting next year, they would no longer be reporting subscriber metrics Read More

Don't Ignore This Chart!1w ago

META Stock in Limbo: What You Need to Know Before the Next Big Price Swing

Meta Platforms Inc. (META), the social media giant formerly known as Facebook, has been in tight consolidation at the top of its range for a little over a month. Following a 23% rise in February after its Q4 earnings, trading volume for the stock has declined significantly Read More

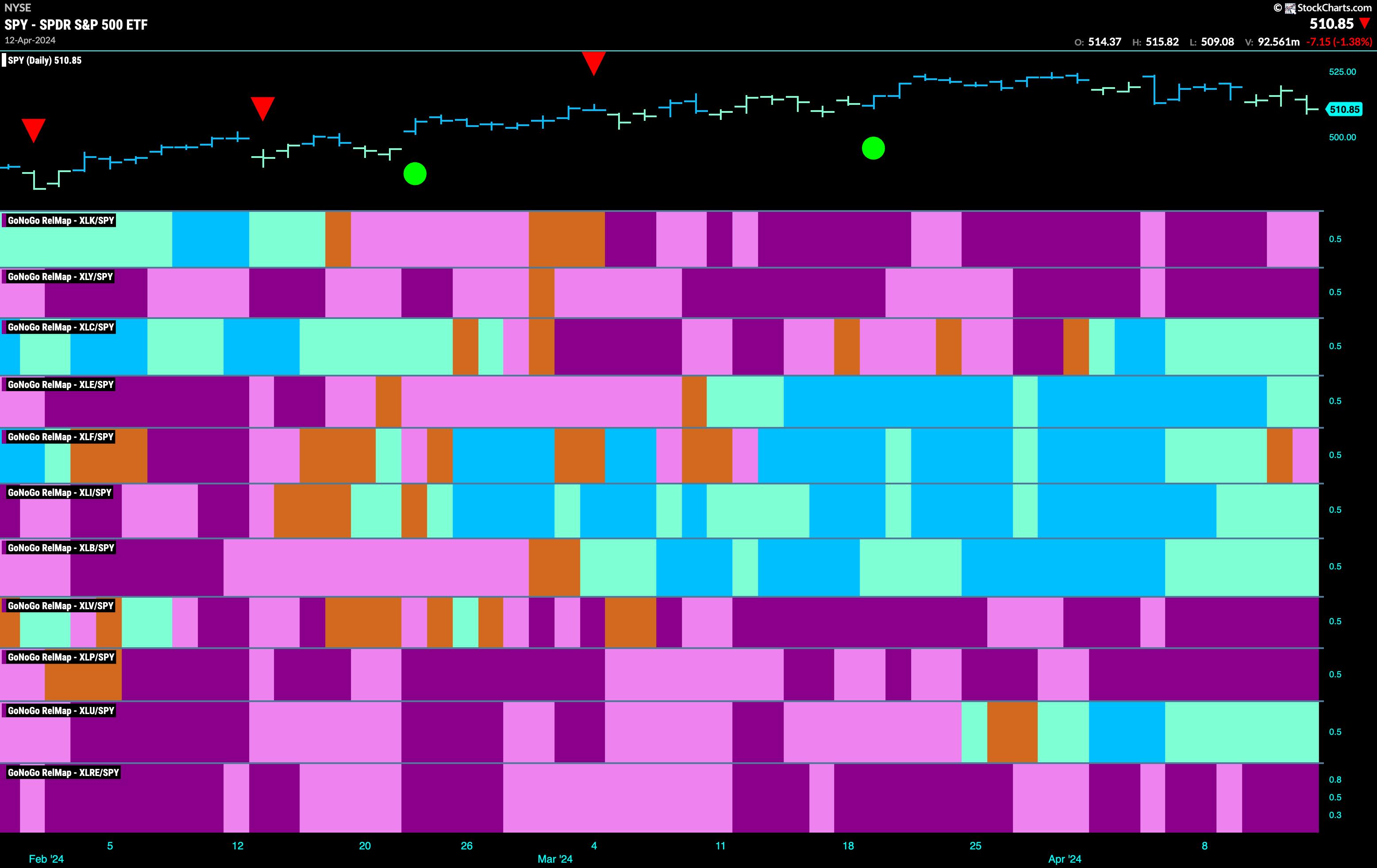

GoNoGo Charts1w ago

Equity Markets Struggle to Hold onto "Go" trend as Industrials Try to Lead | Apr 15 2024

Good morning and welcome to this week's Flight Path. The equity "Go" trend continued this week but we saw some weakness as GoNoGo Trend paints a string of weaker aqua bars to close out the week Read More

The Final Bar1w ago

Charts Flashing "No Go" for S&P 500!

In this edition of StockCharts TV's The Final Bar, Dave welcomes guest Tyler Wood, CMT of GoNoGo Charts. Tyler walks through their proprietary momentum model which confirms a bearish rotation for the major equity benchmarks yet a bullish rotation for the commodity space Read More

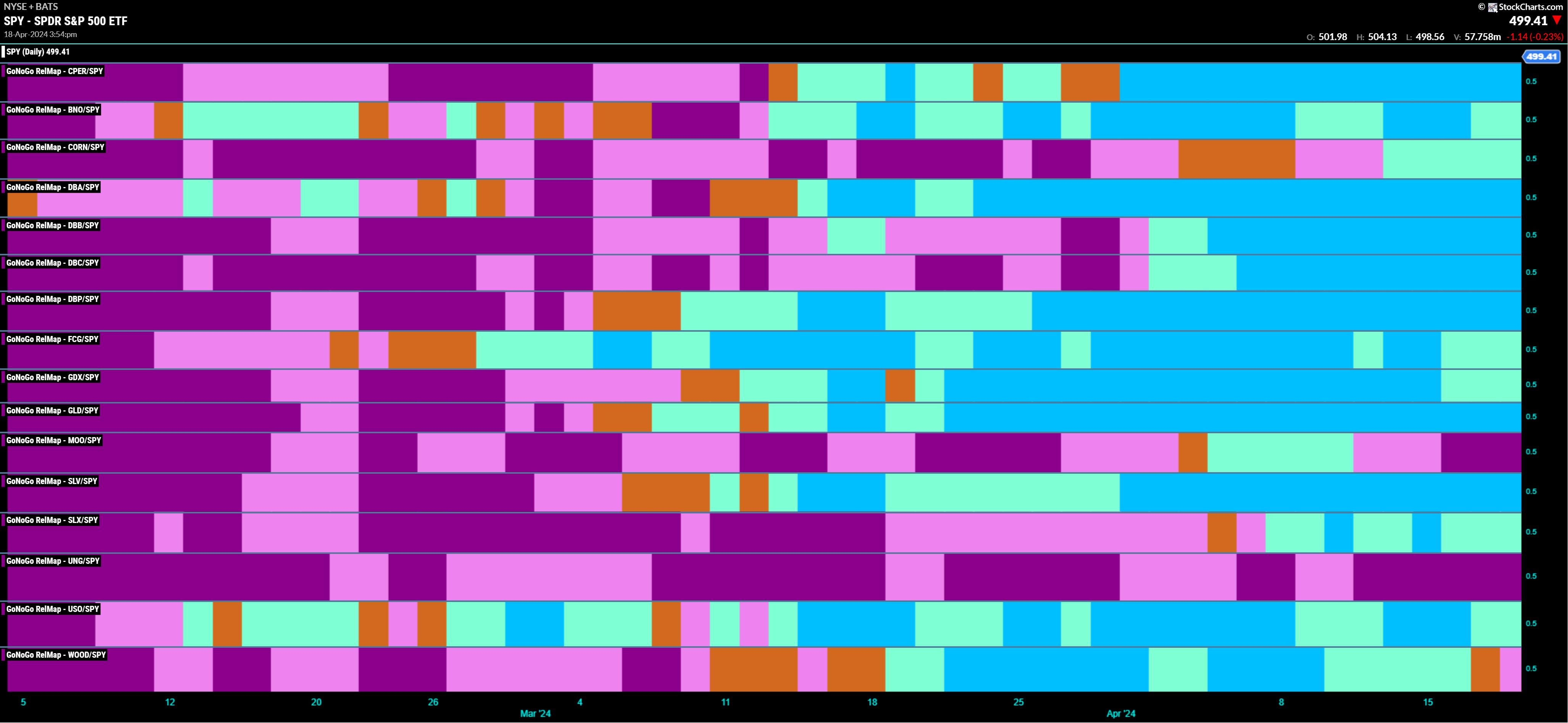

GoNoGo Charts1w ago

Rocks over Stocks | GoNoGo Show 041824

The S&P500 trend conditions have reversed into "NoGo" and strengthened to purple bars. Alex Cole and Tyler Wood, CMT identify intermarket forces including rising rates ($TNX) and a strong US Dollar (UUP) that can provide headwinds to risk assets Read More

Members Only

Larry Williams Focus On Stocks1w ago

Larry's "Family Gathering" April 18, 2024 Recording

Stock Talk with Joe Rabil1w ago

Intraday Trading Entry and Exit Strategies

On this week's edition of Stock Talk with Joe Rabil, Joe details a trade setup in the QQQ that demonstrates how he uses MACD and ADX in multiple timeframes for his trading. He gives detail on the entry and exit for this trade Read More

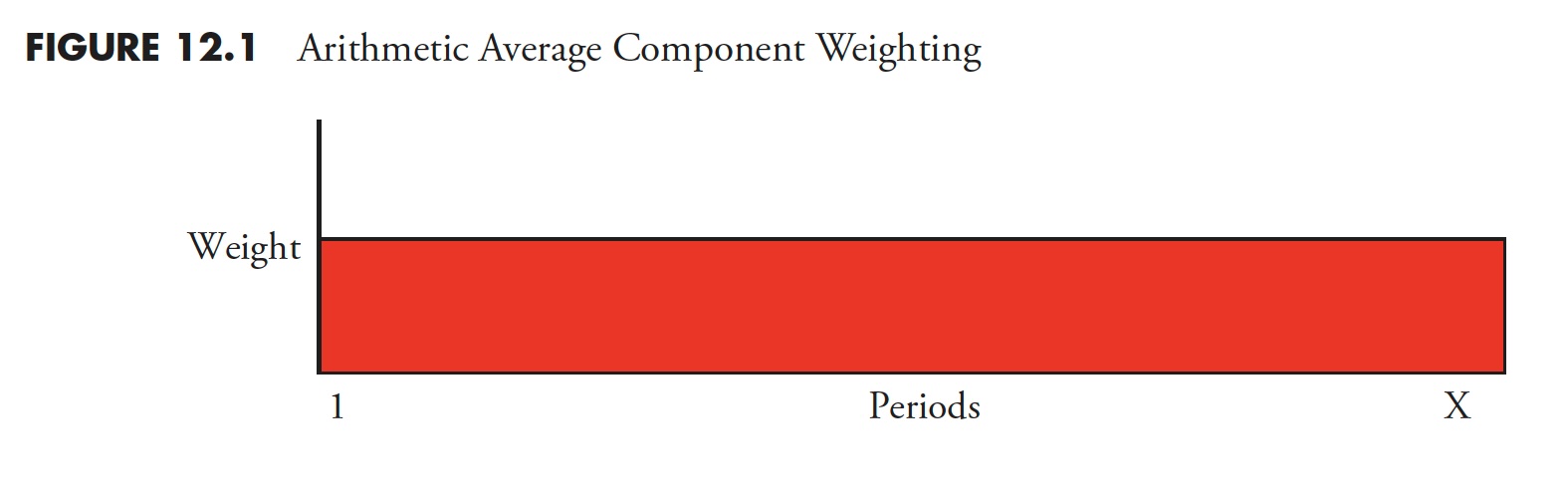

Dancing with the Trend1w ago

Rules-Based Money Management - Part 1: Popular Indicators and Their Uses

Note to the reader: This is the seventeenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful Read More

Members Only

Larry Williams Focus On Stocks1w ago

"Family Gathering" Meeting Today at 2:00 PM Eastern

The Final Bar1w ago

Semiconductors are at CRITICAL Level!

In this edition of StockCharts TV's The Final Bar, Dave welcomes guest Danielle Shay of Simpler Trading. Danielle speaks to the downside rotation for the QQQ, SMH, and leading growth stocks, including why the $210 level is so crucial for the SMH Read More

Fill The Gap by CMT Association1w ago

Important Inflection Point in FXI: Is It Time To Accumulate?

The iShares China Large-Cap exchange-traded fund (FXI) holds the 50 largest large-cap Chinese stocks that trade on the Hong Kong exchange. FXI could soon make a secondary test of its 2022 low. A successful test will show strength, but a failed test will show weakness Read More

Don't Ignore This Chart!1w ago

Will NFLX Pierce Through Resistance With Breakthrough Earnings? Here's What You Need to Know

It's showtime! On Thursday, after the stock market closes, Netflix, Inc. (NFLX) will announce Q1 earnings. The stock is close to a major resistance level. Will it break through when it reports earnings? Or will it fall? The answer depends on whether it beats or misses Read More

Members Only

Larry Williams Focus On Stocks1w ago

Larry's LIVE "Family Gathering" Webinar Airs TOMORROW - Thursday, April 18 at 2:00pm EDT!

The Final Bar1w ago

Bitcoin Halving Could Bring Massive Upside!

In this edition of StockCharts TV's The Final Bar, Dave shares a brief history of Bitcoin halving and relates it to the short-term and long-term technical outlook on this significant development for cryptocurrencies Read More

Don't Ignore This Chart!1w ago

AMD Plunges to a Critical Support Level: Is Now the Time to Go Long?

Leading chip designer Advanced Micro Devices, Inc. (AMD) is at a critical juncture, one which could go either way depending on the dynamics of the market and its specific industry. The stock's technical and fundamental indications are not only mixed, but on opposite extremes Read More