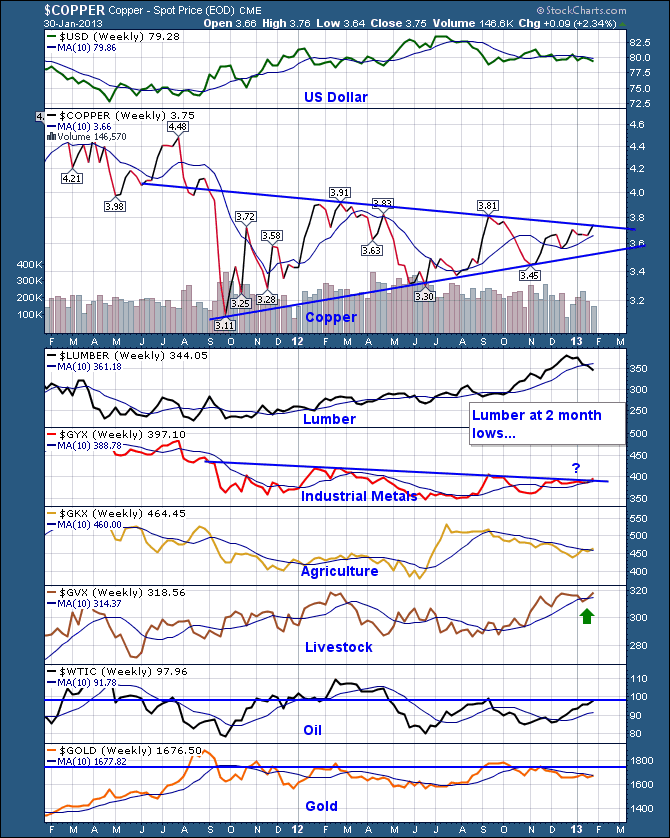

What an interesting chart. Most of the major global stock markets are up against some form of resistance. Here, in commodityville, we see the same!

This is where the rubber meets the road. If the global market upturn is to commence in a big way, it will be with the commodities breaking out.

Livestock is testing resistance to break out to 52 week highs!

Looking through the copper and Industrial metals, they are testing their respective resistance lines.

Oil is at a major support / resistance line... stay tuned.

Gold is stuck between the 1525 support and the resistance line just above. Currently it is in a pattern of lower highs and lower lows. For gold diggers, this sector looks low. Watch for an upside breakout in the miners (not shown) to show the way. Not there yet...

Agriculture has retraced 50% of the move up last summer and here we sit.

The most surprising chart to me is the lumber making 2 month lows...? We should see some other divergences show up on the homebuilders if this starts rolling over. That would be my next move after looking at this!

I continue to think everything needs a pause before the next run up. We'll have to watch the charts to see if that is required.

Good Trading,

Greg Schnell, CMT