I can't help wonder if the miners will finally get a bid here.

Gold has started some major rallies in May before. Currently it just feels so unloved, especially with the US dollar soaring higher every day. I see no reason to jump on a bull trade in $Gold which is a great reason to be aware! Maybe if it tests the April low and can make a double bottom bounce? It seems a stretch at best. Here are the major global miners.

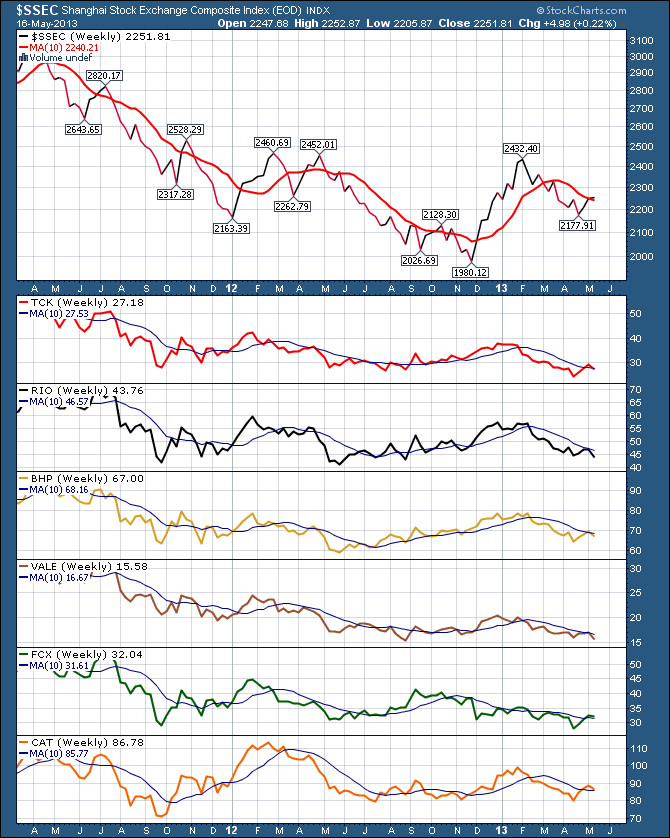

You can see the trend in the miners has followed the $SSEC pretty close.

I also put CAT on this chart as it recently shot up $10 a share. Everything is playing with the 10 week line. Will it prove to be resistance or the chance to get onboard at a nice level? I think some signals out of the $SSEC and the $USD will be the ultimate clues. The miners still look weak when they all hook down on the last reading.

Stay tuned for a breakout or be wary of a continued push down. That 10 week line can be an important area. May has been a month where Gold makes a low. While I definitely don't expect one, it is probably just when we should! However, 2011 showed that the commodity erosion was just getting started in May.

Good Trading,

Greg Schnell, CMT