Rotation, rotation and more rotation. This is what 2010 will be about, with the first week of trading a very good example of what to expect. During 2009, there were only 3 S&P sectors out of 10 that out-performed the S&P 500: Consumer Discretionary, Basic Materials and Technology. Thus far in 2010, we've seen relative weakness in the Consumer Discretionary and Technology groups, with money rotating into the Energy group. This interests us greatly, for it presents an excellent relative trading opportunity to be long Energy and short the S&P 500.

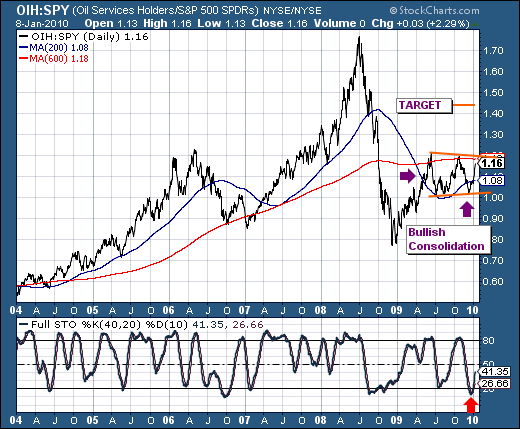

We've chosen the Oil Service HOLDr (OIH) as our energy group of choice, given it is "higher beta" than many other energy groups. The chart clearly shows the OIH / SPY ratio bottomed in December-2008, and has done nothing more than consolidate those gains in bullish fashion since May-2009 - and having done so above the 200-day moving average. The current surge has developed with the 40-day stochastic turning higher from oversold levels, which we suspect will be sufficient to push the ratio through the 600-day moving average towards our ultimate target near 1.45 from its current 1.16.

Good luck and good trading,

Richard