DecisionPoint September 28, 2023 at 01:56 PM

We have introduced two new tables in the DecisionPoint ALERT to give an overview of trend and BIAS for the major market indexes, sectors, and industry groups that we track... Read More

DecisionPoint September 27, 2023 at 06:00 PM

In this week's edition of The DecisionPoint Trading Room, Carl opens with a discussion on why you should use monthly charts even if you are investing in the shorter term... Read More

DecisionPoint September 18, 2023 at 06:49 PM

In this week's edition of The DecisionPoint Trading Room, Carl notes that the "Magnificent 7" stocks are looking "toppy", with only a few exceptions. These leadership stocks could put downside pressure on an already weak market... Read More

DecisionPoint September 14, 2023 at 01:44 PM

Many of the forecasts I hear regarding bonds seem to be based upon what bonds have done for most of the last 40 years, without acknowledging what has happened more recently... Read More

DecisionPoint September 12, 2023 at 07:10 PM

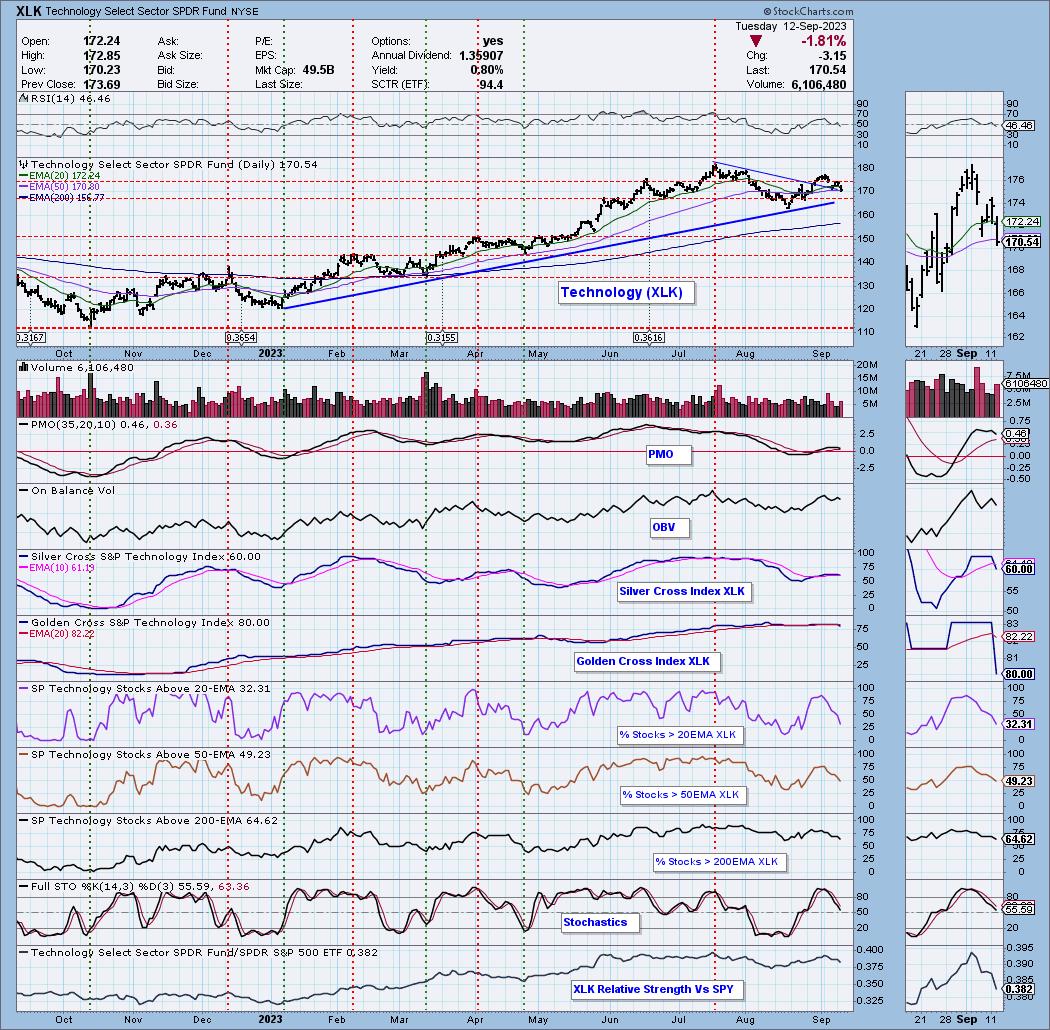

In Monday's DecisionPoint Trading Room we discussed that Technology (XLK) was the last one standing on our Bias Scoreboard with a Bullish Bias in both the intermediate term and long term. Today that bullish bias was lost in both timeframes... Read More

DecisionPoint September 11, 2023 at 07:40 PM

In this week's edition of The DecisionPoint Trading Room, Carl reviews the markets and shares the new DecisionPoint BIAS assessment list. Erin concentrates on Technology (XLK) and Utilities (XLU)... Read More

DecisionPoint September 08, 2023 at 06:48 PM

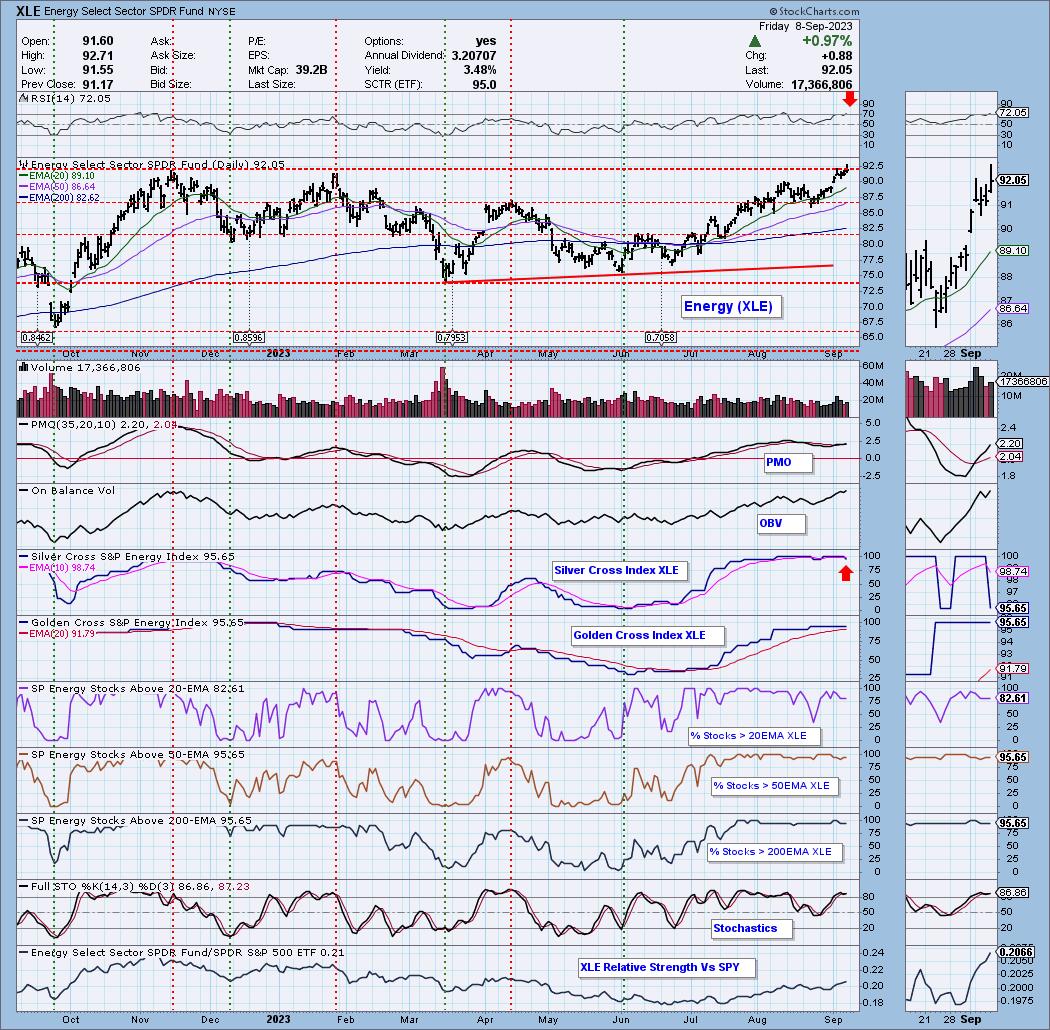

The Energy sector (XLE) has been enjoying a rally throughout the summer. Today. it logged a new all-time high on a small breakout. While the sector looks impervious, there are a few concerns that we should point out. The first issue would be the overbought RSI... Read More