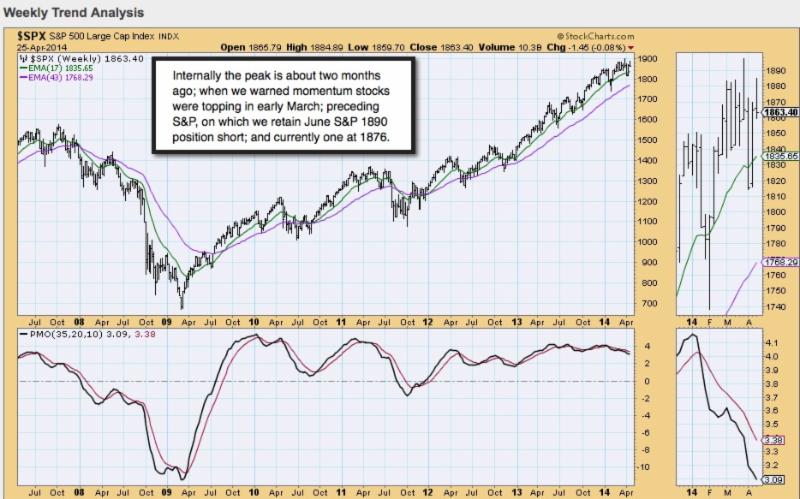

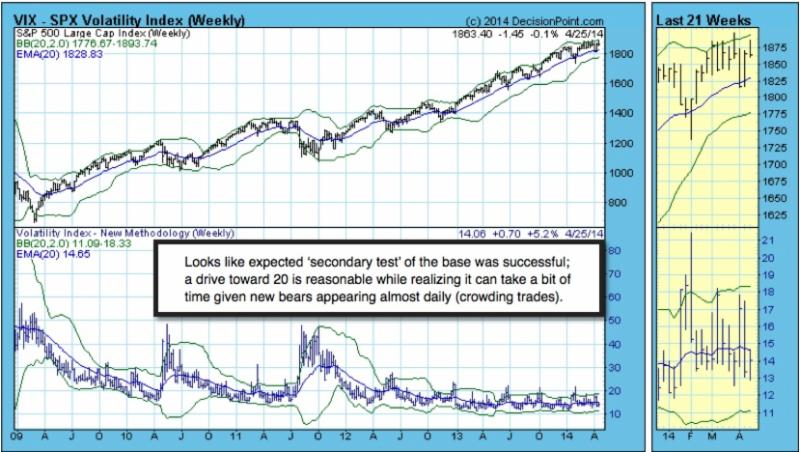

Market behavior not driven by Ukraine is somehow interpreted as 'bullish' for the markets. True superficially by some views; but not analytically or from a factual perspective; if one objectively looks at internal market behavior. First, momentum overpriced tech giants led the decline starting almost two months ago as we'd outlined at the time (internal distribution masked by rotation).

Second, those who've mentioned Ukraine tend to note how global markets, so far, resist reflecting issues with Russia. Acknowledging a bit of defensiveness ahead of a 'military weekend', is partially why we did something unusual. That is: retain Thursday's E-mini/June S&P short-sale from 1876 overnight; and throughout Friday too; and continuing profitably short over this weekend.

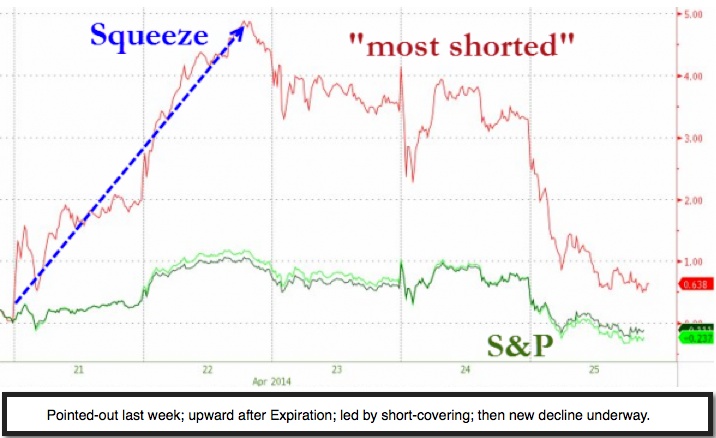

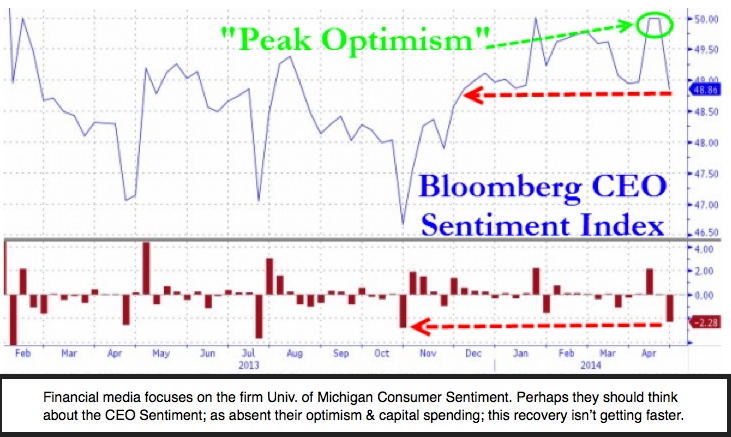

Most who mention Ukraine 'until now' tend to see it not as a meaningful issue; and something that sidetracks the market from an otherwise blissful advance. I believe that the market decline, and institutional tactical defensiveness, in fact was signaled by the very 'rotation' that most analysts or pundits praise. We had argued that was a 'sign of panic'; an ability to mask their exodus before only a 'keyhole exit' remained; and that the recent projected rebound truly yielded only a 'canine aroma'. So before what appear to be 'pre-war' jitters; stocks were in trouble; the funds couldn't short or go heavily cash; so we argued they shifted to less volatile stocks as a place to 'park' money; not because of bullishness.

As to Oil & Gas; will Putin cut-off his nose to spite his face? Reliance on Russia will diminish in years ahead; especially after this; no matter how it resolves. So Russia, heavily dependent on natural resource oil & gas revenues, risks losing it's 'customers'; which normally isn't very profitable.

Now, we actually agree Moscow doesn't see the issues as we outlined; or that some money managers are using a crisis to 'mask' real reasons for market risk (details of this assessed). Analysts tend to act perplexed that many stocks are heavily hit now; ignoring overpriced natures of so many sectors they pushed.

We approach the new trading week 'short' guidelines from the S&P 1890 point of inflection (from which we suggested taking enormous earlier gains); thus the new additional reference point from Thursday, which remains a 'live' guideline short-sale from E-Mini / June S&P 1876. We'll address it early Monday.

Let's hope we don't awake Sunday to a Russian invasion. And too bad Norman Jewison isn't around to make a sequel to 'The Russians Are Coming'.

There are lots of hard challenges ahead; and this time, there must be sobriety in geopolitics & fiscal policies; beyond monetary shell games.

Enjoy the weekend!

Gene

www.ingerletter.com

Copyright (c) 2014 E.E. Inger & Co. Inc. / The Inger Letter