Netflix (NASDAQ: NFLX) Stock Chart Shows Different Market Participant Groups Controlled Price Action at Each Support Level

One of the challenges that retail and technical traders face nowadays is the expanded and far more complex cycle of Market Participant Groups, of which there are 9 distinctly unique groups based upon:

1. Various Market Venues: Lit, Dark, Twilight, Regular exchanges

2. Order types: specialty, TWAP, VWAP, BSLO, Custom, Block

3. Access to speed and automated order delivery to venue

4. Size of share-lot traded regularly

5. Speed of execution

6. Capital resources

7. Access to critical information for decision-making

Learning Relational Analysis can aid the technical trader in anticipating weak or strong support levels for stocks sold short in the current short-term correction.

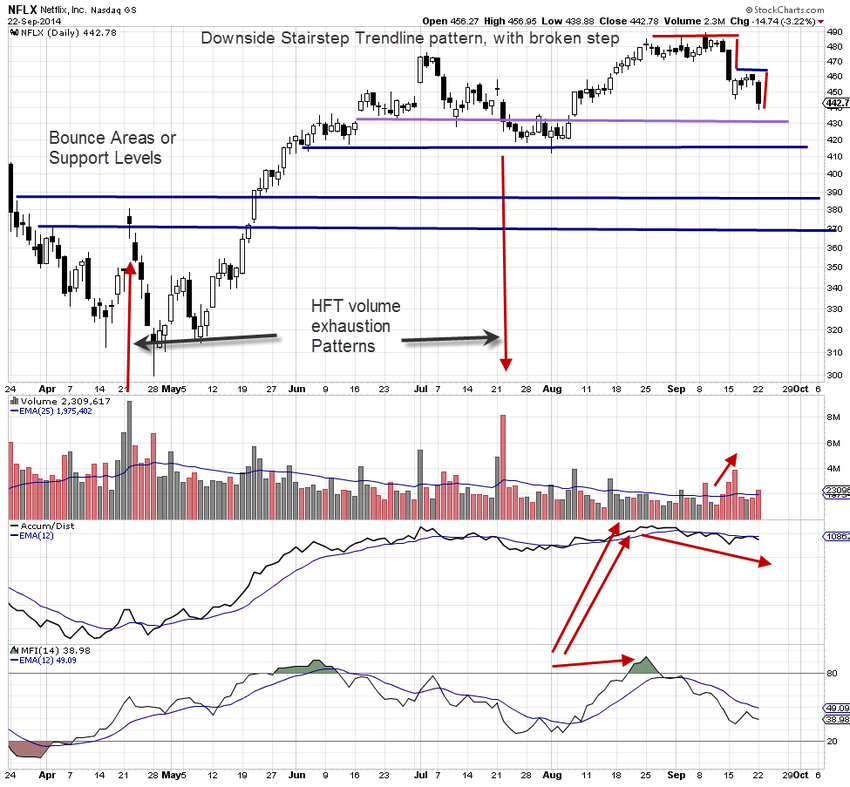

Netflix, for example, is at risk of moving down more. Its stock cycle peaked in early 2014 after an extreme peak deviation formed on long-term cycle charts.

NFLX subsequently formed a short-term bottom and moved up to the current price level where the stock price is retracing within a top formation. The most recent move up was on declining volume, an extended severe peak on the MFI indicator, and a rounding top on the Accum/Dist indicator. That move up was predominantly smaller lots buying on the perceived dip without consideration of the risk factor for a top.

The current Trendline Pattern is a down-trending Stairstep nearing the first tier of weak bounce support. This support level was the initial consolidation after a profit-taking phase. A High Frequency Trading exhaustion volume spike occurred as MFI troughed. However, the gains thereafter, to the peak, were weaker candle patterns on steadily declining volume. That prior consolidation showed early signs of weakening with a lack of large-lot buyers.

This first tier of support is weaker and may easily be pushed through if the markets continue to show sell side pressure. A Bounce due to buyers on the dip and buying to cover from technical traders is likely at the first support tier. The second tier is moderate and is likely to create a higher bounce or even a small common gap.

The third tier is a weaker support level and may not hold up under heavy short selling pressure. The final support is stronger support with some larger-lot accumulation at this lowest level. The bottom formation developed under a shift of sentiment from downside HFT selling to some Dark Pool incremental buying.

The extreme trough shown with MFI indicates this level is the strongest support level for this stock.

However, short sellers need to be aware that there are numerous small-lot uninformed investors buying on the dip which can cause problems for selling short stocks with tiers of support levels that vary in strength due to which participant created each support level.

This stock, like many big-name companies, requires advanced skills to sell short due to the uninformed buy-on-the-dip investors who come into a stock based on news, broker recommendations and guru recommendations rather than technical patterns.

Technical traders must factor in the risk of buy-on-the-dip investors when selling short in the stock market at this time.

Trade Wisely,

Martha Stokes CMT

www.TechniTrader.com

info@technitrader.com