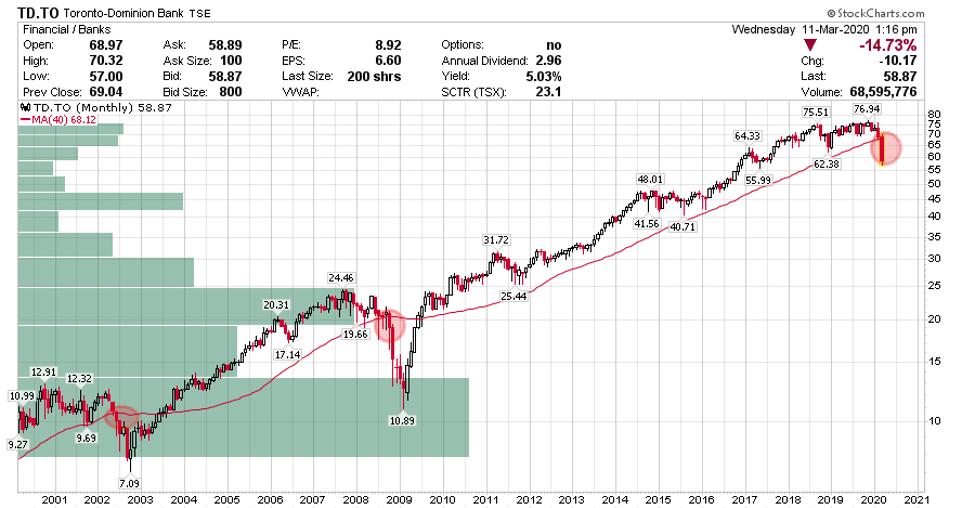

Hello fellow StockCharts users. The Canadian banks are a staple in investment portfolios across Canada; could they possibly be setting up for a potential move lower? Over the weekend, we learned about the new developments that will cause disruptions in the oil markets. Monday turned out to be ugly for the Canadian Banks, with most falling over 10%. The charts that have elevated potential risk are Toronto-Dominion Bank (TD.TO), Bank of Montreal (BMO.TO) and Canadian Imperial Bank of Commerce (CM.TO). Please note as well in this article that I have simplified the charts by just adding the 40-month moving and volume by price bars.

TD.TO has fallen a few times below the 40-month moving average, that being in 2002, 2008 and now in 2020. In the past when it has fallen, we continued lower on average in the following months. We can also observe how significant the bounces have been from 2012, 2015, 2016 and 2018.

BMO has a similar setup as well, except for the fact that it held the 40-month moving average back in 2002, but, as you can see in 2008, once it broke it did continue lower. Currently, as you can see, we have broken below the moving average.

CM, another important Canadian bank, has broken below the 40-month moving average this week and, looking back at when this occurred in 2002 and 2008, we did see a continuation of the downtrend.

- Aleksandar Bozic