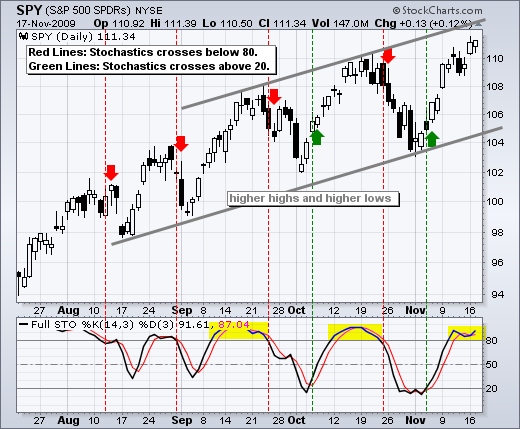

The S&P 500 ETF (SPY) remains in a medium-term uptrend as it approaches the upper trendline of the rising channel. This trendline extends to around 112 this week and SPY could hit this level before starting a downswing. At this point, I consider SPY too strong to entertain bearish thoughts, but also too overextended after a 7.7% advance in 12 days. Short-term, I am watching Monday's gap and the Stochastic Oscillator.

As long as the gap holds and the Stochastic Oscillator remains above 80, SPY is both short-term overbought and strong. A move below the gap zone in SPY and a move below 80 in the Stochastic Oscillator would suggest a pullback within the medium-term uptrend.

On the 30-minute chart, SPY surged above 111 and then consolidated around this level the last two days. CCI surged above +100 and remains in positive territory. A consolidation after an advance is simply a rest that can be considered neutral. Those with a bearish bias may point to lack of follow through, but SPY is clearly strong as long as it holds its gains. There is a support zone around 110 from the gap. This is the first level to watch, but I am setting key short-term support at 109. A move below this level and a CCI break below -100 would reverse the short-term uptrend. Time to sit tight until the next signal.