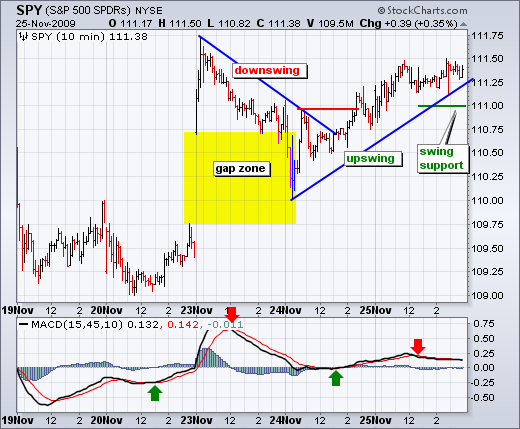

The medium-term trend remains up for SPY, but the going is getting tough around 110. The S&P 500 ETF (SPY) first moved above 110 on November 11th, eleven trading days ago. Since first moving above 110, the ETF has seesawed above and below this level at least four times. The latest move above 110 occurred with a gap up on Monday and there was little follow through after the gap. SPY formed three indecisive candlesticks over the last three days. There is clearly some resistance in this area. In addition, prior short-term reversals in September and October occurred just after SPY recorded a new reaction high. I am not calling for a medium-term trend reversal at this stage, but the odds are increasing for some sort of short-term trend reversal or pullback within this medium-term uptrend.

The indicator window shows MACD(5,35,5) moving below its signal line on Friday, but edging back above the signal line on Wednesday. Even though this negates the signal, this may be a situation where the subjective side of technical analysis comes into play. With a lot of resistance around 111 and the market set to open weak on the prospects of a Dubai default, I would make the index trade above 111.8 before considering the bearish MACD crossover negated.

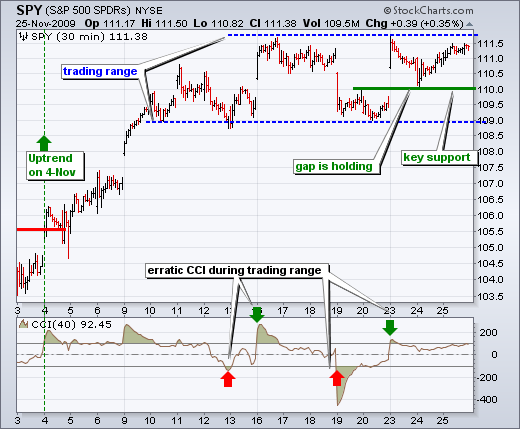

On the 30-minute chart, SPY is locked in a trading range with support at 109 and resistance at 111.8. The range extends from November 10th until November 25th. Technically, a range breakout would be bullish and signal a continuation of the uptrend. SPY gapped up and held the gap with a bounce off 110 this week. As such, I am elevating 110 to key support. A break below this level AND a CCI plunge below -100 would reverse the short-term uptrend. With such well-established support at 109, there is risk of a whipsaw by placing key support at 110. Trading is all about taking risk!

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More