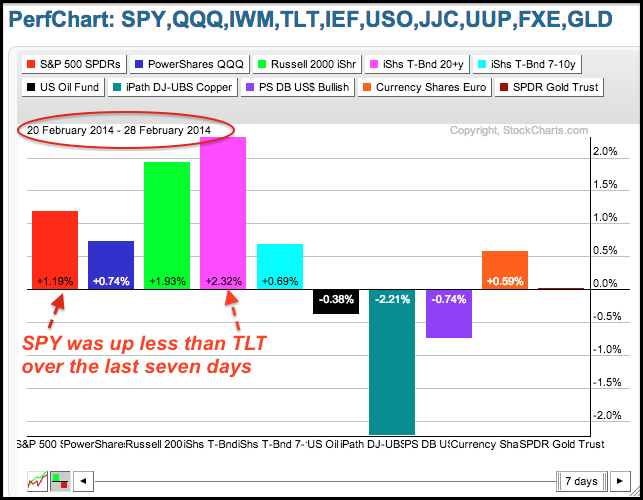

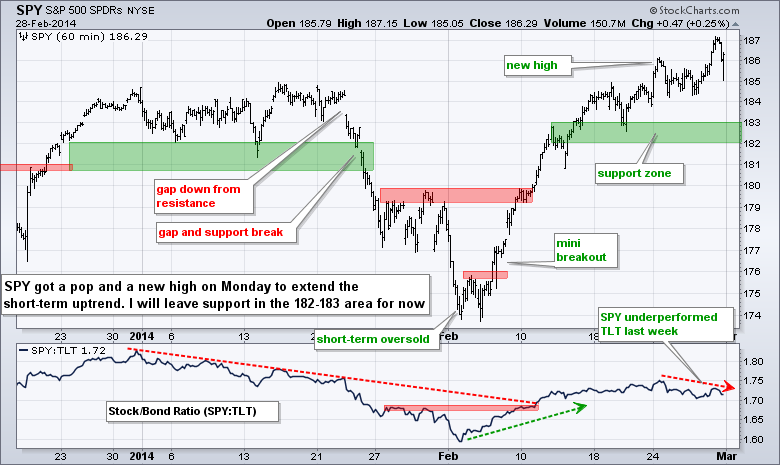

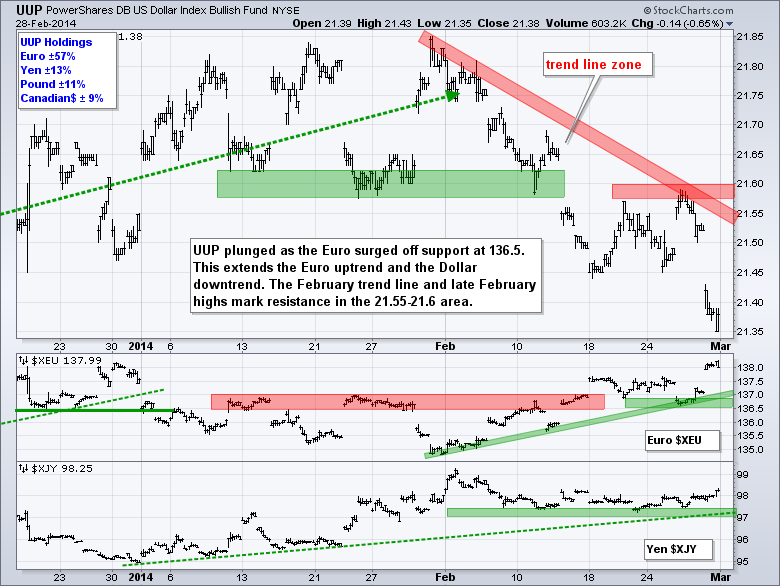

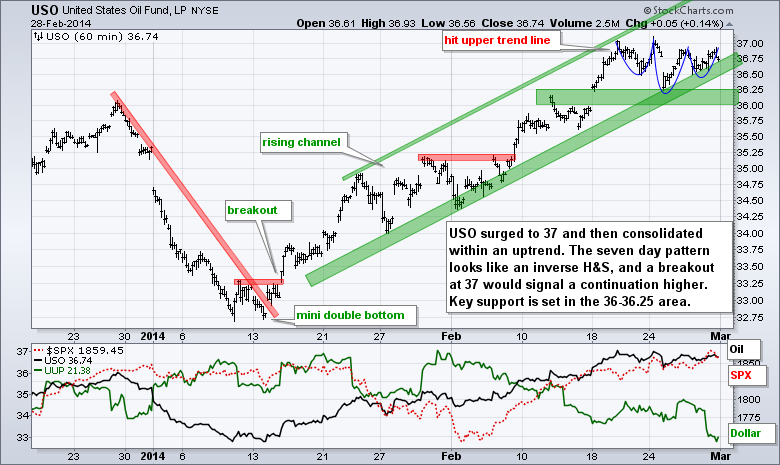

The Russian-Ukraine situation is affecting the markets this morning. Stocks are down in pre-market, the Euro is down and the Yen is down. Even though the Dollar is up, gold and oil are trading sharply higher, as is Natural Gas. European supply disruptions are likely because around half of Russian natural gas flows through Ukraine. However, I don't think this affects US natural gas prices because natural gas is not easy to transport outside of a pipeline. Oil is a different story though and a European spike in natural gas prices could increase demand for alternatives, such as heating oil. Turning back to the US, stocks ended the week and month overbought, and ripe for a correction of some sort. In addition to the ongoing Russian-Ukraine situation, it is a big week for economic reports. The early February reports were mixed with cold weather getting the blame. Other round of mixed or disappointing reports would likely weigh on stocks. Also notice that the 20+ YR T-Bond ETF (TLT) bounced with a 2% advance over the last six days. Treasuries are sensitive to the economy and this bounce does not bode well for this week's economic round. We start with ISM Manufacturing and Auto-Truck sales today.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Mon - Mar 03 - 08:30 - Personal Income & Personal Spending

Mon - Mar 03 - 10:00 - ISM Manufacturing

Mon - Mar 03 - 10:00 - Construction Spending

Mon - Mar 03 - 14:00 - Auto/Truck Sales

Wed - Mar 05 - 07:00 - MBA Mortgage Index

Wed - Mar 05 - 08:15 - ADP Employment Report

Wed - Mar 05 - 10:00 - ISM Services

Wed - Mar 05 - 10:30 - Crude Oil Inventories

Wed - Mar 05 - 14:00 - Fed's Beige Book

Thu - Mar 06 - 07:30 - Challenger Job Report

Thu - Mar 06 - 08:30 - Initial Jobless Claims

Thu - Mar 06 - 08:30 - Continuing Claims

Thu - Mar 06 - 10:00 - Factory Orders

Thu - Mar 06 - 10:30 - Natural Gas Inventories

Fri - Mar 07 - 08:30 - Employment

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.