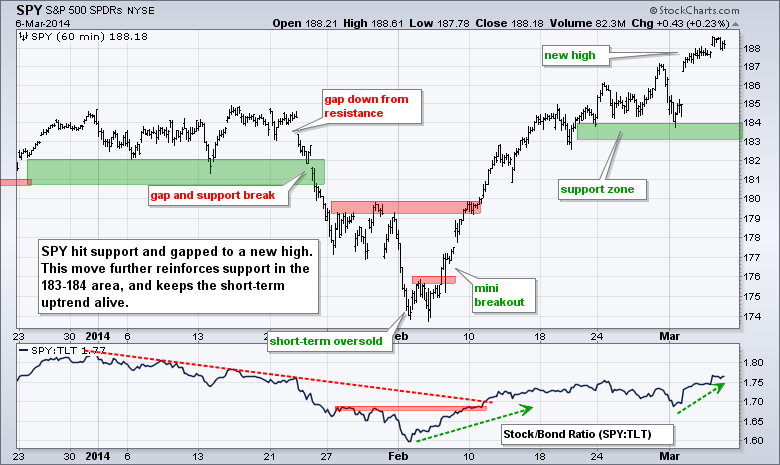

Stocks finished mixed again with some strength coming into the S&P 500 SPDR (SPY) and some weakness in the Russell 2000 ETF (IWM). The moves, however, were fractional and insignificant. Six of the nine sectors were up with the three defensive sectors moving lower (healthcare, utilities and consumer staples). The Finance SPDR (XLF) showed strength again and renewed leadership from financials is positive. The chart below shows the S&P 500 AD Line hitting a new high. Short-term, we can watch support from the late February lows for a trend reversal.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Thu - Mar 06 - 07:30 - Challenger Job Report

Thu - Mar 06 - 08:30 - Initial Jobless Claims

Thu - Mar 06 - 08:30 - Continuing Claims

Thu - Mar 06 - 10:00 - Factory Orders

Thu - Mar 06 - 10:30 - Natural Gas Inventories

Fri - Mar 07 - 08:30 - Employment

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.