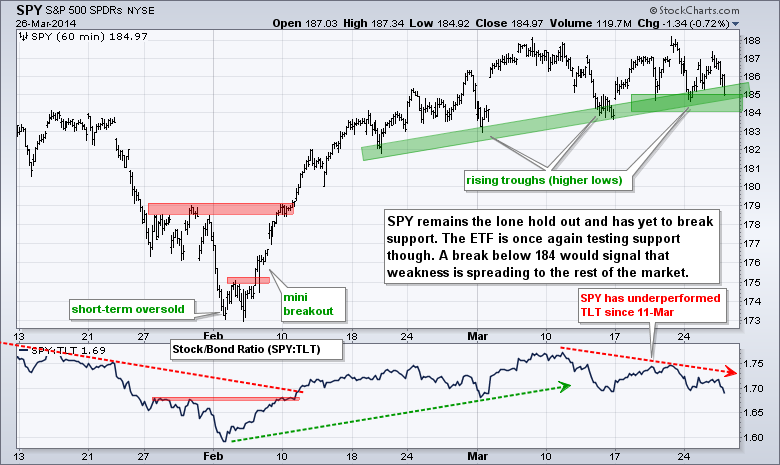

Stocks fell on Wednesday with relatively broad-based selling pressure. The Russell 2000 ETF (IWM) and Russell MicroCap iShares (IWC) led the way lower as money moved out of the riskiest stocks. Eight of nine sector SPDRs were down three of the four offensive sectors falling over 1%. The materials sector led the way lower with a 1.44% decline. Techs were especially weak with the Internet ETF (FDN), Semiconductor SPDR (XSD) and Networking iShares (IGN) falling sharply. Selling pressure started with biotechs in early March and spread to the other high-beta names over the past week. The Biotech SPDR (XBI) is down over 15% in four weeks and volume surged the last four days. It is a route, but a four day decline on extremely high volume is also a selling climax that could give way to a sharp bounce. The question is will this selling pressure spread to the rest of the market? As the chart below shows, SPY has opened strong and closed weak five times in the last twelve days. These long filled candlesticks show selling pressure, but the ETF has yet to break short-term support and remains in a consolidation. Breadth weakened again on Wednesday as the 20-day EMAs for AD Percent and AD Volume Percent both moved into negative territory. SPY is the last man standing, but relative weakness in small-caps, momentum stocks and large-techs could ultimately weigh. Also note that TLT is outperforming SPY and TLT broke out on Wednesday. Relative strength in Treasuries is also a negative for stocks.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Thu - Mar 27 - 08:30 - Initial Claims

Thu - Mar 27 - 08:30 - GDP

Thu - Mar 27 - 10:00 - Pending Home Sales

Thu - Mar 27 - 10:30 - Natural Gas Inventories

Fri - Mar 28 - 09:55 - Michigan Sentiment

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.