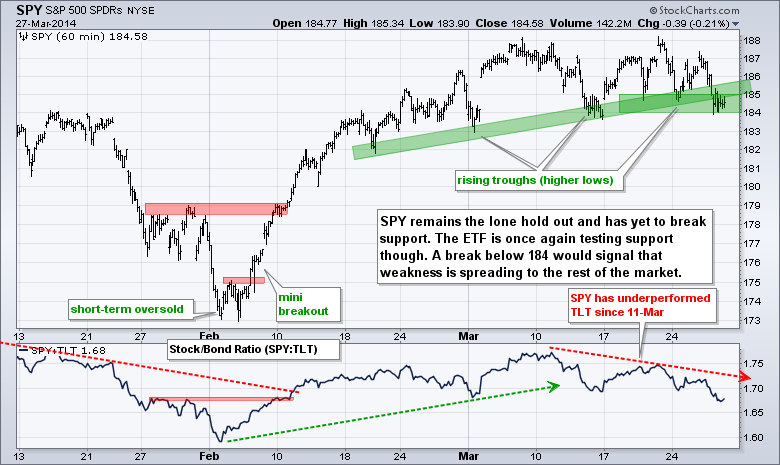

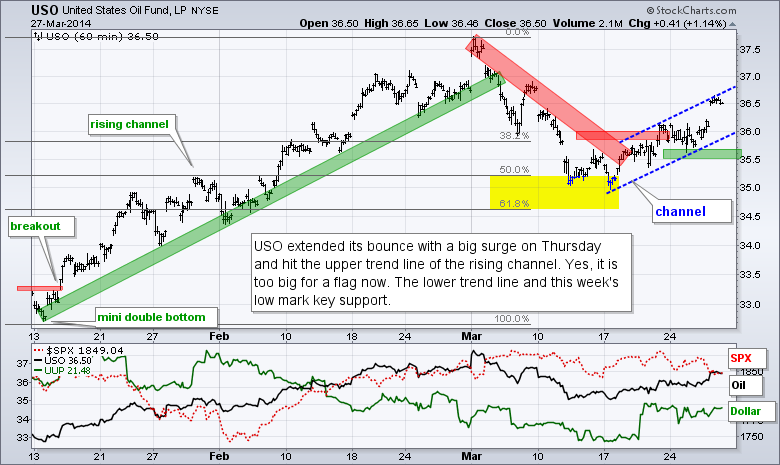

Stocks remained under selling pressure on Thursday, but selling pressure was not that strong and the major index ETFs closed with small losses. Seven of the nine sectors were down with the Finance SPDR (XLF) leading the decline (-.54%). The Energy SPDR (XLE) and Utilities SPDR (XLU) gained. The Regional Bank SPDR (KRE) was hit especially hard with a 1.94% loss. Natural resource stocks were strong as coal, copper, mining and steel stocks ended with nice gains. The breadth chart is bearish for SPY as the 20-day EMAs for AD Percent and AD Volume Percent turned negative on Wednesday. Relative weakness in small-caps and momentum names is also a concern because it suggests a risk-averse environment. In addition, the 20+ YR T-Bond ETF (TLT) broke out and Treasuries are outperforming stocks this month. SPY, however, remains stubbornly in its support zone and even formed an indecisive doji on Thursday. A support test is underway and a gap above 185 would be the first sign that support is actually going to hold.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Fri - Mar 28 - 09:55 - Michigan Sentiment

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.