Programming Note: I will be at the MTA Symposium on Thursday and Friday, and Art's Charts will not be published on those days. http://symposium.mta.org/ Stocks put in a pretty solid performance on the last day of the quarter as small-caps and healthcare led the way higher. The Russell 2000 ETF (IWM) surged 1.79% and easily outperformed the S&P 500 SPDR (SPY), which advanced .91%. Eight sector SPDRs were higher with finance, industrials, materials, healthcare and utilities gaining over 1%. Even though the Technology SPDR (XLK) gained less than 1%, note that the Networking iShares (IGN), Semiconductor SPDR (XSD) and Software iShares (IGV) gained over 1%. There are some concerns because the Consumer Staples SPDR (XLP) and the Utilities SPDR (XLU) hit new highs today. Strength in these two defensive sectors may suggest a certain risk-aversion in the stock market, but this has yet to affect the tech sector (XLK) or the broader market (SPY, RSP). As the chart below shows, XLP hit a new high, but its price relative (XLP:SPY ratio) remains in the doldrums as XLP continues to lag SPY.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

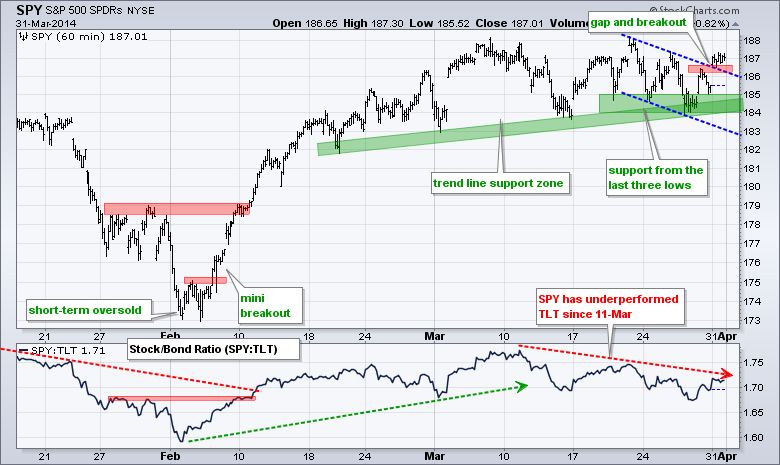

SPY got a little breakout with a gap above 186 and close at 187. There was not much upside after the gap as the ETF pretty much consolidated around 187. The support bounce and breakout, however, are bullish. Key support remains in the 184-185 zone.

**************************************************************

QQQ gapped up and moved above 88, but soon stalled and fell back. While a slight uptrend is present since last week, this small advance could turn into a bear flag. Watch support at 87 for a break that would reverse the four day bounce.

**************************************************************

IWM found support near the 50% retracement and just above the broken resistance zone. The ETF formed two lows near 114 and broke above 116 on Monday. This is the first sign that the bigger uptrend is resuming. A strong breakout should hold and a quick move back below 115.5 would call for a reassessment.

**************************************************************

The 20+ YR T-Bond ETF (TLT) broke resistance with a big surge and then fell back to broken resistance. The trend line zone and last week's low mark upswing support in the 108-108.5 area. A move below 108 would negate the breakout, which would be bearish for Treasuries and bullish for stocks.

**************************************************************

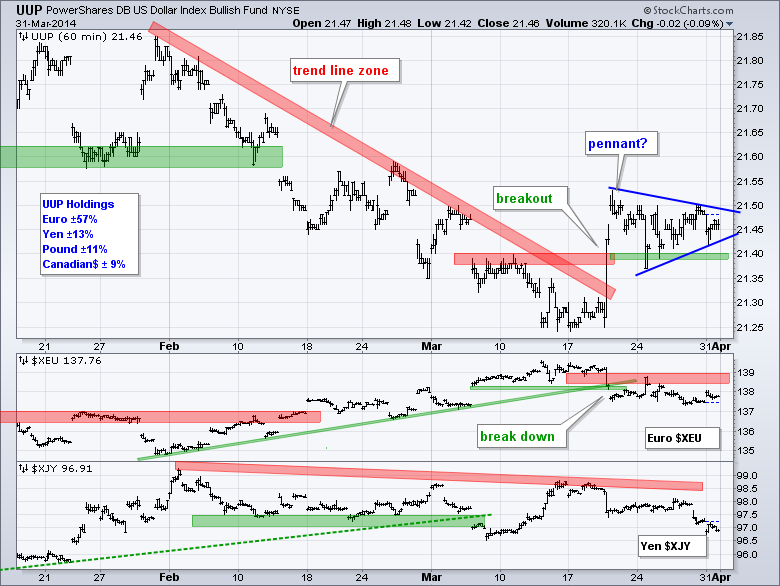

The US Dollar ETF (UUP) is making a breakout bid as the Euro remains soft ahead of this week's European Central Bank (ECB) meeting. Overall, UUP is holding the breakout at 21.40 and this area turned into support. I will stay with a bullish bias as long as 21.35 holds in UUP and the Euro remains below 139.

**************************************************************

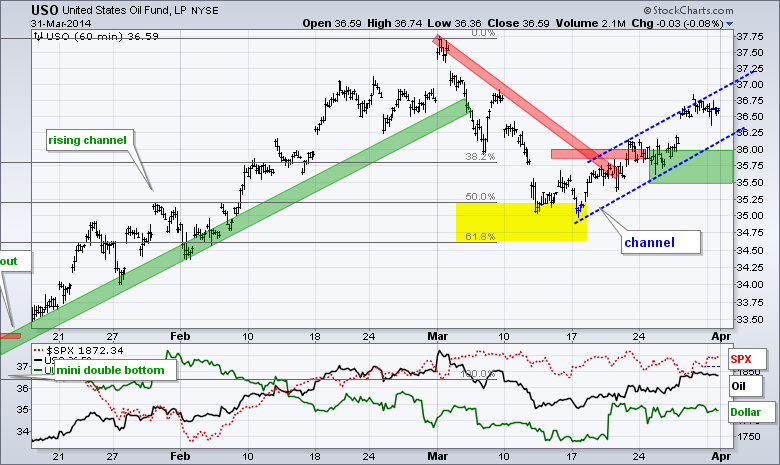

The USO Oil Fund (USO) extended its short-term uptrend with a move above 36.5 last week. The lower trend line and last week's lows combine to mark support in the 35.5-36 area. Oil is showing resilience and energy stocks are strong as XLE and XES hit new highs last week.

**************************************************************

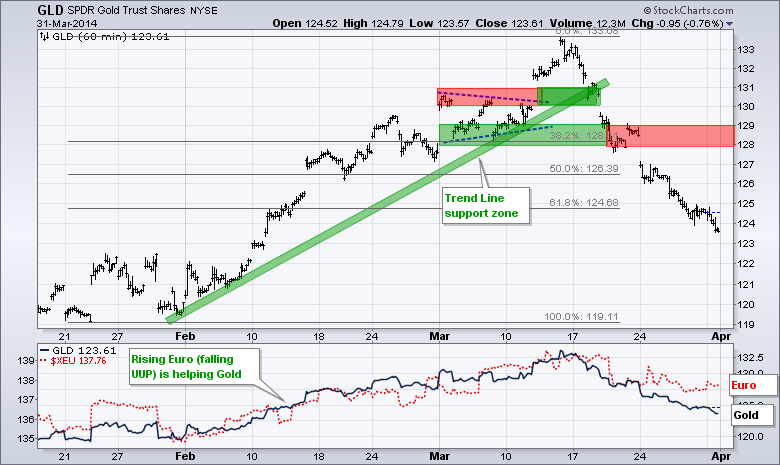

GLD is down over 6% from its high and still shows no signs of firming. Even though gold is oversold and ripe for a bounce, further weakening in the Euro could keep downward pressure on the yellow metal. Broken support in the 128-129 area turns into first resistance.

***************************************************************

Key Reports and Events (all times Eastern):

Tue - Apr 01 - 10:00 - ISM Manufacturing Index

Tue - Apr 01 - 10:00 - Construction Spending

Tue - Apr 01 - 14:00 - Auto Sales/Truck Sales

Wed - Apr 02 - 07:00 - MBA Mortgage Index

Wed - Apr 02 - 08:15 - ADP Employment Report

Wed - Apr 02 - 10:00 - Factory Orders

Wed - Apr 02 - 10:30 - Crude Oil Inventories

Thu - Apr 03 - 07:30 - Challenger Job Report

Thu - Apr 03 - 08:30 - Initial Jobless Claims

Thu - Apr 03 - 10:00 - ISM Services Index

Thu - Apr 03 - 10:30 - Natural Gas Inventories

Fri - Apr 04 - 08:30 - Employment Report

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.