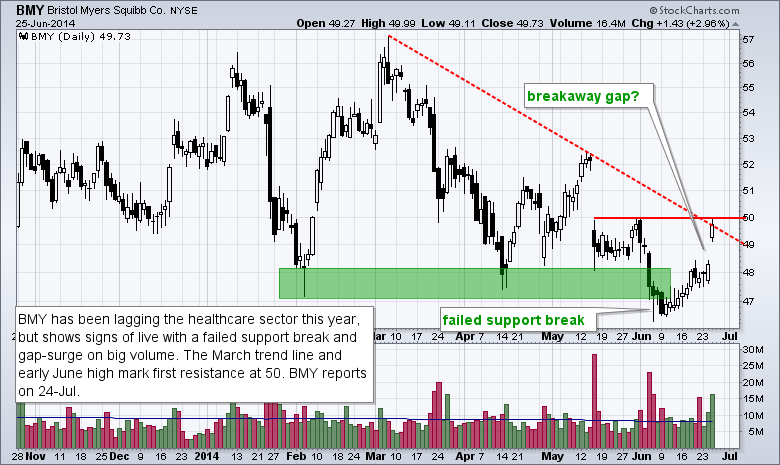

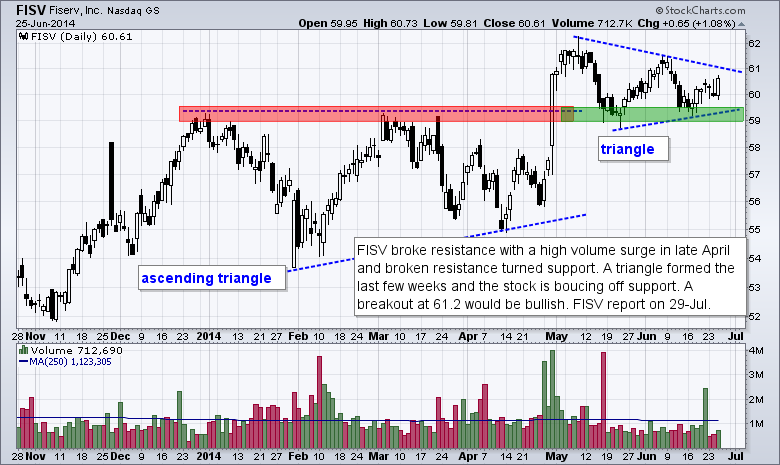

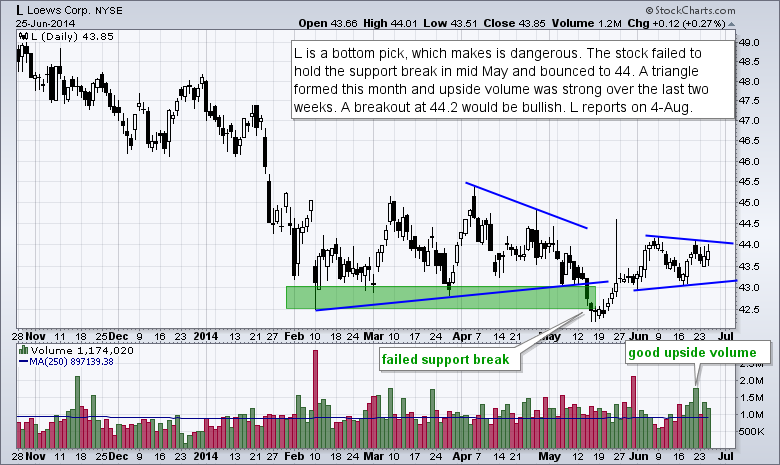

There are six setups today. First, we start tech stock that formed a high-tight flag. Second, there is a big pharma stock that is lagging the group, but formed a breakaway gap on big volume. Third, we have a bottom pick play for a sporting good store. Fourth, there is a tech stock that held its resistance breakout and consolidated. Fifth, we feature a regional bank with a high-tight pennant. And finally, there is a conglomerate showing accumulation as it bounces near support.

**This chart analysis is for educational purposes only, and should not be construed as a recommendation to buy, sell or sell-short said securities**

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.